usd/jpy technical analysis: Understanding Trends and Patterns for Successful Trading

Table of Contents

ToggleNavigating the USD/JPY Landscape: A Deep Dive into Technicals, Fundamentals, and the Central Bank Dance

Welcome, fellow traders, to an in-depth exploration of the dynamic USD/JPY currency pair. If you’re just beginning your journey in the world of foreign exchange or perhaps seeking to deepen your understanding of technical analysis, this article is designed to serve as your guide. The USD/JPY, often referred to as the “Gopher” among market participants, is a fascinating cross-section of two vastly different monetary policy approaches and economic landscapes.

Understanding what drives this pair requires a blend of technical acumen and fundamental insight. It’s like trying to navigate a complex sea; you need both a detailed map (technical analysis) and an understanding of the prevailing weather patterns (fundamental analysis). In this piece, we will dissect the recent movements of the USD/JPY, examining the key technical levels shaping its path and the powerful fundamental forces exerted by the Federal Reserve and the Bank of Japan.

Have you ever wondered why currency pairs move the way they do? It’s a perpetual interplay of factors, and for USD/JPY, the narrative is currently dominated by significant central bank divergence and shifts in global economic sentiment. We aim to demystify these elements, providing you with a clearer picture of what influences this pair and what potential scenarios might unfold.

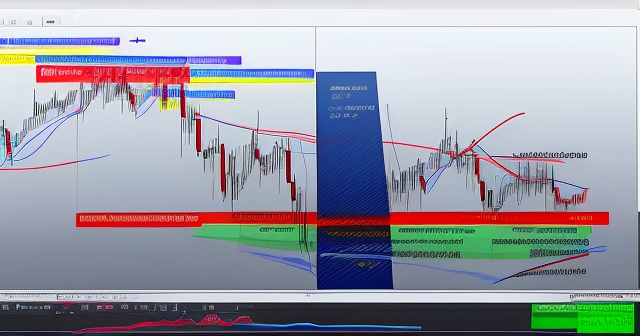

Let’s begin by focusing on the technical perspective. As of our analysis, the USD/JPY pair has been consolidating its position, particularly when viewed on the daily chart. What pattern stands out? We observe the price action confined within what appears to be an ascending channel. This formation is typically seen as a bullish pattern, suggesting that while the pair might experience pullbacks, the overall trajectory is upward as long as the price remains within the channel boundaries.

Think of an ascending channel like climbing a staircase. You might pause on a step (consolidation or minor pullback), but the overall direction is still up. The upper and lower boundaries of the channel act as dynamic resistance and support, respectively. Price tends to bounce between these lines, reflecting a prevailing upward trend, albeit with periods of oscillation.

Analyzing the daily chart provides us with a broader perspective on the trend. Currently, the indication leans towards a bullish inclination. This doesn’t guarantee future upward movement, but it signals that the path of least resistance, based on recent price behavior, has been to the upside. How do we confirm this? By looking at key technical indicators and specific price levels.

Beyond chart patterns, technical indicators offer valuable clues about momentum and potential turning points. For the USD/JPY, examining indicators like the Relative Strength Index (RSI) and key moving averages provides further context. The RSI, a momentum oscillator, measures the speed and change of price movements. A reading above 50, particularly when trending upwards, typically reinforces a bullish view. At recent points, the RSI for USD/JPY has been residing above this crucial 50 mark, aligning with the ascending channel’s bullish suggestion.

Moving averages, such as the Simple Moving Average (SMA) or Exponential Moving Average (EMA), smooth out price data over a specific period, making it easier to identify the trend direction. They can also act as dynamic support or resistance. We specifically monitor the 50-day Exponential Moving Average (EMA). This particular EMA is often used by traders to gauge the intermediate-term trend. If the price is trading above the 50-day EMA, it suggests the trend is upward; below it, the trend is downward.

While some older data points might have shown moving averages suggesting selling pressure, the more recent analyses, particularly those aligning with the observation of the ascending channel and an RSI above 50, indicate prevailing upward momentum. It’s crucial to remember that indicators can sometimes provide mixed signals, and relying on a confluence of evidence from multiple indicators and chart patterns is always a more robust approach.

| Technical Indicator | Current Status | Interpretation |

|---|---|---|

| RSI | Above 50 | Bullish Momentum |

| 50-day EMA | Above price | Upward Trend |

| Ascending Channel | Confirmed | Bullish Pattern |

Now that we’ve identified a potential bullish bias based on the technical setup, where might the USD/JPY find resistance on its journey upwards? Resistance levels are price points or zones where selling pressure is expected to emerge, potentially halting or reversing an upward move. For the USD/JPY, several key resistance levels are on our radar.

First, there are psychological levels – round numbers like 157.00, 158.00, or 160.00. These levels act as mental barriers for traders and often see increased trading activity. The level of 157.00 is a notable immediate hurdle. A sustained move above this level is often interpreted as a sign of underlying strength, potentially paving the way for further gains. Think of these psychological levels as significant milestones on the price chart.

Beyond the psychological marks, we look at structural resistance. The upper boundary of the ascending channel provides dynamic resistance that moves with time. Historically significant highs also serve as strong resistance. We’ve seen the pair test levels near 158.00 and even touch highs near 158.80 more recently. The multi-decade high sits significantly higher, closer to 160.32, representing a formidable barrier that the market has previously struggled to overcome.

What happens if the price breaks convincingly above one of these resistance levels, particularly 157.00 or 158.00? A breakthrough above a resistance level can often lead to an acceleration of the trend, as it signals that buying pressure has overcome the selling interest at that point. Such a move could indeed guide the USD/JPY pair towards the next major resistance zone.

Conversely, where can the USD/JPY find support if it experiences a pullback? Support levels are price points or zones where buying pressure is expected to materialize, potentially stopping or reversing a downward move. Just as important as identifying upside targets is understanding where potential floors exist.

A key support level identified in recent analysis is near the 50-day Exponential Moving Average (EMA), which has been hovering around 155.09. This is a critical confluence point – a technical support level combined with the intermediate-term trend indicator. If the price respects this EMA and bounces off it, it reinforces the bullish bias suggested by the ascending channel.

The lower boundary of the ascending channel also acts as dynamic support. A test of this lower boundary, assuming it coincides with or is near other support levels like the 50-day EMA, would be a key test for the prevailing uptrend. Below these immediate levels, a throwback support area around 152.80 has been noted in analysis. This level represents a previous point of resistance that, once broken, often turns into support (the concept of resistance turning into support).

| Support Level | Price Point | Significance |

|---|---|---|

| 50-day EMA | 155.09 | Key Technical Support |

| Lower Boundary | Dynamic Support | Maintains Uptrend |

| Throwback Support | 152.80 | Potential Floor |

What if the USD/JPY price breaches below the 50-day EMA or the lower boundary of the ascending channel? A breach below a key support level is a significant technical event. It indicates that selling pressure has overwhelmed buying interest at that point and could intensify downward pressure, potentially leading the pair towards lower support zones like 152.80 or even revisiting earlier levels mentioned in older data like 149.00 or 151.20, depending on the magnitude of the breakdown.

While technical analysis provides the roadmap, fundamental analysis explains *why* the market is moving in a certain direction. For the USD/JPY, the most significant fundamental driver over the past few years has been the stark divergence in monetary policy between the United States Federal Reserve (Fed) and the Bank of Japan (BoJ).

Monetary policy refers to the actions undertaken by a central bank to manipulate the money supply and credit conditions to stimulate or constrain economic activity. The primary tools are adjusting interest rates and managing the money supply through measures like bond purchases.

In the US, the Federal Reserve has been engaged in a cycle of hiking interest rates to combat inflation. More recently, the Fed has shifted to a “hawkish hold,” maintaining current rates but signaling a cautious approach to future cuts. What’s particularly impactful is the recent shift in the Fed’s outlook for the remainder of the year. Policymakers, as reflected in the latest projections, now anticipate only one rate cut in 2024, a significant reduction from the three cuts they had projected earlier in the year. This ‘higher for longer’ interest rate outlook in the US makes the US Dollar more attractive to investors seeking higher yields, thus supporting the USD.

Contrast this with the situation in Japan. The Bank of Japan has maintained an ultra-loose monetary policy for years, including negative interest rates (NIRP) and extensive bond purchases, in an effort to stimulate a stagnant economy and fight deflation. While the BoJ recently ended NIRP, its stance remains largely dovish compared to the Fed. This means Japanese interest rates are significantly lower than US rates. This interest rate differential makes holding US Dollar assets more appealing than holding Japanese Yen assets, creating consistent buying pressure for USD/JPY.

This substantial divergence – a hawkish Fed and a dovish BoJ – has been the primary engine driving the USD/JPY pair to multi-decade highs. As long as this divergence persists or even widens, the fundamental pressure on the Yen to weaken against the Dollar remains significant.

The Bank of Japan is at a critical juncture. While they are widely expected to maintain a largely accommodative stance, market participants are keenly focused on the nuances of their policy decisions, particularly regarding bond purchases. Ending negative rates was just the first step in a potential normalization process, but the path forward is fraught with challenges.

A significant challenge for the BoJ is how to exit from its extensive bond purchase program without disrupting the bond market or the broader economy. Reducing the amount of monthly bond purchases is a likely next step, but the pace and scale of this reduction are uncertain. Any signals from the BoJ that they might reduce stimulus faster than expected could provide temporary support for the Japanese Yen, while maintaining the current pace or signaling a slower reduction would likely keep the Yen under pressure.

Traders are closely monitoring BoJ policy statements and press conferences for any hints about their future intentions. Will they give more clarity on the pace of tapering their bond purchases? Will they provide any forward guidance on potential future rate hikes, however distant? The answers to these questions will have a direct impact on the Japanese Yen’s strength and, consequently, the USD/JPY pair.

For those considering trading this pair, understanding the BoJ’s complex situation is paramount. Their policy choices, while often subtle, can trigger significant market reactions.

On the other side of the coin is the Federal Reserve. As we discussed, their recent hawkish hold and the revised projection of only one rate cut in 2024 have been key drivers of US Dollar strength. But what influences the Fed’s decisions?

The Fed’s mandate includes price stability (managing inflation) and maximum employment. Their decisions are heavily influenced by incoming economic data. Recent US economic data releases, such as JOLTS Job Openings and Consumer Confidence, have sometimes shown signs of softening. Traditionally, weaker economic data can increase the likelihood of the Fed needing to cut rates to stimulate the economy. This would typically be bearish for the US Dollar.

However, the current environment is complex. Despite some softer data points, the overall picture remains relatively robust, and inflation, while having decreased from its peak, is still a concern for the Fed. Furthermore, factors like trade uncertainty and broader global economic conditions also play a role in their assessment. The market’s expectation for a September rate cut, as tracked by tools like the CME FedWatch Tool, has recently decreased, reflecting this cautious stance from the Fed and the conflicting signals from the data.

| Economic Indicator | Importance | Current Trend |

|---|---|---|

| JOLTS Job Openings | Labor Market Health | Softening |

| Consumer Confidence | Economic Sentiment | Mixed Signals |

| Producer Price Index (PPI) | Inflation Pressure | Awaiting Release |

Upcoming US data releases, such as Jobless Claims and the Producer Price Index (PPI), are therefore closely watched events. Jobless Claims provide insight into the health of the labor market, a key factor for the Fed. PPI data gives a picture of inflation pressures from the producer’s perspective, which can feed into consumer inflation. Strong data might reinforce the Fed’s hawkish posture, while weak data could increase the probability of rate cuts down the line, potentially weighing on the Dollar.

As we look ahead, the immediate future for USD/JPY trading is heavily contingent on upcoming data and policy announcements. Both the Bank of Japan’s monetary policy decision and subsequent press conference, and key US economic data releases, will act as potential catalysts for significant price movement.

Will the BoJ signal a change in its bond purchase program? Will US data surprise to the upside or downside, shifting expectations for Fed rate cuts? These events hold the potential to either reinforce the current technical patterns or cause a decisive break in either direction. The market is currently in a state of cautious anticipation, waiting for these pieces of the puzzle to fall into place.

Understanding the potential impact of these scheduled events is crucial for managing risk and identifying trading opportunities. Unexpected outcomes from central bank meetings or economic data can lead to swift and significant moves in the USD/JPY pair, often referred to as volatility. Being prepared for potential volatility around these events is a key aspect of trading this pair effectively.

Navigating these volatile periods requires access to platforms that offer reliability and quick execution. When considering your trading partner for navigating global markets and events, the technological infrastructure matters. Moneta Markets provides support for leading platforms like MT4 and MT5, known for their charting tools and execution capabilities, combined with their proprietary Pro Trader platform, aiming to provide a seamless experience for various trading strategies.

So, where does this leave us with the USD/JPY? We see a technical picture suggesting a bullish bias, reinforced by the ascending channel and key indicator readings like the RSI above 50. Key resistance levels around 157.00, 158.00, and ultimately the multi-decade high near 160.32, mark the potential upside targets. On the downside, critical support zones, including the 50-day EMA near 155.09 and the throwback support around 152.80, are the levels to watch for potential downside risk.

Underpinning this technical structure is the powerful fundamental engine of central bank divergence. The hawkish stance of the Federal Reserve, particularly their revised rate cut outlook, provides strong support for the US Dollar. Meanwhile, the Bank of Japan’s relatively dovish position, despite ending NIRP, keeps the Japanese Yen under pressure. This divergence remains the primary long-term driver of the pair’s upward trend.

However, the market is not static. Upcoming events, specifically the Bank of Japan’s policy decision and key US economic data, hold the potential to significantly alter the landscape. These events could either reinforce the current technical trends or provide the catalyst needed for a decisive break from the established patterns.

As traders, our task is to integrate these layers of analysis. Use the technical levels to identify potential entry and exit points and to manage risk (setting stop-losses). Understand the fundamental drivers to grasp the underlying forces at play and anticipate potential market reactions to news events. The delicate balance between these technical and fundamental realities will ultimately determine the future direction of the USD/JPY pair.

Remember, successful trading involves continuous learning and adaptation. The market is constantly evolving, and staying informed about both the technical setup and the fundamental narrative is crucial for making well-informed trading decisions in pairs like USD/JPY. Keep your charts updated, monitor the news flow from the central banks and economic calendars, and approach the market with discipline and a clear strategy.

usd/jpy technical analysisFAQ

Q:What is the current trend for the USD/JPY pair?

A:The trend for the USD/JPY pair is currently bullish, characterized by an ascending channel and technical indicators like the RSI above 50.

Q:What significant resistance levels should traders watch?

A:Key resistance levels include 157.00, 158.00, and 160.32, which are psychological barriers and multi-decade highs.

Q:How does the Federal Reserve’s policy affect the USD/JPY pair?

A:The Federal Reserve’s hawkish stance and interest rate outlook bolster the US Dollar, thereby impacting the strength of the USD/JPY pair.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。