S&P 500 Predictions: What 5 Experts See for 2024-2025 & Beyond

Table of Contents

ToggleIntroduction: Decoding S&P 500 Predictions in a Volatile Market

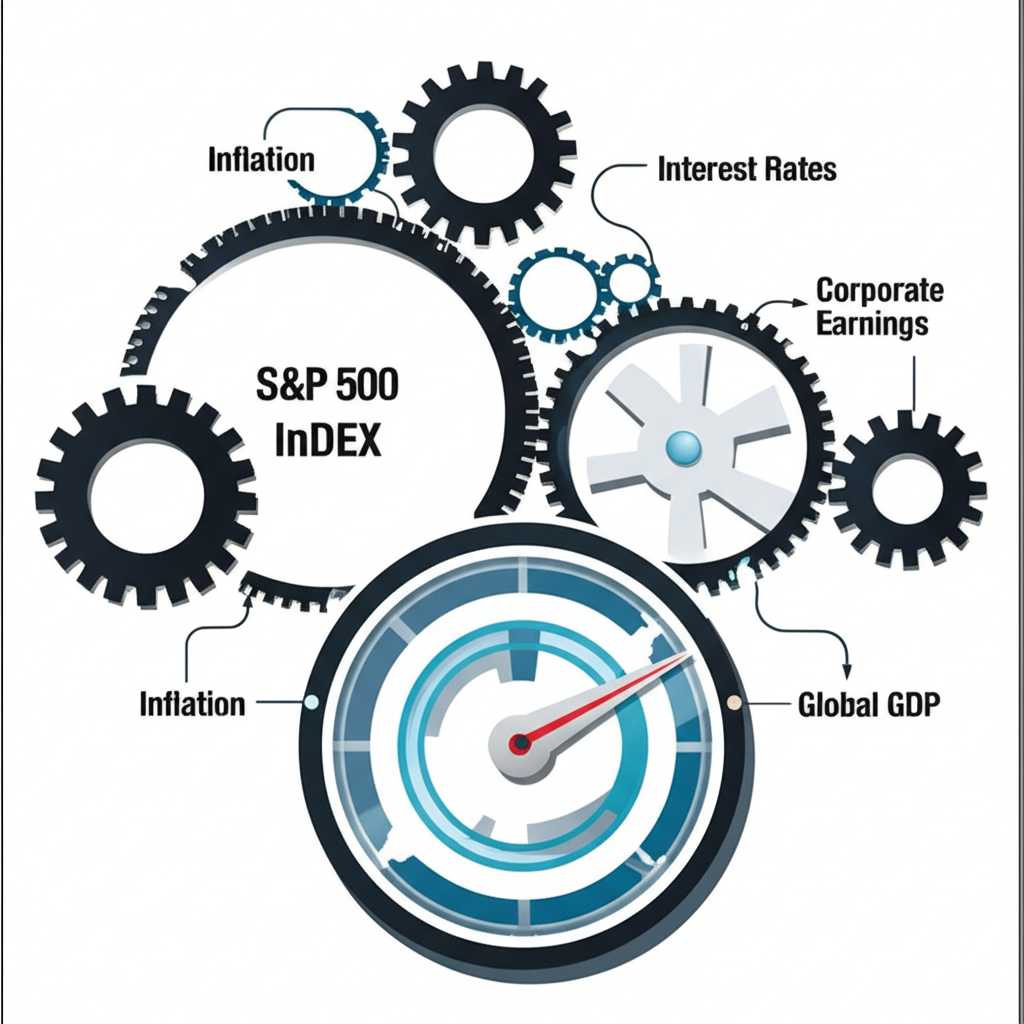

The S&P 500 stands as the most widely recognized benchmark of the U.S. equity market, tracking the performance of 500 of the nation’s largest publicly traded companies. For everyone from individual savers to institutional investors, its movements offer critical insights into the broader economic landscape. Yet forecasting where the index is headed isn’t a matter of simple trend extrapolation—it’s a complex puzzle shaped by shifting economic policies, corporate results, and global events. In a climate marked by fluctuating inflation, evolving monetary policy, and geopolitical tensions, understanding the forces behind S&P 500 predictions has never been more essential. This analysis dives deep into the latest forecasts, unpacks the drivers shaping them, and explores how investors can interpret this information with clarity and confidence.

Key Factors Driving S&P 500 Performance

The trajectory of the S&P 500 is far from arbitrary. Beneath the surface of daily price swings lie structural forces that determine long-term value. These aren’t fleeting trends—they’re foundational elements that analysts monitor closely when assessing market health and setting expectations for future performance. Recognizing how these components interact provides a clearer lens through which to evaluate any forecast.

Inflation and Interest Rate Environment

One of the most powerful levers influencing the S&P 500 is monetary policy, particularly the Federal Reserve’s response to inflation. When inflation rises, the Fed often hikes interest rates to cool spending and borrowing. While this can stabilize prices, it also increases financing costs for businesses, potentially squeezing profit margins and reducing the present value of future cash flows—key inputs in stock valuation models. On the flip side, when inflation moderates and rate cuts appear on the horizon, equities often benefit from cheaper capital and improved growth expectations. The end of a tightening cycle or the start of quantitative easing can ignite investor optimism, while unexpected hawkish turns can trigger sharp sell-offs. As such, every Fed meeting and economic data release becomes a potential catalyst for market movement.

Corporate Earnings Growth and Profit Margins

If interest rates shape the environment, corporate earnings power the engine. The S&P 500, at its core, reflects the collective profitability of America’s leading companies. When earnings rise consistently—driven by strong demand, operational efficiency, or pricing power—stock prices tend to follow. Analysts scrutinize quarterly reports not just for headline numbers but for forward guidance, margin trends, and sector-specific performance. For example, the technology sector’s outsized influence means that strong results from major tech firms can lift the entire index, even if other sectors lag. Conversely, widespread earnings disappointments, especially during uncertain economic times, can spark broader market declines. Profit margins, in particular, are a key indicator: sustained high margins suggest competitive advantages and pricing control, while narrowing margins may signal rising costs or weakening demand.

Economic Growth and Recession Risks

The health of the broader economy plays a direct role in shaping investor sentiment and corporate performance. Gross Domestic Product (GDP) growth signals whether businesses are expanding, consumers are spending, and hiring is strong. A robust economy typically supports higher revenues and profits across the index, fueling upward momentum. However, when growth slows—particularly if two consecutive quarters show contraction—the risk of recession looms. Such periods often lead to declining corporate earnings, tighter credit conditions, and rising unemployment, all of which pressure stock valuations. Market participants closely watch indicators like the yield curve, jobless claims, and consumer confidence for early warning signs. Even the mere perception of an impending downturn can trigger volatility, as investors adjust portfolios in anticipation of weaker returns.

Geopolitical Events and Global Stability

Markets thrive on predictability, and geopolitical shocks disrupt it. Conflicts in key regions, trade disputes, energy supply disruptions, or sudden shifts in foreign policy can send ripples through global markets. For instance, tensions in the Middle East may spike oil prices, affecting transportation and manufacturing costs. A major cyberattack or natural disaster could impair supply chains, hitting corporate earnings. Similarly, changes in leadership or policy in large economies like China or the European Union can alter trade flows and investor sentiment. These events are difficult to forecast but can have immediate and lasting effects on the S&P 500. While markets often recover from short-term shocks, prolonged instability can weigh on long-term investment decisions and capital allocation.

S&P 500 Forecasts: Expert Consensus & Divergent Views

Wall Street’s outlook on the S&P 500 is rarely unanimous. Analysts from major financial institutions regularly update their projections, reflecting evolving data and shifting risk assessments. While some lean bullish based on strong fundamentals, others urge caution due to valuation concerns or macroeconomic headwinds. These forecasts are typically segmented by time horizon, offering distinct perspectives on near-term volatility and long-term potential.

Short-Term Outlook (Next 6-12 Months)

In the coming months, attention remains fixed on inflation data, labor market trends, and the Federal Reserve’s next steps. Earnings season also plays a pivotal role—positive surprises can boost sentiment, while weak guidance may reignite concerns about economic resilience. As of mid-2024, many top-tier firms project modest gains for the S&P 500, with price targets clustered between 5,200 and 5,400. Goldman Sachs, for example, maintains a bullish stance, citing strength in the technology sector and resilient consumer spending. Bank of America expresses cautious optimism, noting that while fundamentals remain solid, valuations are stretched in certain areas. JPMorgan takes a more neutral view, expecting limited upside unless there’s a clear pivot toward rate cuts. So, is the S&P 500 expected to go up? The prevailing sentiment suggests a positive bias, though with elevated volatility due to policy uncertainty and external risks.

[Table: Major Bank S&P 500 Price Targets (Next 6-12 Months)]

| Institution | S&P 500 Target | Outlook |

|—|—|—|

| Goldman Sachs | 5,400 | Bullish on tech & earnings |

| Bank of America | 5,200 | Cautiously optimistic |

| JPMorgan Chase | 5,000 | Neutral to slightly bullish |

Mid-Term Projections (S&P 500 Forecast 2025)

Looking toward 2025, the outlook hinges on several key assumptions: that inflation continues to trend downward, the Fed achieves a soft landing, and corporate earnings maintain a steady growth path. Under these conditions, analysts project the S&P 500 could reach between 5,500 and 5,800. This forecast anticipates a normalization of monetary policy, with rate cuts potentially stimulating equity valuations. However, uncertainty surrounds the U.S. presidential election, which could bring changes in tax, regulatory, or fiscal policy. Market participants will also be watching for signs of labor market softening or a slowdown in consumer spending—both of which could delay or derail the expected recovery. What is the S&P 500 forecast for 2025? Broadly speaking, the expectation is for continued growth, but likely at a more measured pace than the strong rallies seen in previous years.

Long-Term Horizon (S&P 500 Forecast Next 5-10 Years)

Over the next decade, the S&P 500’s performance will be shaped less by quarterly volatility and more by structural forces. Technological innovation—especially in artificial intelligence, biotechnology, and clean energy—is expected to drive transformative growth across industries. Productivity gains from automation and digital transformation could enhance corporate profitability, while demographic trends like aging populations may reshape demand patterns in healthcare and financial services. Historically, the index has delivered average annual returns of 7% to 10% after inflation, and many experts believe this trend can continue over the long run. Of course, this doesn’t imply a straight upward climb—market cycles include corrections and bear markets. But for long-term investors, staying invested through these fluctuations has historically been rewarded. The key lies in focusing on the underlying strength of American businesses rather than short-term noise.

[Image: S&P 500 Historical Performance Chart with Long-Term Trend Line]

Understanding Prediction Methodologies

Not all S&P 500 forecasts are created equal. The methods analysts use can lead to vastly different conclusions, and understanding these approaches helps investors assess the reliability and relevance of any given prediction. From traditional analysis to cutting-edge technology, the tools of market forecasting have evolved significantly.

Fundamental vs. Technical Analysis

Two primary schools of thought dominate market forecasting: fundamental and technical analysis. Fundamental analysts dig into economic data, company financials, and industry dynamics to estimate intrinsic value. They ask questions like: Are earnings growing? Is debt manageable? Is the business model sustainable? This approach is especially useful for long-term investors who prioritize financial health over price movements. Technical analysts, by contrast, focus solely on price charts and trading volume. They look for patterns—such as head-and-shoulders formations or moving average crossovers—to predict future trends. While critics argue that technical analysis ignores business fundamentals, proponents believe that all available information is already reflected in the price. Many professional investors blend both methods, using fundamentals to determine what to buy and technicals to decide when.

The Role of AI and Quantitative Models in S&P 500 Predictions

In recent years, artificial intelligence and machine learning have transformed the forecasting landscape. These systems, sometimes referred to in discussions about “Sp500 AI prediction,” can analyze millions of data points in real time—from earnings transcripts and Federal Reserve statements to social media sentiment and satellite imagery of retail parking lots. By identifying subtle correlations and anomalies, AI models can detect shifts in market sentiment before they become apparent through traditional indicators. For example, natural language processing can parse news articles to gauge whether coverage of the economy is turning more positive or negative. However, these models aren’t foolproof. They rely heavily on historical patterns, which may not hold during unprecedented events like pandemics or financial crises. Additionally, the opacity of some AI systems—often called “black boxes”—makes it difficult to understand how they arrive at their conclusions. As a result, most firms use AI as a supplement to human judgment, not a replacement.

Potential Risks and Opportunities for the S&P 500

No forecast is complete without weighing both the upside and downside. While the long-term trajectory of the S&P 500 has been upward, the path is rarely smooth. Recognizing the key risks and opportunities allows investors to prepare for various scenarios and adjust their strategies accordingly.

Downside Risks (Why is the S&P 500 crashing? Stock market correction prediction 2025)

A market correction—defined as a drop of 10% or more from recent highs—is a normal part of the market cycle, but severe downturns often stem from deeper imbalances. One major concern is that inflation could reaccelerate, forcing the Federal Reserve to resume aggressive rate hikes. Higher borrowing costs could dampen consumer spending and corporate investment, leading to lower earnings. Geopolitical flare-ups, such as a wider conflict in the Middle East or a breakdown in U.S.-China relations, could disrupt trade and energy supplies. A sharp rise in unemployment or a housing market slump might signal an oncoming recession, further pressuring equities. Sector-specific risks also exist—overvalued tech stocks, for instance, could face steep corrections if growth slows. Why is the S&P 500 crashing? It’s rarely one single factor, but rather a confluence of deteriorating fundamentals, policy missteps, and shifting investor psychology.

[Image: Chart showing historical S&P 500 drawdowns during corrections]

Upside Opportunities

Despite these risks, compelling catalysts could propel the S&P 500 higher. Breakthroughs in artificial intelligence, quantum computing, or green technology may unlock new revenue streams across multiple sectors. Strong corporate balance sheets—built up during periods of low interest rates—give companies flexibility to invest, acquire, or return capital to shareholders through buybacks and dividends. A sustained period of disinflation could allow the Fed to cut rates without reigniting price pressures, providing a strong tailwind for equities. Additionally, fiscal policy, such as infrastructure spending or incentives for domestic manufacturing, could stimulate growth. For long-term investors, dips in the market often represent buying opportunities in high-quality businesses at more attractive valuations.

Investment Implications: What S&P 500 Predictions Mean for You

Forecasts are useful, but they should inform—not dictate—your investment strategy. Every investor has unique goals, time horizons, and risk tolerances, and no single prediction fits all. The real value of S&P 500 outlooks lies in helping you understand the range of possible outcomes and how different scenarios might impact your portfolio.

Strategies for Different Market Conditions

When growth appears strong and inflation is under control, a growth-oriented portfolio with exposure to innovative sectors like technology and healthcare may outperform. During uncertain or volatile periods, shifting toward defensive sectors—such as utilities, consumer staples, or healthcare—can help cushion potential losses. Dividend-paying stocks may also provide stability and income. For those concerned about short-term swings, dollar-cost averaging—investing fixed amounts regularly—can reduce the impact of market timing. Most importantly, maintaining a diversified portfolio across asset classes, sectors, and geographies remains one of the most effective ways to manage risk. Attempting to time the market based on a single forecast is rarely successful; history shows that staying invested over the long term tends to yield better results than trying to predict every turn.

Conclusion: Navigating the Future of the S&P 500

The S&P 500 is more than just a number—it’s a reflection of the dynamism, resilience, and complexity of the U.S. economy. Its movements are shaped by an intricate web of interest rates, earnings, economic data, and global events, all of which evolve in real time. While expert forecasts provide valuable context, they are inherently speculative and subject to constant revision. From the immediate impact of inflation and Fed policy to the long-term influence of innovation and demographics, the index’s path is influenced by forces both predictable and unforeseen. By understanding the methodologies behind predictions, evaluating risks and opportunities, and aligning decisions with personal financial goals, investors can navigate uncertainty with greater confidence. Ultimately, success in the S&P 500 isn’t about predicting the future with perfect accuracy—it’s about building a resilient strategy that endures through all market conditions.

1. Is the S&P 500 expected to go up in the next 6 months?

Many leading financial institutions project continued, albeit moderate, growth for the S&P 500 in the next 6 months. This is often based on resilient corporate earnings and expectations of easing inflation, though geopolitical risks and monetary policy remain key variables.

2. What is the S&P 500 forecast for 2025, according to top analysts?

Top analysts generally forecast a positive but potentially less aggressive growth phase for the S&P 500 in 2025, with price targets often ranging from 5,500 to 5,800. This outlook assumes stable economic conditions and continued corporate profitability.

3. What does Warren Buffett’s investment philosophy suggest about the S&P 500’s future?

Warren Buffett is a strong proponent of long-term investing in broad market indices like the S&P 500. His philosophy suggests that over long periods, the S&P 500 will reliably deliver positive returns due to the innovation and productivity of American businesses, despite short-term volatility. He often advises against trying to time the market.

4. What are the primary reasons why the S&P 500 might experience a significant downturn?

Primary reasons for a significant downturn include:

- Persistent high inflation leading to aggressive interest rate hikes.

- A recession triggered by reduced consumer spending or high unemployment.

- Major geopolitical conflicts or trade wars.

- Unexpected corporate earnings declines or a crisis in the financial system.

5. Can AI models accurately predict the S&P 500’s movements?

AI models can identify complex patterns and process vast datasets for S&P 500 predictions, offering valuable insights, particularly for short-term movements. However, their accuracy is limited by reliance on historical data and they may struggle with unprecedented events. They are best used as a complementary tool rather than a definitive predictor.

6. What is the long-term S&P 500 forecast for the next 5 to 10 years?

The long-term S&P 500 forecast for the next 5 to 10 years remains broadly optimistic. Historical data suggests average annual returns in the high single digits to low double digits, driven by technological advancements, corporate innovation, and overall economic growth, despite inevitable cyclical fluctuations.

7. What macroeconomic factors are most influential on S&P 500 predictions?

The most influential macroeconomic factors include:

- Inflation rates and Federal Reserve monetary policy (interest rates).

- Overall economic growth (GDP).

- Unemployment rates and consumer spending.

- Geopolitical stability.

8. How do corporate earnings impact the S&P 500 outlook?

Corporate earnings are a fundamental driver of the S&P 500. Strong and consistent earnings growth across its constituent companies typically leads to higher stock valuations and a positive outlook for the index. Conversely, declining earnings can signal economic weakness and lead to market corrections.

9. Are there specific sectors within the S&P 500 that are expected to outperform or underperform?

Sector performance varies with economic cycles and technological trends. Currently, technology, artificial intelligence, and healthcare often show strong growth potential. Energy or consumer discretionary sectors might outperform in specific economic conditions, while utilities or consumer staples could offer defensive stability.

10. What should investors consider when interpreting S&P 500 predictions?

Investors should consider:

- The source and methodology of the prediction.

- The time horizon (short-term vs. long-term).

- The range of different expert opinions.

- Their own financial goals and risk tolerance.

- The importance of diversification and a long-term investment strategy, rather than reacting to every forecast.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。