Japan PPI: What the Rising Wholesale Prices Mean for Your Investments

Table of Contents

ToggleIntroduction to Japan’s Producer Price Index (PPI)

Japan’s Producer Price Index (PPI) stands as a cornerstone metric in assessing the nation’s economic momentum, offering a clear window into how prices evolve at the early stages of production. Unlike consumer-focused indicators, the PPI tracks the average changes in selling prices received by domestic producers—whether for goods leaving factories or entering the country through imports—before they reach retail shelves. In Japan, this data is officially captured by the Bank of Japan (BoJ) through its Corporate Goods Price Index (CGPI), a comprehensive measure that has become synonymous with the country’s PPI. By focusing on transactions between businesses, the CGPI sheds light on inflationary trends brewing beneath the surface of consumer markets. For economists, investors, and policymakers, understanding movements in Japan’s PPI is essential for anticipating broader economic shifts, particularly in a country long shaped by deflationary pressures and cautious pricing behavior.

Why Japan PPI Matters: A Key Inflation Indicator

The significance of Japan’s PPI extends far beyond a simple measure of wholesale prices—it acts as a leading signal for the direction of the broader economy. Because producer prices often shift before consumer prices, the PPI serves as an early warning system for inflation or deflation. When manufacturers face higher input costs for raw materials or energy, those pressures eventually ripple through the supply chain. While Japanese firms have historically been reluctant to pass these increases on due to decades of price stagnation, sustained spikes in the PPI suggest mounting strain on profit margins and growing potential for consumer price adjustments. This dynamic makes the index a vital tool for investors evaluating corporate earnings outlooks, especially in sectors heavily dependent on imported inputs. For the Bank of Japan, PPI trends offer crucial context when assessing whether inflation is gaining organic momentum or merely reflecting temporary global shocks. As such, fluctuations in producer prices are closely watched for clues about the sustainability of price growth and the timing of future monetary policy shifts.

PPI vs. CPI: Understanding the Lag Effect in Japan

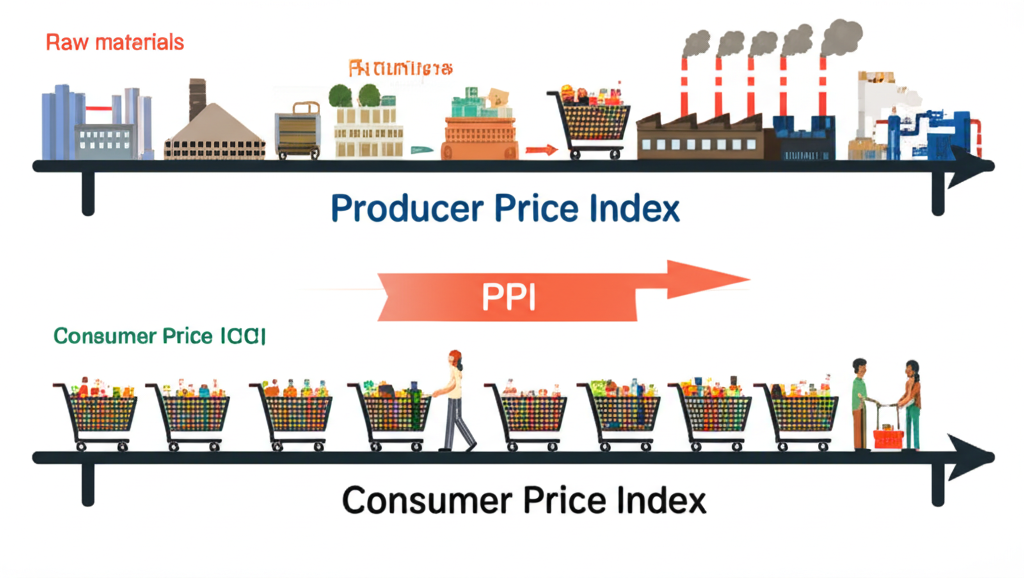

Although both the Producer Price Index and the Consumer Price Index (CPI) track inflation, they capture different phases of the economic cycle. The PPI reflects price changes from the perspective of producers—covering raw materials, intermediate goods, and finished products sold in bulk—while the CPI measures what households actually pay for everyday goods and services. One of the most important dynamics in Japan’s inflation landscape is the lag between movements in these two indices. Historically, increases in the PPI took months, if ever, to fully translate into higher consumer prices. This delay stemmed from structural factors: intense competition, weak pricing power among firms, and consumer expectations of stable or falling prices. However, recent years have seen a shift. Global supply disruptions, surging energy costs, and a weaker yen have forced more companies to adjust their prices, accelerating the pass-through from producer to consumer inflation. The result has been a tighter correlation between PPI and CPI, challenging long-standing assumptions about Japan’s resistance to inflation and signaling a potential turning point in the economy’s price-setting behavior.

Decoding Japan PPI Data: Sources, Components, and Calculation

The primary source for Japan’s PPI data is the Bank of Japan, which publishes the Corporate Goods Price Index (CGPI) on a monthly basis. This index is constructed using a representative basket of goods whose prices are monitored over time, with each category weighted according to its relative importance in intercompany transactions. The calculation compares current prices to those in a base year, generating key metrics such as year-over-year (YoY) and month-over-month (MoM) percentage changes. These figures allow analysts to gauge not only the direction of price trends but also their pace and persistence. The CGPI encompasses a broad spectrum of economic activity, including manufacturing, agriculture, mining, and utilities, making it a holistic reflection of cost movements across the production chain. Given Japan’s reliance on global trade, the index also incorporates price data for imported and exported goods, adding an international dimension to its analytical value.

Key Components of Japan’s Corporate Goods Price Index (CGPI)

The CGPI is composed of several major categories, each contributing differently to the overall index based on economic weight and volatility:

- Manufacturing Products: This is the largest segment, covering everything from high-tech electronics and industrial machinery to textiles and processed foods. Movements here reflect the health of Japan’s industrial base and global demand for its exports.

- Agricultural, Forestry, & Fishery Products: Prices in this category are sensitive to seasonal factors, weather events, and changes in global food markets. Even minor supply disruptions can lead to noticeable swings.

- Mining Products: Although Japan has limited domestic mining, this category tracks prices for energy sources like crude oil and coal, as well as industrial minerals. These are heavily influenced by global commodity markets.

- Electricity, Gas, & Water: Utility prices are shaped by both energy import costs and government regulations. As energy-intensive industries rely on stable utility pricing, changes here can have widespread ripple effects.

- Imported Goods Price Index (IMPI): This sub-index is particularly critical for Japan, which imports the majority of its energy and raw materials. The IMPI is highly sensitive to fluctuations in global prices and the strength of the yen—when the currency weakens, import costs rise sharply in yen terms.

- Exported Goods Price Index (EXPI): This tracks the prices Japanese firms receive for goods sold abroad. It offers insight into international competitiveness and how global demand conditions affect domestic pricing power.

Sectors with high weightings—such as petroleum and coal products or iron and steel—can disproportionately influence the headline CGPI. For example, a sudden spike in global oil prices can drive the entire index upward, even if other sectors remain stable. Analysts therefore examine both aggregate trends and component-level data to distinguish between broad-based inflation and isolated price shocks.

Historical Trends and Latest Figures: A Look at Japan PPI Performance

Japan’s Producer Price Index has undergone a dramatic transformation over the past few decades. For much of the1990s and2000s, the CGPI trended flat or negative, mirroring the country’s prolonged struggle with deflation. Companies operated under intense pressure to maintain low prices, limiting their ability to raise wages or invest aggressively. However, the global economic upheavals following the pandemic triggered a sharp reversal. Supply chain bottlenecks, surging commodity demand, and geopolitical tensions sent input costs soaring. By2022 and into2023, Japan’s PPI reached levels not seen in decades, with year-on-year gains exceeding10% at their peak—driven largely by energy, raw materials, and a sharply depreciating yen. More recently, the pace of increase has begun to ease. According to reports from Reuters, wholesale inflation has moderated, though it remains elevated compared to pre-2020 levels. For instance, a hypothetical reading of Japan PPI rising to4.2% in January of a recent year would indicate that producer prices are still under significant upward pressure, reflecting ongoing challenges related to import costs and global market volatility. Monitoring both YoY and MoM trends through detailed charts helps stakeholders assess whether inflationary pressures are cooling sustainably or merely pausing before another surge.

Japan PPI and the Bank of Japan’s Monetary Policy

The Bank of Japan relies heavily on PPI data when shaping its monetary policy stance. While the central bank’s official inflation target of2% is measured against the Consumer Price Index, the PPI provides an early readout on where price pressures are originating. A sustained rise in producer prices signals that inflation is not just a temporary import-driven phenomenon but could be embedding itself deeper into the economy. This distinction is critical. If businesses across multiple sectors begin adjusting prices upward in response to rising costs, it may indicate a broader shift in pricing behavior—one that could eventually feed into stronger consumer inflation and wage growth. In such cases, the BoJ might consider scaling back its ultra-accommodative policies, including yield curve control or large-scale asset purchases. Conversely, if PPI readings show signs of weakening, especially amid sluggish domestic demand, the central bank may opt to maintain or even reinforce its stimulus measures to prevent a relapse into deflation.

The BoJ’s Stance: Interpreting PPI for Future Policy Direction

The Bank of Japan’s interpretation of PPI data goes beyond headline numbers. Officials carefully analyze whether price increases are broad-based or concentrated in specific areas, and whether they stem from external shocks or domestic demand. For example, a surge in the PPI driven by higher global oil prices—what economists call cost-push inflation—may be viewed as transitory, especially if domestic consumption remains weak. In contrast, widespread price increases across manufacturing and services, coupled with rising wages, would suggest more sustainable demand-pull inflation, increasing the likelihood of policy normalization. The BoJ also pays close attention to the pass-through rate from PPI to CPI. If businesses are increasingly able to pass on higher costs to consumers, it signals improved pricing power—a key milestone after decades of deflation. Recent policy statements have reflected this nuanced view, with the central bank acknowledging the role of PPI in identifying inflationary momentum while emphasizing the need for confidence in its persistence before making significant policy shifts.

Forward-Looking Insights: Forecasting Japan PPI and Economic Impact

Predicting future movements in Japan’s PPI requires balancing a range of interconnected variables. Global commodity prices—particularly crude oil, natural gas, and industrial metals—remain a dominant factor, given Japan’s near-total dependence on energy imports. Equally influential is the value of the yen: a weaker currency amplifies import costs, directly feeding into higher producer prices. Supply chain resilience, geopolitical risks, and global trade flows also play pivotal roles. Analysts use econometric models that incorporate these inputs to generate forecasts, often projecting a gradual decline in PPI growth as supply conditions stabilize and commodity markets rebalance. However, unexpected disruptions—such as conflicts affecting energy routes or new trade restrictions—can quickly reverse this trajectory. Beyond the numbers, the bigger question for Japan is whether elevated PPI levels can catalyze a self-sustaining cycle of higher wages and consumer spending. Achieving this would mark a historic departure from the deflationary era and pave the way for a more normalized monetary policy environment. The path of the PPI will therefore remain central to understanding Japan’s long-term economic prospects.

Sectoral Impact Analysis: How PPI Affects Japanese Industries

The impact of PPI fluctuations varies significantly across Japan’s economic sectors:

- Manufacturing: Industries reliant on imported raw materials—such as steel, chemicals, and electronics—face direct exposure to PPI-driven cost increases. When input prices rise faster than output prices, profit margins shrink unless companies can pass costs to buyers, a challenge in competitive markets.

- Energy Sector: As a major component of the CGPI, energy prices influence nearly every other industry. Volatility in oil and gas markets translates into higher production, transportation, and operational costs across the board.

- Services: While the CGPI focuses on goods, service providers feel the indirect effects of rising PPI through increased expenses for utilities, equipment, and outsourced materials. Transportation and logistics firms, in particular, are sensitive to fuel price swings.

- Export-Oriented Industries: A rising PPI can erode the global competitiveness of Japanese exports if cost increases are not offset by currency movements. However, a weaker yen can partially neutralize this effect by making exports cheaper in foreign currencies.

For businesses, understanding these dynamics is key to managing risk, adjusting pricing strategies, and planning capital expenditures. Investors, meanwhile, can use PPI trends to identify sectors under margin pressure or those better positioned to absorb or pass on costs, helping to refine portfolio allocations in an evolving inflation landscape.

Conclusion: The Enduring Significance of Japan PPI

The Producer Price Index in Japan remains a vital gauge of economic health, offering early insights into inflationary currents before they reach consumers. As the Corporate Goods Price Index, it captures the complex interplay of domestic production, global trade, and currency dynamics that shape Japan’s cost structure. Its role in informing the Bank of Japan’s policy decisions, forecasting consumer inflation, and highlighting sector-specific pressures ensures its continued relevance. After decades defined by price stagnation, the recent surge in PPI has reignited debates about Japan’s inflation trajectory and the potential for lasting economic change. In a world of volatile commodity markets and shifting supply chains, tracking Japan’s PPI is more important than ever—for policymakers navigating monetary normalization, for businesses managing input costs, and for investors positioning for the future. It is not just a statistic; it is a barometer of Japan’s economic evolution.

Frequently Asked Questions about Japan PPI

What is the Producer Price Index (PPI) in Japan, and how is it calculated?

The Japan Producer Price Index (PPI), often referred to as the Corporate Goods Price Index (CGPI) by the Bank of Japan, measures the average change over time in the selling prices received by domestic producers for their output. It tracks prices of goods traded between businesses. It is calculated by surveying prices for a fixed basket of goods across various sectors, weighted by their economic importance, and comparing these prices to a base year.

How often is Japan’s PPI data released, and what are the key dates to watch on the economic calendar?

The Bank of Japan typically releases the Corporate Goods Price Index (CGPI) data on a monthly basis, usually around the8th or9th business day of the month, covering data for the previous month. Key economic calendars will list the exact release dates, which are crucial for financial analysts and investors.

What is the significance of Japan’s PPI in relation to its overall inflation trends and the Consumer Price Index (CPI)?

Japan PPI is a leading indicator for overall inflation. Changes in producer prices often precede changes in the Consumer Price Index (CPI) because businesses typically pass on their increased costs to consumers. Monitoring PPI provides early signals of inflationary or deflationary pressures that may eventually impact consumer prices and purchasing power.

How does the Bank of Japan (BoJ) utilize PPI data when formulating its monetary policy decisions?

The Bank of Japan uses PPI data to assess underlying inflationary pressures within the economy. It helps the BoJ understand if price increases are broad-based or confined to specific sectors, and whether they are likely to lead to sustainable consumer inflation towards its2% target. This analysis informs decisions on interest rates and other monetary policy tools.

What are the current forecasts for Japan PPI, and what factors are expected to influence these predictions?

Forecasts for Japan PPI are influenced by global commodity prices, exchange rates (especially the Japanese Yen’s value against the US Dollar), global supply chain conditions, and domestic demand. While forecasts often project a moderation in the pace of increases, persistent geopolitical tensions or unexpected shifts in global trade can introduce volatility.

Can a rise in Japan’s PPI indicate an impending increase in consumer prices, and what is the typical lag?

Yes, a rise in Japan’s PPI often indicates an impending increase in consumer prices due to the “pass-through” effect. The typical lag can vary, but it’s generally several months. In some cases, businesses may absorb costs for a period before increasing consumer prices, especially in a market historically prone to deflation.

Where can I access the most accurate and up-to-date historical and current Japan PPI data and charts?

The most accurate and up-to-date data for Japan PPI (CGPI) can be found on the official website of the Bank of Japan. Financial news services and economic data providers also compile and present this data, often with historical charts and analysis.

How do global commodity prices and the Japanese Yen’s exchange rate impact Japan’s PPI?

Japan is heavily reliant on imported raw materials and energy. Therefore, an increase in global commodity prices (e.g., oil, metals) directly raises the cost of inputs for Japanese producers, pushing up the PPI. Similarly, a depreciation of the Japanese Yen makes imports more expensive when converted to Yen, further contributing to higher producer prices.

Did Japan’s PPI increase to4.2% in January of the most recent year, and what were the implications?

While specific figures vary year by year, if Japan’s PPI did increase to4.2% in January (of a recent year), it would signify a substantial year-over-year increase in wholesale prices. Such a rise would typically imply significant cost pressures on businesses, potentially leading to higher consumer prices, impacting corporate profitability, and prompting closer scrutiny from the Bank of Japan regarding its monetary policy stance.

Is Japan struggling with inflation based on recent PPI and CPI indicators, and what is the outlook?

After decades of battling deflation, Japan has recently experienced periods of significant inflation, particularly driven by rising Producer Price Index figures, which have subsequently pushed up the Consumer Price Index. The outlook is complex; while some cost-push factors may moderate, the Bank of Japan is closely watching for signs of sustained demand-led inflation and wage growth to determine if Japan has truly exited its deflationary era.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。