Why Did Cisco Buy Splunk? Unpacking the $28 Billion Acquisition’s Strategic Impact

Table of Contents

ToggleIntroduction: The Landmark Acquisition of Splunk by Cisco

In March 2024, the technology world took notice as Cisco Systems finalized its $28 billion acquisition of Splunk, marking one of the most significant shifts in enterprise IT strategy in recent years. This wasn’t just a financial transaction—it was a bold declaration of intent from a company long associated with networking hardware, now repositioning itself at the forefront of software-driven, data-powered infrastructure. The move underscores Cisco’s ambition to lead in an era defined by escalating cyber threats, sprawling multi-cloud environments, and the growing need for intelligent automation. As organizations struggle to maintain visibility and control across fragmented digital ecosystems, Cisco’s integration of Splunk’s powerful data analytics engine signals a new chapter in unified security and observability. The central question on everyone’s mind remains: what strategic imperatives drove this transformative decision?

The Core Strategic Rationale: Why Cisco Needed Splunk

Cisco’s acquisition of Splunk was far from impulsive. It reflects a deliberate and forward-looking strategy to evolve beyond its traditional strengths in networking and embrace the future of enterprise IT—one where data, software, and intelligence converge. The decision was shaped by clear market dynamics: customers increasingly demand integrated platforms that simplify complexity, reduce vendor sprawl, and deliver faster, more automated responses to operational and security challenges. Splunk fills critical gaps in Cisco’s portfolio, particularly in real-time data analysis, security operations, and full-stack monitoring. By bringing these capabilities in-house, Cisco aims to accelerate its transformation into a software-first organization with a stronger recurring revenue base and deeper customer engagement.

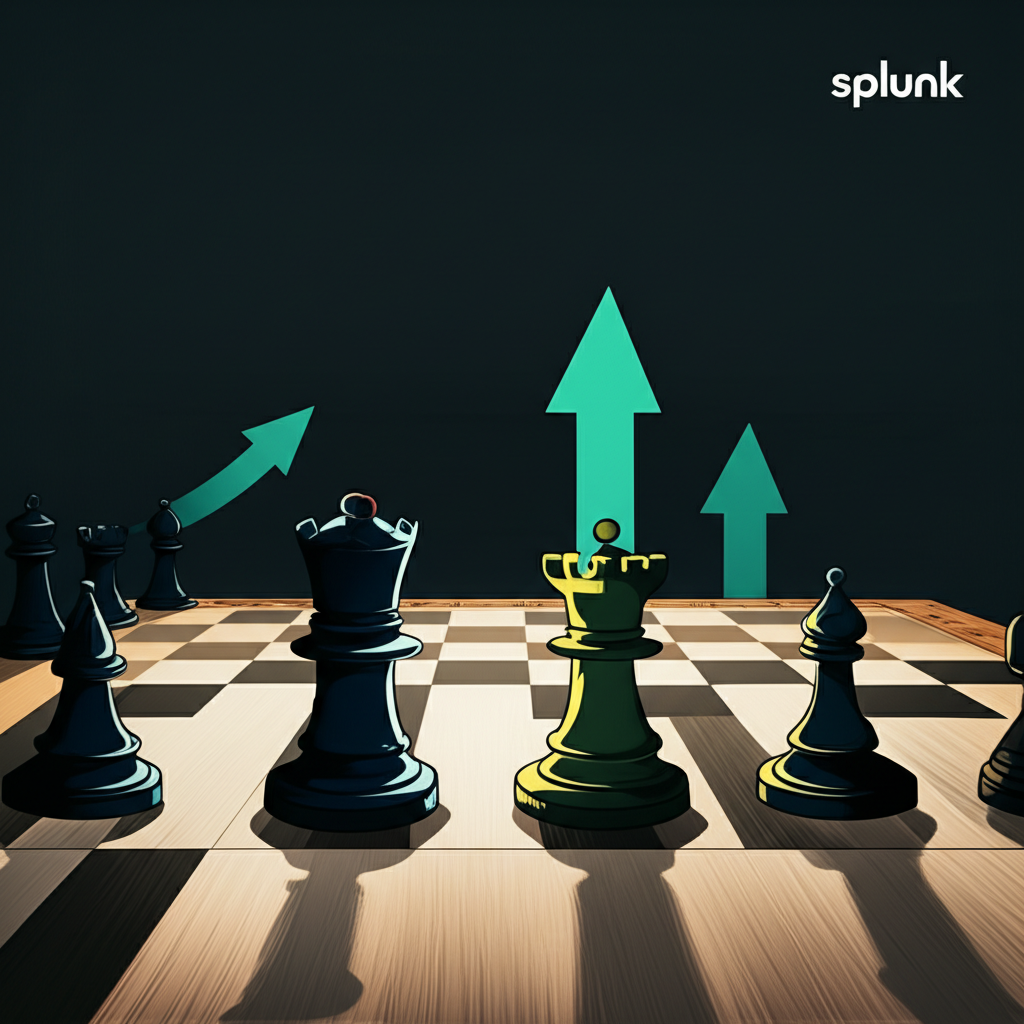

Strengthening Cybersecurity Portfolio: A Unified Threat Defense

Cybersecurity remains one of the most urgent priorities for enterprises worldwide, and Cisco’s acquisition of Splunk directly addresses a key limitation in its existing security stack: advanced threat detection and response. While Cisco has long been a leader in network-based security—offering firewalls, secure access, and endpoint protection—it needed a more robust capability to analyze vast streams of security telemetry across hybrid environments. Splunk’s expertise in Security Information and Event Management (SIEM) and Security Orchestration, Automation, and Response (SOAR) provides exactly that. The platform excels at ingesting log data from thousands of sources, identifying anomalies, and orchestrating automated remediation workflows.

By combining Splunk’s analytics power with Cisco’s deep network visibility and threat intelligence—such as data from SecureX, Duo, and Umbrella—the merged entity can deliver a closed-loop security system. Imagine a threat detected in a cloud workload triggering an immediate quarantine of the affected device through Cisco’s Secure Firewall, all orchestrated automatically via Splunk’s SOAR engine. This level of integration promises not only faster mean time to detection and response but also a more proactive security posture capable of anticipating and neutralizing threats before they escalate.

Dominating Observability and Full-Stack Visibility

As digital transformation accelerates, IT environments have become increasingly complex, with applications spanning on-premises data centers, public clouds, and edge locations. This fragmentation has made traditional monitoring tools inadequate. Observability—going beyond simple monitoring to provide deep insights into system behavior—has become essential. Splunk has long been a leader in this space, with powerful capabilities in Application Performance Monitoring (APM) and IT Operations Management (ITOM).

Cisco, with its dominant presence in network infrastructure, now gains the ability to correlate network performance data with application and user experience metrics. This full-stack visibility enables faster root cause analysis—no longer guessing whether a performance issue stems from the network, a microservice, or a database. For example, a sudden spike in user complaints about app latency can be instantly traced to a misconfigured network policy or a failing container, thanks to correlated data from both Cisco and Splunk systems. The goal is a single pane of glass that gives IT teams comprehensive control and insight, reducing downtime and improving service delivery.

Accelerating Data Analytics and AI Capabilities

At its foundation, Splunk is a data platform engineered to handle massive volumes of machine-generated data—logs, metrics, traces, and events—from virtually any source. This capability is not just valuable for security and observability; it’s the fuel for artificial intelligence and machine learning. Cisco recognizes that the next generation of enterprise solutions will be driven by AI: predicting outages, automating responses, and optimizing performance without human intervention.

By integrating Splunk’s data ingestion and processing engine, Cisco can supercharge its AI/ML initiatives across its entire product suite. For instance, AI models trained on Splunk’s historical data can predict network congestion before it impacts users or identify subtle, anomalous behaviors that indicate a zero-day attack. This data-centric approach allows Cisco to move from reactive to predictive and prescriptive operations. The combined platform could eventually offer self-healing networks and autonomous security operations centers, dramatically reducing the burden on overstretched IT teams.

Financial Underpinnings and Market Dynamics

The $28 billion price tag for Splunk was not made lightly. It reflects a strategic bet on long-term growth, recurring revenue, and market leadership in high-margin software segments. The acquisition was structured as an all-cash deal, closing on March 18, 2024, as confirmed in a Cisco press release. Despite the premium paid over Splunk’s pre-announcement valuation, Cisco projected that the deal would be immediately accretive to gross margin and non-GAAP EPS within two fiscal years. This financial discipline underscores the confidence in Splunk’s strong recurring revenue model, sticky customer base, and leadership in fast-growing markets.

The $28 Billion Bet: Acquisition Price and Valuation

Splunk’s business model—cloud-first, subscription-based, and highly scalable—aligns perfectly with Cisco’s strategic pivot toward software and recurring revenue. Prior to the acquisition, Cisco was already investing heavily in software, but Splunk brings an established, high-margin SaaS platform with deep enterprise penetration. The $28 billion valuation reflects more than just current revenue; it’s a bet on future synergies, cross-selling opportunities, and the ability to monetize integrated solutions across Cisco’s vast customer base of over 400,000 organizations. The deal is expected to generate significant cost synergies and revenue uplift through bundled offerings and expanded cloud adoption.

Competitive Landscape and Market Share Expansion

The merger reshapes the competitive landscape in both cybersecurity and observability. In security, Cisco-Splunk now stands as a formidable challenger to Microsoft, Palo Alto Networks, and CrowdStrike. While those players have strong cloud-native security offerings, Cisco brings unmatched network telemetry and a global presence, enabling deeper integration between security and infrastructure.

In observability, the combined company directly competes with Datadog, Dynatrace, and New Relic. Unlike pure-play observability vendors, Cisco can leverage its installed base of networking hardware to offer a unique value proposition: seamless, out-of-the-box data collection from the network layer, enriched by Splunk’s application and user-level insights. This hybrid advantage allows Cisco to offer a truly full-stack solution that is difficult for others to replicate. The result is a broader total addressable market and the potential to capture a larger share of enterprise IT budgets through bundled, cross-domain platforms.

Benefits and Synergies: A Win-Win Proposition?

The acquisition is designed to create value across multiple dimensions—strategic, financial, and operational. While large-scale integrations carry risks, the potential synergies suggest a compelling win-win scenario for Cisco, Splunk, and their customers.

For Cisco: Expanding Portfolio and Recurring Revenue

Cisco gains immediate access to a mature, cloud-native software platform with strong enterprise adoption. Splunk’s software and subscription revenue—historically growing at double-digit rates—complements Cisco’s efforts to diversify beyond hardware. The acquisition accelerates Cisco’s transition to a 50%+ software and services revenue model, a key goal set by CEO Chuck Robbins. Moreover, Splunk’s developer-friendly platform and API ecosystem open new avenues for innovation and ecosystem growth. By integrating Splunk into its security and observability offerings, Cisco can deepen customer relationships, increase wallet share, and reduce churn through platform lock-in.

For Splunk: Scale, Resources, and Global Reach

Splunk, while innovative, faced challenges scaling independently against well-resourced tech giants. As a standalone company, it struggled to match the go-to-market reach and R&D investment of larger players. Now, as part of Cisco, Splunk gains access to a global sales force, a vast partner network, and billions in annual R&D funding. This enables faster product development, broader market penetration, and enhanced cloud infrastructure investment. Cisco’s operational scale also allows Splunk to expand into new verticals and geographies with reduced friction. The acquisition doesn’t just provide stability—it offers a launchpad for accelerated growth and innovation.

For Customers: Integrated Solutions and Enhanced Value

End users stand to benefit the most from this merger. The promise is a simpler, more powerful IT stack. Instead of managing multiple point solutions from different vendors, customers can consolidate security and observability onto a unified platform. This reduces complexity, lowers operational costs, and improves response times. For example, a security analyst could investigate a phishing attack using correlated data from email gateways, endpoint agents, and network flows—all within a single interface. Similarly, a DevOps team could troubleshoot a slow application by viewing network latency, database queries, and API response times in one place. The integration also paves the way for AI-driven automation, such as auto-remediating misconfigurations or predicting capacity bottlenecks.

Integration Challenges and Future Vision

Despite the strong strategic case, the road ahead is not without obstacles. Merging two large, culturally distinct organizations requires careful navigation of technical, operational, and human challenges.

Navigating Integration: Technical and Cultural Hurdles

Technically, aligning Splunk’s cloud-native architecture with Cisco’s hybrid, hardware-integrated ecosystem is complex. Ensuring seamless data flow, API compatibility, and unified user experiences across dozens of products will demand significant engineering effort. Customers will expect minimal disruption, making backward compatibility and smooth migration paths essential.

Equally challenging is the cultural integration. Splunk has operated with the agility and innovation mindset of a software startup, while Cisco, though evolving, carries the legacy of a hardware giant. Retaining Splunk’s top talent—especially engineers and product leaders—is critical. If key personnel leave due to cultural misalignment or uncertainty, the innovation engine that made Splunk valuable could stall. Cisco’s leadership must foster a culture of collaboration, empower Splunk’s teams, and communicate a clear, inspiring vision for the future.

The Combined Product Roadmap: What to Expect Next

The success of the acquisition will ultimately depend on execution. Cisco has outlined a vision for a unified security and observability platform that operates across hybrid and multi-cloud environments. Key elements of the future roadmap include:

- A Unified Data Fabric: A shared data layer that ingests and normalizes telemetry from Cisco and Splunk sources, enabling cross-domain correlation and a single source of truth.

- AI-Driven Automation: Embedding machine learning into security and operations workflows to enable predictive analytics, autonomous remediation, and intelligent alerting.

- Consolidated User Experience: A streamlined interface that allows security and IT teams to manage both security and observability from one console, reducing context switching and improving efficiency.

- Cloud-Native Evolution: Continued investment in Splunk Cloud and Cisco’s cloud services to deliver scalable, resilient, and globally available solutions.

Early efforts will focus on integration points—such as linking Splunk SIEM alerts with Cisco Secure Firewall policies—but over time, customers can expect deeply embedded capabilities, new bundled offerings, and AI-powered features that redefine what’s possible in enterprise IT.

Illustrative diagram of the envisioned integrated platform.

Impact on Employees and Organizational Structure

Large acquisitions inevitably lead to organizational changes. While Cisco has emphasized growth and opportunity, some role consolidation is expected, particularly in overlapping functions like sales, marketing, and support. Splunk’s CEO, Gary Steele, joined Cisco’s executive leadership team, reporting directly to Chuck Robbins—a signal that Splunk’s strategic importance is recognized at the highest level. However, mid-level teams will face integration into Cisco’s broader structure. Transparent communication, clear career paths, and a focus on cultural integration will be essential to maintain morale and retain critical talent. The way Cisco manages this transition will determine whether the combined company becomes greater than the sum of its parts—or loses the innovative spark that made the deal worthwhile.

The strategic alliance aims to combine the strengths of both brands.

Table: Key Strengths Before Acquisition and Expected Synergies

| Company | Pre-Acquisition Core Strengths | Expected Synergies with Combined Entity |

|---|---|---|

| Cisco | Network Infrastructure, Enterprise Networking, Firewalls, Secure Access, IoT, Global Sales & Support | Enhanced Data Analytics for Network Ops, AI-driven Security Automation, Expanded Cloud-based Recurring Revenue |

| Splunk | SIEM, SOAR, Observability (APM, ITOM), Machine Data Analytics, Cloud-Native Software, Developer Ecosystem | Global Scale & Reach, Deeper Integration with Network Telemetry, Accelerated AI/ML Development, Broader Customer Base Access |

| Combined | Unified Security & Observability Platform, Full-Stack Visibility, Proactive Threat Detection & Response, Data-Driven IT Operations |

Conclusion: A Bold Move for a Data-Driven Future

Cisco’s $28 billion acquisition of Splunk is more than a merger—it’s a strategic repositioning for the next era of enterprise IT. By integrating Splunk’s data analytics powerhouse into its security and networking foundation, Cisco is building a unified platform capable of delivering end-to-end visibility, intelligent automation, and proactive defense. The move addresses critical market needs: simplifying complex IT environments, accelerating response to cyber threats, and harnessing data for smarter decision-making.

While integration challenges loom large, the potential rewards are substantial. Customers gain access to more powerful, cohesive solutions. Cisco strengthens its software portfolio and recurring revenue. Splunk gains the scale and resources to innovate at a global level. If executed well, this acquisition could set a new standard for integrated IT platforms, forcing competitors to rethink their strategies and accelerating the shift toward AI-driven, data-centric operations. In a world where visibility is power, Cisco is betting that the company with the most complete view of the digital landscape will lead the future.

When did Cisco officially complete its acquisition of Splunk?

Cisco officially completed its acquisition of Splunk on March 18, 2024. The deal was initially announced in September 2023.

What was the total acquisition price Cisco paid for Splunk?

Cisco paid approximately $28 billion in an all-cash transaction to acquire Splunk.

What are the primary strategic reasons behind Cisco’s decision to acquire Splunk?

The primary reasons include:

- Strengthening Cybersecurity: Integrating Splunk’s SIEM and SOAR capabilities with Cisco’s network security.

- Dominating Observability: Enhancing full-stack visibility and IT operations management.

- Accelerating Data Analytics & AI: Leveraging Splunk’s data platform to power AI/ML across Cisco’s portfolio.

How will Splunk’s cybersecurity capabilities integrate with Cisco’s existing security portfolio?

Splunk’s SIEM (Security Information and Event Management) and SOAR (Security Orchestration, Automation, and Response) platforms will complement Cisco’s existing network security products (e.g., firewalls, secure access). This integration aims to provide a unified platform for threat detection, investigation, and automated response across the entire IT environment, from network to endpoints to applications. The goal is to offer a more holistic and proactive cybersecurity defense.

What benefits can existing Cisco and Splunk customers expect from this acquisition?

Customers can expect:

- Integrated Solutions: Simplified IT environments with unified security and observability.

- Enhanced Value: Improved operational efficiency, faster incident response, and stronger security posture.

- Vendor Consolidation: Potential to reduce the number of vendors and streamline procurement.

- Future Innovation: Accelerated development of AI-driven security and observability features.

Will Splunk continue to operate as a separate entity, or will its brand be fully absorbed by Cisco?

While Splunk will become a part of Cisco, it is expected that its brand and product lines will be maintained and integrated into Cisco’s broader portfolio. Splunk CEO Gary Steele joined Cisco’s executive leadership team, reporting to Chairman and CEO Chuck Robbins, indicating a strategic integration rather than a complete absorption. The focus will be on leveraging Splunk’s distinct strengths while aligning with Cisco’s overall vision.

What role will Splunk’s observability platform play in Cisco’s future product strategy?

Splunk’s observability platform will be central to Cisco’s strategy to provide full-stack visibility and insights across increasingly complex IT environments. It will enable Cisco to offer comprehensive monitoring of applications, infrastructure, and user experiences, integrating with Cisco’s networking and infrastructure data. This is crucial for real-time performance optimization, proactive troubleshooting, and ensuring business continuity.

Are there any anticipated changes to Splunk’s product roadmap or support after the acquisition?

Cisco has expressed a commitment to continue investing in Splunk’s product roadmap. While there will be efforts to integrate Splunk’s offerings with Cisco’s, customers should expect continued support for existing Splunk products and a focus on evolving them within the combined ecosystem. The long-term vision is a unified platform, which may lead to new feature sets and bundled solutions, but existing contracts and support structures are expected to transition smoothly.

How does this acquisition impact the competitive landscape in the cybersecurity and observability markets?

This acquisition significantly reshapes the competitive landscape. In cybersecurity, Cisco-Splunk will be a stronger contender against players like Palo Alto Networks, CrowdStrike, and Microsoft, offering a more comprehensive security operations platform. In observability, it will challenge leaders such as Datadog, Dynatrace, and New Relic by providing a differentiated full-stack solution leveraging Cisco’s extensive network and infrastructure presence. This move is expected to drive further consolidation and innovation across both markets.

What are the potential long-term implications for innovation and talent retention within the combined company?

Long-term implications for innovation are positive, with the combined resources potentially accelerating AI/ML development and integrated solutions. However, talent retention is a critical challenge. Cisco must successfully integrate distinct corporate cultures and ensure Splunk’s innovative talent feels valued and empowered to prevent attrition. Successful integration of talent and cultures will be key to unlocking the full innovative potential of the combined entity and maintaining market leadership.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。