Brexit Economic Forecast: Navigating Challenges and Opportunities in a Changing Landscape

Table of Contents

ToggleNavigating the Post-Brexit Economy: Understanding the Structural Shifts and Forecasts

Five years after the United Kingdom officially left the European Union, the economic landscape continues to evolve, presenting both complexities and challenges for businesses and investors alike. As a knowledge-focused brand, we understand that navigating these shifts requires a deep understanding of the underlying economic forces at play. While global events like the COVID-19 pandemic and geopolitical conflicts have undoubtedly impacted every nation, analyses from key institutions and studies increasingly highlight how Brexit has introduced distinct structural barriers, affecting everything from trade flows and business investment to labour supply and overall growth relative to international peers.

This article is designed to walk you through the latest forecasts and evidence, drawing upon data from reputable sources like the Office for Budget Responsibility (OBR), Goldman Sachs, the National Institute of Economic and Social Research (NIESR), and academic studies from institutions like Aston University Business School. Our goal is to help you understand Brexit's enduring economic impact, providing the clarity needed to make informed decisions in your investment journey. Think of us as your guide, helping you decipher the language of economics and its real-world implications.

Key indicators that illustrate Brexit's impact include:

- A decline in trade volumes between the UK and EU since 2021.

- Increased costs of compliance due to non-tariff barriers.

- A significant negative impact on Foreign Direct Investment (FDI) inflows.

Understanding Brexit as a Structural Economic Shift

When we talk about economic shocks, we often think of sudden events like a financial crisis or a pandemic that cause temporary downturns. However, economists classify Brexit differently. It's largely seen as a self-imposed, structural, and permanent economic shock. Why permanent and structural?

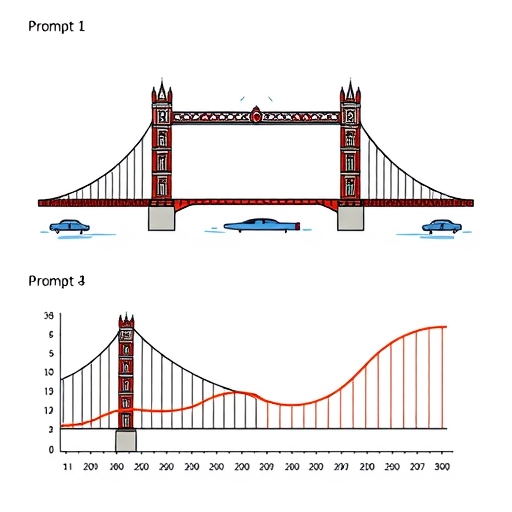

Unlike a cyclical recession that markets eventually recover from, leaving a major trading bloc like the EU fundamentally alters the operating environment for businesses and individuals. It changes the rules of trade, investment flows, and the movement of people in a lasting way. Imagine building a bridge over a river (remaining in the EU Single Market and Customs Union) versus deciding to navigate that river using complex, costly ferries and customs checks forever (the post-Brexit Trade and Cooperation Agreement, or TCA). The latter represents a permanent increase in the 'cost' of connection, embedding inefficiency into the system.

This structural change introduces lasting inefficiencies, primarily through increased trade barriers and regulatory divergence, which in turn impacts productivity and investment potential. It's not just a temporary bump in the road; it's a fundamental reshaping of the UK's economic geography and its relationship with its largest trading partner. Understanding this structural nature is crucial because it suggests the economic consequences are not expected to simply fade away over time without policy intervention.

The Headline Numbers: GDP Growth and Underperformance

Perhaps the most cited metric when assessing economic health is Gross Domestic Product (GDP). Here, the data paints a clear picture of relative underperformance. Estimates from prominent financial institutions provide striking figures. For example, Goldman Sachs analysis suggests that Brexit has potentially cut approximately 5% off UK economic growth relative to comparable advanced economies since the 2016 referendum. That's a significant figure, representing billions of pounds that the economy is not producing compared to a counterfactual scenario where the UK remained in the EU.

Adding to this, the National Institute of Economic and Social Research (NIESR) has also highlighted this divergence. They compare the UK's economic trajectory since 2016 not just to a 'stay' scenario but also to the performance of other similar advanced economies, including G7 peers. Their findings consistently show the UK lagging behind. By 2023, the UK notably stood out among G7 nations as being the only one that had not fully recovered its pre-pandemic GDP level, with Brexit's structural barriers being a key factor cited for this relative weakness.

While isolating the precise impact of Brexit from other global events (like the pandemic or the energy price shock from the Russia-Ukraine war) is complex, the consensus among these analyses is that Brexit has imposed a considerable and distinct drag on the UK's overall economic performance, setting it on a lower growth path than it otherwise would have been on.

| Year | GDP Growth (%) | Comparative Economies Performance |

|---|---|---|

| 2016 | 2.1 | Advanced Economies Average: 1.8 |

| 2021 | 7.4 | Advanced Economies Average: 5.4 |

| 2023 (Projected) | 1.4 | Advanced Economies Average: 2.0 |

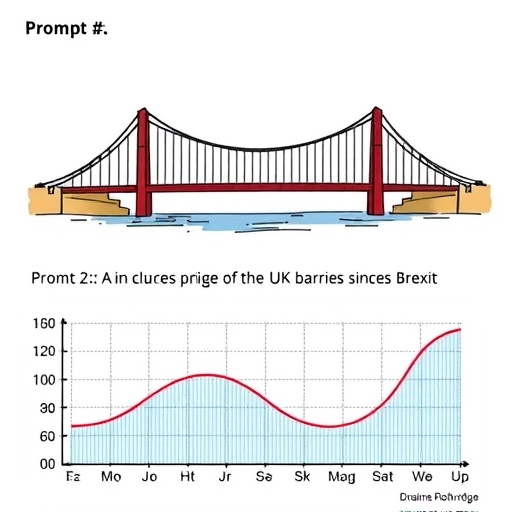

The Persistent Friction in UK-EU Trade

Trade is the lifeblood of modern economies, and Brexit fundamentally altered the UK's relationship with its closest and largest trading partner, the EU. Before Brexit, the UK was part of the EU's Single Market and Customs Union, allowing for virtually frictionless trade. The Trade and Cooperation Agreement (TCA), which came into effect in 2021, replaced this with a free trade agreement that, while avoiding tariffs and quotas on most goods, reintroduced significant non-tariff barriers.

These non-tariff barriers are the new friction points. They include customs checks, regulatory compliance requirements, paperwork, and divergent standards. Imagine you're shipping goods from the UK to Germany now. Instead of a simple process, you now need customs declarations, potentially safety certificates, proof of origin, and face possible physical checks. This adds time, complexity, and cost.

Official forecasts from the Office for Budget Responsibility (OBR) project that, in the long run, UK exports to and imports from the EU will be around 15% lower than if the UK had remained in the EU. However, real-world data from specific studies paint an even starker picture, particularly for goods trade. Research from Aston University Business School, for instance, using sophisticated counterfactual analysis, found that UK goods exports to the EU were 27% lower and imports from the EU were 32% lower in the first few years after the TCA compared to what they would likely have been without Brexit. While services trade has been more resilient in some areas, it also faces new barriers.

This substantial reduction in trade volumes has wide-ranging effects, impacting sectors that rely heavily on EU markets and supply chains, and ultimately limiting economic activity.

Breaking Down the Trade Barriers: Red Tape and Rules of Origin

Let's delve deeper into exactly what constitutes these "non-tariff barriers" and why they are so impactful. It's not just about filling out forms; it's the cumulative burden of administrative costs, compliance complexity, and regulatory divergence. This is often referred to as 'red tape,' and it disproportionately affects smaller businesses (SMEs) who may lack the resources, expertise, or scale to navigate the new customs procedures, VAT requirements, and regulatory checks effectively.

A key component of the TCA friction is Rules of Origin. Under the agreement, goods traded between the UK and the EU are only tariff-free if they meet specific rules proving they originated in the UK or EU. This sounds simple, but for products made with components from multiple countries (as is common in complex supply chains), proving origin can be incredibly complicated and requires detailed record-keeping. If origin rules aren't met, tariffs apply, making the goods more expensive and less competitive.

Furthermore, regulatory divergence means that UK and EU standards and regulations can gradually drift apart over time. For instance, specific certifications required for certain products might become different. This forces businesses exporting in both directions to potentially meet two sets of requirements, adding further costs and complexity. The Aston University study highlighted that these burdens have also led to a reduction in the variety of goods exported to the EU by UK firms, suggesting businesses are simplifying their offerings or withdrawing from certain markets entirely because the administrative hurdle is too high.

| Year | Impact on Trade Volumes | Percentage Decrease |

|---|---|---|

| 2021 | Goods Exports to EU | 27% |

| 2021 | Goods Imports from EU | 32% |

These tangible costs and complexities act as a constant drag on trade efficiency, raising costs for businesses and consumers alike, and ultimately contributing to lower trade volumes than would otherwise be the case.

The Deep Impact on Business Investment and FDI

Investment, particularly business investment and Foreign Direct Investment (FDI), is crucial for future economic growth, innovation, and job creation. Unfortunately, the data shows a significant negative impact in this area since the Brexit referendum.

Why would Brexit affect investment? Businesses thrive on stability and predictability. The prolonged period of uncertainty leading up to, during, and even after the finalisation of the TCA created a climate of caution. Companies delayed investment decisions, unsure about the future trading relationship, regulatory environment, and access to labour. This delay has had a lasting effect.

Analysis shows a tangible decline. Foreign Direct Investment inflows into the UK, a key measure of how attractive the country is for international businesses looking to set up or expand, saw a significant drop. Data indicates a 37% decrease in FDI inflows between 2016 and 2022. This isn't just a number; it represents missed opportunities for new factories, research centres, and high-value jobs that foreign companies might have brought to the UK.

Domestic business investment has also been weaker than expected. The National Institute of Economic and Social Research (NIESR) estimates suggest that UK business investment could have been around 12.4% higher in 2023 if Brexit had not occurred. Lower investment today means lower productivity and growth potential tomorrow. It's a cycle where uncertainty leads to less investment, which in turn constrains the economy's ability to expand and compete effectively in the future.

Uncertainty: The Silent Deterrent to Economic Activity

While trade barriers and regulatory changes are concrete impacts, one of the most insidious effects of Brexit has been the prolonged and often underestimated factor of uncertainty. From the moment of the referendum result in 2016, through the lengthy negotiation process, to the ongoing adjustments and minor disputes even after the TCA, businesses have faced an environment of flux.

Uncertainty makes planning difficult. If you're a business owner, how do you decide whether to invest in new machinery, hire more staff, or expand into a new market when you're unsure about future access to your key export markets, the regulatory landscape, or the availability of skilled labour? This 'wait and see' approach, adopted by many companies, has directly contributed to the weaker business investment discussed earlier.

Surveys like the Bank of England's Decision Maker Panel (DMP) have consistently shown that Brexit uncertainty has been a significant concern for businesses, influencing their hiring and investment intentions. Even attempts to resolve specific areas of friction, such as the Windsor Framework addressing Northern Ireland trade issues, while providing some practical relief in specific areas, do not entirely eliminate the broader uncertainty about the future trajectory of the UK-EU economic relationship or the potential for further regulatory divergence.

This persistent uncertainty is a significant cost in itself, freezing potential economic activity and acting as a brake on entrepreneurial spirit and growth.

The Productivity Puzzle: Why 4% Matters

Productivity, often defined as output per hour worked, is the most critical driver of long-term economic prosperity and living standards. A more productive economy can produce more goods and services with the same amount of effort, leading to higher wages and greater wealth. The Office for Budget Responsibility (OBR) forecasts that, in the long run, Brexit will reduce the UK's potential productivity by 4% relative to remaining in the EU. This 4% figure might sound small, but over years and decades, it compounds into a substantial impact on national income and living standards.

How does Brexit reduce productivity? Primarily through the increased non-tariff barriers to trade. These barriers make it harder and more expensive for businesses to import components or export finished goods. This means companies face higher costs for inputs, less choice in suppliers (reducing efficiency), and reduced access to large markets, which limits their ability to achieve economies of scale. It also hinders innovation and the diffusion of best practices that often come through close international trade and investment links.

Imagine a manufacturer who previously sourced a specific part easily and cheaply from the EU. Now, with customs checks, paperwork, and potential delays, that part costs more, takes longer to arrive, or they might have to switch to a less efficient domestic supplier. This directly impacts their operational efficiency and thus their productivity. Brexit is seen as exacerbating pre-existing weaknesses in UK productivity performance, making the long-standing 'productivity puzzle' even harder to solve.

While navigating complex economic landscapes like the one shaped by Brexit, staying informed and prepared is key for anyone involved in financial markets. If you're exploring opportunities in various asset classes, including foreign exchange or contracts for difference (CFDs), choosing a robust platform is essential.

If you're considering starting out in forex trading or want to explore a wide range of CFD instruments to potentially capitalise on market movements influenced by macro factors, then Moneta Markets is a platform worth considering. Based in Australia, they offer access to over 1000 financial instruments, providing options for both new and experienced traders seeking diverse opportunities.

Brexit's Influence on the Labour Market and Inflation

The ending of the free movement of people between the UK and the EU was a core element of Brexit. While the UK still welcomes migrants under its new points-based system, the composition and flow of migration have changed. This has had notable effects on the UK labour market.

Specific sectors that historically relied heavily on EU workers, such as hospitality, healthcare, and parts of the agricultural sector, have experienced labour shortages. While global factors also play a role, the reduction in the free movement of EU workers has been a contributing factor. For businesses, these shortages can lead to higher wage costs (as they compete for fewer workers), limitations on output, and increased operational difficulties.

Economists have also linked changes in migration patterns and reduced labour supply elasticity (how easily the labour supply responds to demand) to the inflationary pressures experienced in the UK post-pandemic. A less flexible labour market means that when demand for workers increases, wages are bid up more sharply, contributing to overall price increases in the economy. The OBR has recently revised up its forecasts for net inward migration (settling at 315,000 per year in the medium term), reflecting observed trends, but the post-Brexit system still represents a structural shift compared to the previous free movement regime.

These labour market adjustments and their potential link to inflation are another facet of how Brexit continues to influence the UK's economic stability and policy challenges.

New Trade Deals: A Limited Counterbalance?

A key argument for leaving the EU was the ability for the UK to strike its own trade deals with countries around the world, outside the EU's common commercial policy. The UK has indeed signed new trade agreements with countries like Australia, Japan, and others. However, economic analysis suggests that the benefits from these new deals are likely to be relatively modest compared to the costs associated with reduced trade with the EU.

Why is this the case? The EU remains the UK's largest and closest trading partner by a significant margin. The economic benefits from trade deals depend heavily on the size of the partner economy and the extent to which barriers are reduced. While new deals might reduce some tariffs or quotas, the economies involved are typically smaller than the EU bloc, and the deals often do not remove the complex non-tariff barriers (like regulatory alignment or customs checks) that characterise trade with the EU post-Brexit.

For instance, the OBR and Goldman Sachs have estimated that the long-run economic benefits from new trade deals signed by the UK, such as those with Japan or Australia, are likely to add only around 0.1% to UK GDP over 15 years. To put that into perspective, this is a tiny fraction of the estimated cost to GDP growth resulting from reduced trade and productivity with the EU. This analysis suggests that while striking new trade deals is a logical step for an independent trading nation, they are unlikely, on their own, to materially offset the economic impact of leaving the EU's Single Market and Customs Union.

Fiscal Implications and Ongoing Adjustments

Brexit has also had direct implications for the UK's public finances, impacting government revenue and spending. One clear change is the UK no longer contributes to the EU budget, saving billions of pounds annually, which can theoretically be redirected within the UK economy. However, these savings are captured within the government's overall spending plans and must be weighed against other costs.

The UK also incurred significant costs associated with the financial settlement paid to the EU upon departure. Furthermore, leaving the EU Customs Union meant the UK introduced its own customs border and the UK Global Tariff (UKGT) schedule. While trade with the EU is largely tariff-free under the TCA, tariffs now apply to imports from the EU that don't meet Rules of Origin or come via routes like Type 3 customs declarations with low preferential utilisation rates (PURs), as well as imports from non-EU countries with which the UK does not have a free trade agreement. This has led to an increase in tariff revenue collected by the UK government compared to when these revenues went to the EU budget. The OBR has noted this impact on the fiscal forecast, alongside temporary challenges related to tax non-compliance during the transition to new customs and VAT regimes.

The government is actively exploring ways to leverage "Brexit freedoms" – the ability to set its own regulations outside of EU law. However, policies explicitly rule out returning to the Single Market, Customs Union, or free movement, focusing instead on potential regulatory divergence and targeted support for affected sectors. The fiscal landscape is thus a mix of savings, settlement costs, changes in revenue streams, and the costs of new border infrastructure and regulatory systems.

Successfully navigating complex global markets often requires access to sophisticated tools and platforms that can handle diverse asset classes and provide regulatory assurance. Whether you are analysing macroeconomic trends like Brexit's impact or executing specific trading strategies, your choice of trading partner is critical.

When you are evaluating trading platforms, the flexibility and technological capabilities offered are key considerations. Moneta Markets stands out in this regard, supporting widely-used platforms like MT4, MT5, and Pro Trader. This, combined with features designed for fast execution and competitive low spread settings, contributes to providing a potentially advantageous trading experience for those looking to act on market insights.

Navigating the Landscape: Implications for Investors and Traders

So, what does this complex picture of Brexit's economic impact mean for you as an investor or trader? Firstly, it underscores the importance of understanding macroeconomic factors. While technical analysis focuses on price patterns and market indicators, these are often driven by fundamental economic realities. Structural shifts like the ones caused by Brexit can influence currency movements (GBP volatility), sector performance (impact on export-oriented vs. domestically focused industries), and overall market sentiment.

For investors focused on UK assets, recognizing the estimated long-run impact on productivity and growth potential is crucial for evaluating long-term prospects. Understanding the trade barriers and their effect on specific industries (e.g., Agrifood, Automotive, Textiles, Materials manufacturing have been cited as particularly affected, while others like Tobacco, Railway, and Aircraft have shown more resilience in export variety according to the Aston study) can inform sector allocation decisions.

For traders, the uncertainty and structural adjustments can create volatility and trading opportunities. Shifts in labour markets affecting inflation might influence Bank of England monetary policy decisions, impacting interest rates and, consequently, the strength of the pound (GBP). Navigating this requires robust analysis, risk management, and access to platforms that can execute trades efficiently across various markets.

Staying informed about economic data releases, official forecasts, and analyses from reputable institutions provides valuable context for your trading decisions. The landscape is more complex, but with greater understanding comes the potential for more informed participation in the markets.

If you are actively seeking a regulated broker for global trading opportunities across various asset classes, finding a reliable partner is paramount. Regulatory compliance offers a layer of confidence and security in your trading activities.

If you are looking for a broker that offers regulatory compliance and access to global trading opportunities, Moneta Markets is a strong contender. Holding multiple regulatory licenses, including from the FSCA, ASIC, and FSA, they also provide essential support features like segregated client funds, free VPS services, and 24/7 client support, including in Chinese, making them a preferred choice for many traders seeking comprehensive protection and service.

Conclusion: Looking Ahead in a Reshaped Economy

In conclusion, the economic forecasts and analyses from leading institutions consistently point to Brexit having imposed significant and structural costs on the UK economy. The reintroduction of trade barriers with the EU, while not involving widespread tariffs, has led to substantial reductions in trade volumes, largely due to the burdens of customs, regulations, and paperwork. This friction, coupled with prolonged uncertainty since 2016, has dampened business investment and foreign direct investment, contributing to a forecasted long-run hit to productivity potential.

While new trade deals outside the EU represent diversification, their projected economic benefits are widely seen as insufficient to offset the costs associated with reduced trade and increased friction with the EU. Shifts in the labour market and fiscal adjustments represent further facets of this ongoing structural change.

The UK government is seeking ways to mitigate these effects and leverage regulatory autonomy. However, the evidence suggests that navigating the long-term economic landscape shaped by Brexit's inherent barriers will require sustained strategic focus on enhancing competitiveness, adapting supply chains, and restoring business confidence to stimulate the investment needed for future growth. For investors and traders, this complex environment necessitates a robust understanding of macroeconomic fundamentals alongside technical analysis, enabling more informed decision-making in a market shaped by enduring structural shifts.

brexit economic forecastFAQ

Q:What are the primary effects of Brexit on the UK economy?

A:Brexit has led to increased trade barriers, reduced investment, and ongoing uncertainty, which collectively constrain economic growth.

Q:How has Brexit affected UK trade with the EU?

A:UK trade with the EU has seen significant declines, with exports to the EU down by 27% and imports by 32% shortly after the TCA.

Q:Will new trade deals benefit the UK economy?

A:While the UK has signed new trade deals, their economic benefits are projected to be modest compared to the costs associated with reduced trade with the EU.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。