EUR/JPY Forecast: Unlocking Opportunities in the Dynamic Cross Pair Landscape

Table of Contents

ToggleIntroduction: Understanding the EUR/JPY Landscape

The EUR/JPY currency pair stands as one of the most closely watched cross-rates in the global foreign exchange market, reflecting the complex interplay between two major economic regions—the Eurozone and Japan. Unlike traditional USD-based pairs, EUR/JPY offers a direct barometer of divergent monetary policies, economic resilience, and investor sentiment across continents. The Euro, representing a union of 20 nations with a collective GDP rivaling the United States, contrasts sharply with the Japanese Yen—a historically low-yielding currency often sought during times of market stress. This dynamic creates a fertile ground for trading opportunities, particularly in carry trades where investors borrow in yen to fund euro-denominated assets, capitalizing on interest rate differentials.

At the heart of EUR/JPY’s movement lies the policy stance of two central banks with vastly different mandates and economic challenges. While the European Central Bank (ECB) grapples with persistent inflation and the need to normalize rates, the Bank of Japan (BoJ) has long maintained ultra-accommodative policies, only recently showing signs of gradual adjustment. This divergence fuels volatility and directional momentum in the pair. Traders monitor not only domestic economic indicators but also shifts in global risk appetite, geopolitical developments, and technical structures that can amplify or reverse underlying trends. This analysis aims to dissect the current state of EUR/JPY, explore its fundamental and technical drivers, and offer a layered outlook across multiple timeframes—equipping traders with a strategic framework for informed decision-making.

Current EUR/JPY Market Overview & Price Action

In recent weeks, EUR/JPY has demonstrated heightened volatility, reacting sharply to evolving inflation data, central bank commentary, and changing expectations around interest rate trajectories. The pair has oscillated within a defined range, showing signs of consolidation before explosive breakouts triggered by key data releases. A notable trend has been the market’s sensitivity to even subtle shifts in rhetoric from Frankfurt and Tokyo. For instance, stronger-than-expected Eurozone inflation figures have repeatedly sparked upward momentum, reinforcing expectations of further ECB tightening. Conversely, any indication that the BoJ might maintain or extend its yield curve control measures tends to weigh on the yen, pushing EUR/JPY higher.

However, the pair is not immune to broader market dynamics. Periods of risk aversion—sparked by geopolitical flare-ups, equity market sell-offs, or global growth concerns—have led to sudden yen strength as investors flee to safe-haven assets. This often results in sharp declines in EUR/JPY, regardless of underlying economic fundamentals. The current price action suggests a market at a crossroads: bullish momentum persists on the back of carry trade demand, yet resistance looms as traders question the sustainability of such imbalances. With both central banks under scrutiny, the near-term path will likely hinge on whether economic data supports further divergence or signals a potential convergence in policy outlooks.

Key Technical Levels & Immediate Outlook

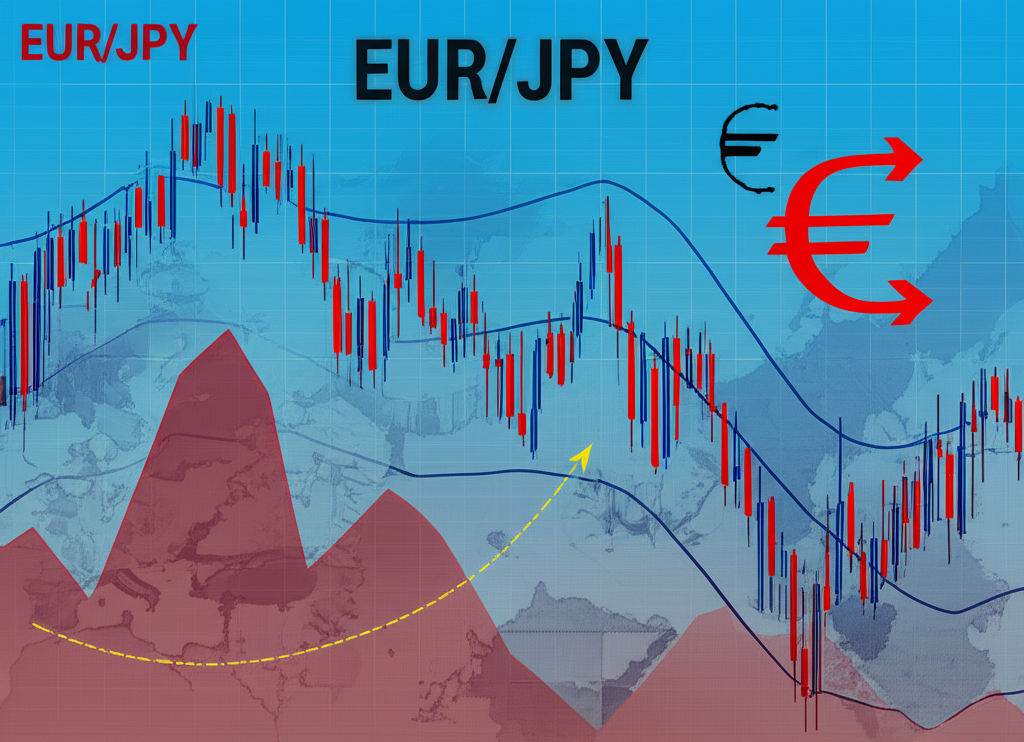

From a technical standpoint, EUR/JPY is currently testing a critical resistance zone near 164.80, a level that has capped rallies multiple times over the past quarter. A decisive break above this threshold could open the door to 166.00 and beyond, targeting long-term resistance established in previous cycles. On the flip side, failure to sustain gains above 164.00 may invite profit-taking and a retest of support around 162.50, coinciding with the 50-day moving average on the daily chart. This area also aligns with a prior swing low and a confluence of Fibonacci retracement levels, enhancing its significance.

The immediate outlook remains skewed toward volatility, particularly as traders brace for upcoming CPI data from the Eurozone and wage growth figures from Japan—both of which can recalibrate expectations for central bank action. Short-term traders are advised to monitor price reactions at these key levels, using them as potential entry or exit zones. A sustained close above resistance could confirm bullish continuation, while a breakdown below 162.50 might signal a deeper correction. Given the pair’s sensitivity to macro headlines, maintaining tight risk controls and avoiding overexposure ahead of major announcements is crucial.

In-Depth Technical Analysis for EUR/JPY

Technical analysis offers a structured lens through which to interpret EUR/JPY’s price behavior, helping traders identify high-probability setups and manage risk effectively. By examining patterns, indicators, and historical price zones across multiple timeframes, investors can gain a clearer picture of potential trend continuations or reversals.

Major Support & Resistance Zones

The most influential levels in EUR/JPY are those that have repeatedly acted as turning points. On the upside, resistance at 165.00 has proven formidable, representing a psychological barrier and a technical ceiling formed by previous highs. Above this, 167.20 marks the next significant zone, associated with a 61.8% Fibonacci extension of the 2022–2023 rally. On the downside, immediate support rests at 162.50, while stronger foundational support lies at 158.50—a level that held during the 2023 risk-off episodes. A break below this would suggest a fundamental shift in market sentiment, possibly signaling the end of the current carry-driven rally.

Traders often combine these static levels with dynamic support and resistance, such as pivot points and moving averages, to refine entry and exit strategies. The weekly pivot at 163.70, for example, has served as a magnet for price on several occasions, reinforcing its role as an intraday decision point.

Moving Averages & Oscillators (RSI, MACD, Stochastic)

The 50-day and 200-day moving averages remain cornerstone tools in trend analysis. Currently, the 50-day EMA sits just below price at 163.00, acting as dynamic support in an uptrend. A golden cross—where the 50-day crosses above the 200-day—remains intact, supporting the broader bullish structure. However, any sustained drop below the 50-day could trigger short-term bearish momentum, especially if accompanied by weakening volume.

Momentum indicators further refine this view. The Relative Strength Index (RSI) has hovered near 60 on the daily chart, indicating bullish momentum without entering overbought territory. A move above 70 could signal overheating, particularly if not confirmed by strong volume. The MACD shows a positive histogram with the fast line above the signal line, reinforcing upward momentum. Meanwhile, the Stochastic oscillator has recently formed a bullish crossover near the 20 level, suggesting potential upside continuation if supported by price action.

Chart Patterns & Candlestick Formations

Recent price action has formed a symmetrical triangle on the 4-hour chart, indicating a period of consolidation before a likely breakout. Given the prevailing trend, a breakout above the upper trendline near 164.80 would carry higher probability, targeting the 166.00 region. Conversely, a breakdown could lead to a retest of the triangle’s base at 162.50.

Candlestick patterns also offer tactical insights. A bullish engulfing pattern formed at the 162.70 support level last week, coinciding with a spike in buying volume—this was followed by a strong rally, validating the signal. Similarly, a doji near 164.80 resistance suggests indecision, potentially foreshadowing a pullback. Traders should watch for confirmation through follow-through candles before acting on such signals.

Fundamental Drivers Shaping the EUR/JPY Forecast

Beyond charts and indicators, the fundamental backdrop remains the primary engine behind EUR/JPY’s long-term trajectory. The divergence in monetary policy between the ECB and BoJ continues to dominate the narrative, but economic performance, inflation dynamics, and global sentiment also play critical roles.

ECB vs. BoJ Monetary Policy: Interest Rate Differentials

The interest rate gap between the Eurozone and Japan remains one of the widest among major currency pairs. The ECB has raised rates to 4.5%, with inflation still above target, suggesting further hikes cannot be ruled out. In contrast, the BoJ maintains rates near 0%, with only gradual adjustments to its yield curve control policy. This stark differential makes EUR/JP Decoration a prime candidate for carry trades, where investors earn the spread between the two rates.

However, this setup is not without risk. Any hawkish shift from the BoJ—such as a move toward positive rates—could trigger a rapid unwind of carry positions, leading to a sharp drop in EUR/JPY. Conversely, if the ECB signals a dovish pivot due to weakening growth, the spread could narrow, reducing the pair’s appeal. Traders must stay vigilant for shifts in central bank language, as even subtle changes in tone can move markets. For the latest policy updates, visit the European Central Bank and Bank of Japan websites.

Eurozone & Japanese Economic Indicators

Economic data from both regions serves as a constant catalyst for price movement. In the Eurozone, inflation (HICP), GDP growth, and manufacturing PMI are closely watched. A surprise uptick in core inflation could reinforce ECB hawkishness, boosting the euro. In Japan, wage growth, inflation expectations, and retail sales are key. Strong wage increases could signal sustainable inflation, increasing pressure on the BoJ to tighten further.

For example, Japan’s spring wage negotiations in 2024 saw the largest gains in decades, fueling speculation about a policy shift. Similarly, a weaker-than-expected German industrial output report recently triggered a brief pullback in EUR/JPY, highlighting how regional data can influence the broader pair. Monitoring the economic calendar and comparing actual results to consensus forecasts allows traders to anticipate market reactions.

Global Risk Sentiment & Geopolitical Events

The Japanese Yen’s status as a safe-haven currency means EUR/JPY often moves inversely to risk appetite. During equity market sell-offs or geopolitical crises—such as tensions in the Middle East or a debt crisis in emerging markets—investors tend to unwind leveraged positions, including EUR/JPY carry trades. This leads to yen strength and a drop in the pair. Conversely, periods of strong global growth and market optimism see capital flowing into higher-yielding assets, supporting the euro and pushing EUR/JPY higher.

The pair’s sensitivity to risk sentiment means that even events outside Europe and Japan—like U.S. Federal Reserve decisions or Chinese economic data—can indirectly impact EUR/JPY through their effect on global liquidity and investor behavior.

EUR/JPY Forecasts by Timeframe: Short, Medium, and Long-Term Outlook

A comprehensive trading strategy requires alignment across multiple time horizons. Below is a breakdown of expected scenarios based on current conditions and potential catalysts.

EUR/JPY Forecast Tomorrow & Next Week (Short-Term)

In the immediate term, EUR/JPY will likely remain range-bound between 162.50 and 164.80, with direction determined by incoming data. Key events include the Eurozone CPI release and Japanese industrial production figures. A hotter-than-expected inflation print could propel the pair toward 165.00, while weaker data may trigger a pullback. Technical breakouts on the 4-hour chart will offer intraday trading opportunities, but traders should exercise caution around high-impact news events due to increased slippage and spread widening.

EUR/JPY Monthly & Quarterly Outlook (Medium-Term)

Over the next three to six months, the pair’s direction will hinge on whether the ECB-BoJ policy divergence persists. If inflation in the Eurozone remains sticky and the ECB delivers another rate hike, while the BoJ maintains its dovish stance, EUR/JPY could climb toward 167.00. However, any sign of BoJ tightening—such as an exit from negative rates—could cap gains or trigger a correction. Sustained strength above 165.00 would confirm bullish momentum, while a close below 162.00 could signal a shift in trend.

EUR/JPY Forecast 2025 & Beyond (Long-Term)

Looking ahead to 2025 and beyond, the long-term outlook depends on structural shifts in Japanese monetary policy. If the BoJ achieves a full normalization of rates—raising them to 1% or higher—the yen could enter a sustained appreciation phase, undermining the carry trade and potentially reversing EUR/JPY’s long-term uptrend. However, if Eurozone growth remains resilient and inflation proves persistent, the ECB may keep rates elevated, supporting the euro. Demographic challenges in Japan and productivity gaps between the two economies will also influence the long-term balance. The most likely scenario is a gradual narrowing of the interest rate differential, leading to a consolidation phase or a slow correction in EUR/JPY unless a major policy shift occurs.

Trading Strategies & Risk Management for EUR/JPY

Success in trading EUR/JPY requires a disciplined approach that combines technical precision with fundamental awareness and robust risk controls.

Identifying Buy/Sell Opportunities and Entry/Exit Points

Several strategies can be applied depending on market conditions:

- Trend Following: In a confirmed uptrend, buying pullbacks to the 50-day MA or key support zones offers favorable risk-reward.

- Breakout Trading: Entering on a confirmed break above 164.80 with volume confirmation can capture momentum moves.

- Reversal Trading: At overbought RSI levels near resistance, a bearish engulfing pattern or MACD divergence could signal a short opportunity.

- Carry Trade: For long-term investors, holding EUR/JPY for positive swap income is viable if volatility is managed and central bank risks are monitored.

Entries should be precise—buying above support with a stop below, or selling below resistance with a stop above. Profit targets should align with the next technical level or Fibonacci extension.

Understanding & Mitigating EUR/JPY Trading Risks

Key risks include:

- Volatility Risk: Sharp moves around central bank meetings can erase gains quickly.

- Carry Trade Unwinding: A sudden risk-off event can trigger massive yen buying.

- Liquidity Risk: Spreads can widen during news events, affecting execution.

Mitigation strategies:

- Always use stop-loss orders, ideally based on technical levels.

- Limit position size—no more than 1-2% of capital per trade.

- Diversify across asset classes to avoid overexposure.

- Stay updated on central bank calendars and economic releases.

- Use trailing stops to protect profits during strong trends.

Building Your Own EUR/JPY Forecast Framework: A Practical Guide

Developing a personal forecasting system enhances consistency and reduces emotional decision-making. Follow this structured approach:

- Start with Fundamentals: Monitor ECB and BoJ policy statements, inflation trends, and economic calendars. Use Trading Economics to track upcoming data.

- Layer in Technicals: Analyze weekly and daily charts for trend direction. Identify key support/resistance, moving averages, and chart patterns. Platforms like TradingView offer powerful tools for this.

- Synthesize Scenarios: Combine fundamental expectations with technical setups. Ask: What if inflation surprises? What if the BoJ speaks hawkishly? How would price react?

- Define a Trading Plan: Set entry, exit, and stop-loss levels in advance. Determine risk-reward ratios (aim for at least 1:2). Review and update the plan weekly.

Conclusion: Key Takeaways for EUR/JPY Traders

The EUR/JPY pair remains a powerful reflection of global monetary divergence, economic performance, and investor psychology. Its movements are shaped by the interplay of ECB tightening, BoJ caution, and shifting risk appetite. Technical analysis provides critical timing signals, while fundamentals determine the underlying trend. Traders must remain agile, balancing carry trade opportunities with the ever-present risk of sudden reversals.

Whether trading short-term breakouts or positioning for long-term trends, success hinges on a disciplined, multi-layered approach. By integrating real-time data, technical precision, and proactive risk management, investors can navigate EUR/JPY with greater confidence. As the macro landscape evolves in 2025 and beyond, staying informed and adaptable will be the key to sustained performance in this dynamic currency pair.

What are the primary factors influencing the EUR/JPY exchange rate today?

The primary factors influencing EUR/JPY today are the monetary policy stances of the European Central Bank (ECB) and the Bank of Japan (BoJ), particularly interest rate differentials. Additionally, key economic data releases from the Eurozone and Japan (e.g., inflation, GDP, employment), and shifts in global risk sentiment, play a significant role.

Is EUR/JPY considered a volatile currency pair, and what are its main risks?

Yes, EUR/JPY can be quite volatile, especially due to its sensitivity to interest rate differentials and global risk appetite. The main risks include:

- Sudden shifts in central bank policy.

- Rapid unwinding of carry trades during risk-off periods.

- Unexpected geopolitical events causing sharp market movements.

How do interest rate differentials between the ECB and BoJ impact the EUR/JPY forecast?

A wider interest rate differential, where Eurozone rates are significantly higher than Japan’s, typically makes EUR/JPY attractive for carry trades, leading to Euro strength and a higher exchange rate. Conversely, a narrowing differential, often due to a hawkish BoJ or dovish ECB, tends to weaken the pair as carry trades become less profitable or are unwound.

What technical indicators are most reliable for forecasting EUR/JPY movements?

Reliable technical indicators for EUR/JPY include:

- Major support and resistance levels.

- Key moving averages (e.g., 50-day, 200-day EMA/SMA) for trend identification.

- Oscillators like RSI, MACD, and Stochastic for momentum and overbought/oversold conditions.

- Recognizable chart patterns and candlestick formations for reversal or continuation signals.

What is the long-term outlook for EUR/JPY, specifically for 2025 and beyond?

The long-term outlook for EUR/JPY into 2025 and beyond will largely depend on the BoJ’s path to monetary policy normalization. If the BoJ significantly raises interest rates, it could lead to a long-term appreciation of the Yen and a potential decline in EUR/JPY. However, continued Eurozone economic strength and sticky inflation could provide underlying support for the Euro, leading to a more balanced or even upward trend if the BoJ’s tightening is gradual.

Where can I find real-time EUR/JPY charts and data for my own analysis?

You can find real-time EUR/JPY charts and data on various platforms, including: TradingView, MetaTrader 4/5 (via most forex brokers), Investing.com, and numerous financial news websites that offer live charting tools.

Should I buy or sell EUR/JPY right now based on current market sentiment?

Whether to buy or sell EUR/JPY right now depends on your personal trading strategy, risk tolerance, and current market conditions. It’s crucial to conduct your own comprehensive technical and fundamental analysis, consider the latest news, and align your decision with your specific trading plan. This article provides a framework, but real-time decisions require continuous monitoring.

How do major economic news events from the Eurozone and Japan affect EUR/JPY?

Major economic news events can cause significant volatility. For example, higher-than-expected inflation in the Eurozone might strengthen the Euro as markets anticipate ECB rate hikes, pushing EUR/JPY up. Conversely, weaker-than-expected GDP in Japan could weaken the Yen, also potentially pushing EUR/JPY up, assuming the Euro remains strong. Surprises in data often lead to sharp, immediate reactions.

What are the key support and resistance levels to watch for EUR/JPY next week?

Key support and resistance levels for EUR/JPY next week will be determined by recent price action. Generally, look for strong previous highs as resistance and previous lows as support. Dynamic levels from moving averages (e.g., 50-period, 200-period) on the daily or 4-hour charts will also be crucial. For specific, up-to-date levels, consult real-time charts and technical analysis from reputable sources.

Can geopolitical events significantly alter the EUR/JPY forecast, and how?

Yes, geopolitical events can significantly alter the EUR/JPY forecast. The Japanese Yen is often considered a safe-haven currency, meaning it tends to strengthen during periods of global uncertainty or conflict. A major geopolitical crisis could lead to a rapid shift in risk sentiment, prompting investors to sell riskier assets (like the Euro in a carry trade context) and buy the Yen, causing EUR/JPY to fall sharply.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。