Euro Yield Curve: A Trader’s Essential Guide to Understanding Market Trends

Table of Contents

ToggleUnderstanding the Euro Area Yield Curve: A Trader’s Essential Guide

Welcome, fellow traders and investors! Today, we’re diving deep into a critical indicator in the financial world: the Euro area yield curve. Think of the yield curve as the pulse of the bond market – it tells us how investors perceive future interest rates and economic health across different time horizons within the Eurozone. For anyone trading currencies, fixed income, or even equities influenced by macro conditions, understanding this curve isn’t just helpful; it’s essential. Let’s explore what it is, why it matters, and how external forces and the European Central Bank (ECB) shape its contours.

Here are some key points regarding the Euro yield curve:

- The yield curve provides insights into future interest rates.

- It reflects economic health and investor sentiment.

- Understanding the curve is crucial for making informed trading decisions.

What Exactly is a Yield Curve? The Term Structure of Interest Rates

At its heart, a yield curve is simply a graphical representation showing the relationship between the yields on bonds of the same credit quality, but different maturities. When we talk about the Euro area yield curve, we’re usually referring to government bonds issued by Eurozone countries, often focusing on the benchmark AAA-rated bonds or a broader aggregate of central government debt.

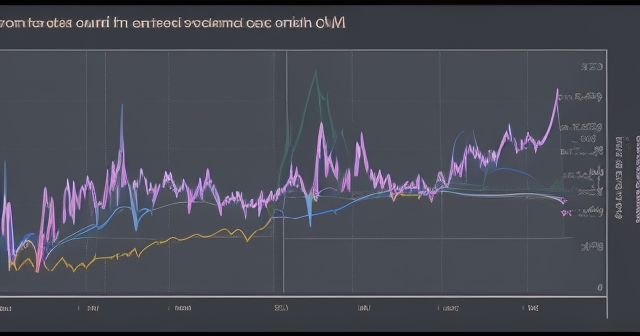

This relationship between yields and time to maturity is technically known as the term structure of interest rates. Imagine plotting points on a graph: the x-axis is the time to maturity (say, from 3 months up to 30 years), and the y-axis is the yield (the return an investor gets for holding the bond until it matures). Connecting these points gives you the yield curve.

Why is this structure important? Because it reflects the collective expectations of market participants about future interest rates, inflation, and economic growth. A typical yield curve slopes upwards (is ‘normal’), meaning longer-term bonds offer higher yields than shorter-term ones. This is usually because investors demand extra compensation for the increased risks associated with tying up their money for longer periods, such as inflation risk or the risk of interest rates rising.

But yield curves aren’t always normal. They can be ‘inverted’ (sloping downwards), suggesting markets expect interest rates to fall in the future, often signaling economic slowdown or recession. They can also be ‘flat’, indicating uncertainty or a transition period.

Why the Euro Yield Curve is a Key Financial Barometer

The Euro area yield curve serves as a crucial barometer for several reasons. Firstly, it’s a key input for pricing a vast array of financial assets, from corporate bonds and loans to derivatives. Banks and financial institutions use it as a benchmark for setting lending rates.

Secondly, and perhaps most importantly for traders, the shape and level of the curve provide insights into market expectations about the ECB’s monetary policy. Short-term yields are highly sensitive to current policy rates and near-term expectations. Long-term yields, while still influenced by monetary policy, also incorporate expectations about long-term economic growth, inflation, and structural factors.

Thirdly, the spread between yields of different Eurozone countries’ government bonds reflects market perceptions of sovereign credit risk. The difference in yields between, say, Italian and German 10-year bonds (the BTP-Bund spread) is a widely watched indicator of risk sentiment within the Euro area.

Understanding the factors that move this curve gives you a distinct advantage in anticipating broader market shifts. Whether you’re trading bond futures, interest rate derivatives, or even trying to gauge the future direction of the Euro exchange rate, the yield curve offers vital clues.

How the ECB Estimates and Publishes Euro Yield Curves

You might wonder, how do we get a single ‘Euro area’ yield curve when each country issues its own bonds? The European Central Bank (ECB) plays a crucial role here by providing a standardized estimate. Since hypothetical zero-coupon bonds for every single maturity are not directly observable in the market, the ECB has developed a methodology to estimate yield curves from the prices and yields of actual traded bonds.

The ECB estimates zero-coupon yield curves and then derives forward yield curves and par yield curves for the euro area. Let’s quickly clarify these:

- Zero-Coupon Yield Curve: This represents the theoretical yields on zero-coupon bonds across different maturities. Zero-coupon bonds don’t pay periodic interest; investors profit from buying them at a discount to their face value. This curve is fundamental as it isolates the pure time value of money.

- Par Yield Curve: This shows the hypothetical yields that bonds with standard coupon payments (that trade at par, i.e., 100) would have across different maturities. This curve is often what people intuitively think of as ‘the’ yield curve, as it relates more directly to coupon-paying bonds.

- Forward Yield Curve: This curve indicates the market’s implied future interest rates for a given period at some point in the future. For example, what is the market expecting the 1-year interest rate to be, starting two years from now? This is derived from the spot (zero-coupon) curve.

The ECB calculates these curves daily based on the TARGET business calendar, typically using bond data as of noon (12:00 CET). They source data from relevant trading venues, like EuroMTS Ltd for bond prices, and incorporate ratings data, such as from Fitch Ratings, especially when looking at specific credit quality segments like AAA-rated bonds.

ECB’s Methodology: Filtering and Selecting Bonds

The accuracy and reliability of the estimated yield curve depend heavily on the underlying data and the methodology used. The ECB employs stringent criteria for selecting the bonds included in their estimation process. Not just any bond makes the cut.

Here are some key selection criteria:

- Issuer: The bonds must be issued by euro area central governments (classified under sector S.1311). This ensures we are looking at sovereign debt risk, which is fundamental to the ‘risk-free’ (or lowest-risk within the zone) benchmark concept, rather than corporate or sub-sovereign debt.

- Currency: They must be denominated and issued in euros.

- Coupon Type: Only fixed coupon bonds or zero-coupon bonds (including STRIPS – Separate Trading of Registered Interest and Principal of Securities) are included. This excludes complex instruments like perpetual bonds, variable rate bonds, or inflation-linked bonds, which have features that would distort the pure term structure signal.

- Maturity: The bonds must have a finite maturity. The methodology typically considers residual maturities ranging from 3 months up to 30 years, covering the most liquid and relevant part of the curve.

- Liquidity/Tradability: While not an explicit rule listed in the provided data, bond liquidity is inherently important for getting reliable price/yield data from trading venues.

Furthermore, the ECB applies an outlier removal mechanism. In any market data set, some reported prices or yields might be distorted due to factors like low trading volume at a specific time, data errors, or very specific bond characteristics not captured by the general model. Identifying and removing these outliers is crucial to ensure the estimated curve accurately reflects the prevailing market conditions across the yield spectrum.

The ECB provides these estimated curves for two main datasets: one based exclusively on AAA-rated euro area central government bonds (considered the safest) and another based on all eligible euro area central government bonds (including those with lower ratings), allowing for an assessment of the aggregate picture and potentially capturing broader market sentiment.

Do you see how this detailed process adds to the credibility and authoritativeness of the ECB’s published data? It’s not a simple average; it’s a sophisticated estimation based on carefully selected and filtered market information.

External Forces: How US Data Moves European Bonds

Now, let’s talk about what actually *moves* the curve after it’s constructed. While domestic factors are important, Eurozone government bond yields, particularly benchmark yields like the German 10-year bund, tend to trade in tandem with US Treasury yields. Why is this the case?

The global financial markets are highly interconnected. US Treasuries are often seen as the world’s premier safe-haven asset. When there is global uncertainty or risk aversion, demand for US Treasuries rises, pushing their prices up and yields down. This risk-off sentiment often spills over into other developed bond markets, including the Eurozone.

Crucially, market expectations about the Federal Reserve’s monetary policy are a dominant global driver. Recent soft US economic data, such as weaker-than-expected inflation figures, retail sales, or factory output, often prompts bets on the Federal Reserve cutting interest rates sooner or more aggressively. When markets expect the Fed to cut rates, US Treasury yields fall, especially at the shorter end, but the impact resonates across the curve.

Because of the strong correlation, this decline in US Treasury yields exerts downward pressure on Eurozone bond yields. Traders and investors often arbitrage between these markets or simply follow the directional lead from the highly liquid US Treasury market. Even if the Eurozone economy has its own dynamics, a significant shift in US rate expectations or risk sentiment is often powerful enough to drag Eurozone yields along.

For instance, despite recent de-escalation in US-China trade tensions (which might theoretically reduce demand for safe-haven bonds and push yields up), the persistence of soft US economic data has dominated market reaction. This shows that while global risk factors matter, fundamental economic signals, particularly from the world’s largest economy, can hold significant sway over international bond markets.

Domestic Signals: The ECB’s Influence and Rate Cut Expectations

While the US casts a long shadow, the European Central Bank’s monetary policy is the primary domestic driver of the Euro area yield curve, particularly at shorter and medium-term maturities. Market expectations about the ECB’s future interest rate decisions are constantly being priced into bond yields.

If money markets price in potential ECB rate cuts – for example, anticipating a 25 basis point cut at the upcoming June meeting and perhaps around 50 basis points total over the year – this expectation directly pressures shorter-term Eurozone yields (like the German 2-year bund yield) lower. Why? Because a bond’s yield is influenced by the expected path of short-term rates over its life. If those rates are expected to fall, the bond becomes more attractive at a lower yield.

ECB policymakers’ comments are closely scrutinized for clues about their future policy intentions. Statements from Governing Council members, like Martins Kazaks quoted previously highlighting high uncertainty, remind markets that policy is not on a predetermined path. The economic environment is constantly evolving, and policy decisions are data-dependent. Any hint of a change in the ECB’s assessment of inflation or growth can lead to swift adjustments in market rate expectations and, consequently, yield levels.

The ECB’s stance on issues like quantitative easing (QE) or quantitative tightening (QT) also influences longer-term yields by affecting the supply and demand dynamics in the bond market. A large bond-buying program (QE) tends to suppress yields, while reducing the balance sheet (QT) can put upward pressure on them.

In essence, the Euro yield curve at the short end is a direct reflection of the market’s best guess at what the ECB will do next with interest rates, while the longer end blends these expectations with broader economic outlooks.

Reading Specific Yield Levels and Spreads: What the Data Tells Us

Looking at aggregate curves is one thing, but examining specific bond yields and spreads provides granular insight into market sentiment and risk perceptions. Let’s consider some key examples:

- German 10-year Bund Yield: This is the benchmark for the Euro area. Its movement is watched globally as a gauge of risk-free rates in the Eurozone. A rising yield suggests increasing optimism or inflation expectations, while a falling yield signals caution or expectations of lower rates. The provided data noted its recent fluctuations influenced by US data and trade news.

- German 2-year Bund Yield: Highly sensitive to near-term ECB rate expectations. Movements here often reflect shifts in the market’s pricing of the next ECB meeting or the cumulative cuts expected over the next couple of years.

- Italian 10-year Yield: The yield on Italian government debt incorporates both the Eurozone benchmark rate component and a sovereign risk premium specific to Italy.

- Germany-Italy Spread (BTP-Bund Spread): This is the difference between the Italian 10-year yield and the German 10-year yield. It’s a critical indicator of perceived risk within the Euro area. A widening spread indicates increased concern about Italy’s fiscal health or political stability relative to Germany, often during periods of stress. A narrowing spread, as seen recently (around four-year lows according to the data), suggests reduced sovereign risk premium and greater market confidence in the Eurozone’s cohesion or specific member states’ finances.

These specific points on the curve tell a story. When the German 10-year yield falls but the Italy-Germany spread narrows, it might suggest that while global factors (like US data) are driving the core rate lower, specific concerns about Italian debt risk are simultaneously receding. Conversely, if the German yield is stable but the Italian yield spikes, widening the spread, it points to a specific issue related to Italy, not the broader Eurozone or global market.

Decoding Longer Maturities: The 30-Year Perspective

While short-term yields are driven by immediate monetary policy expectations, longer-term yields, like the 30-year Eurozone Central Government Bond Par Yield, offer a different perspective. They tend to be more heavily influenced by long-term economic growth potential, structural inflation trends, and demographic shifts.

Looking at a specific data point, such as the 30-Year Eurozone Central Government Bond Par Yield being 3.41% as of a certain date, is useful. Comparing this value to its level from the previous day, the previous year, or its long-term average provides context. A yield significantly below its long-term average might suggest markets foresee a prolonged period of low growth or low inflation, or it could reflect aggressive long-term bond buying (QE). A yield above its long-term average could signal expectations of stronger future growth or persistent inflation.

For traders, understanding the shape of the *entire* curve, including the long end, is vital. An inverted long end might signal recession fears, while a steepening curve (where the long end rises faster than the short end) can sometimes indicate expectations of future economic recovery and inflation.

Analyzing the long end helps inform longer-term investment decisions and provides clues about the market’s confidence (or lack thereof) in the long-term economic outlook. It’s like looking far out on the horizon, rather than just at the immediate path ahead.

Utilizing ECB Yield Curve Data for Analysis

The ECB makes its estimated yield curve data publicly available, with daily values extending back to September 6, 2004. This extensive historical data is invaluable for analysis.

How can you use this data?

- Trend Analysis: Examine how yield levels and the shape of the curve have evolved over time in response to economic events, policy changes, or market crises.

- Spread Analysis: Track spreads between different maturities (e.g., 10-year minus 2-year) to analyze steepening or flattening trends, or spreads between different countries’ bonds (e.g., Italy-Germany) to monitor sovereign risk.

- Correlation Studies: Analyze the correlation between Eurozone yields and other assets, such as equity indices, currency pairs (like EUR/USD), or commodity prices.

- Backtesting Strategies: If you are developing trading strategies based on interest rate movements or sovereign risk, historical yield data is essential for backtesting.

The ECB provides this data for public information and statistical purposes. While it reflects market prices, it is crucial to understand its limitations. The ECB explicitly states that this data is not intended for trading purposes, providing price/yield quotations for specific bonds, identifying trading opportunities, or offering investment advice. It is a statistical estimate based on market data, not a real-time trading feed for specific instruments.

Understanding these nuances is part of being a responsible and informed trader. The data gives you context and insight, but you must rely on live market data and your own analysis for actual trading decisions.

Important Data Disclaimers: Using Information Responsibly

As we touched upon, the data provided by institutions like the ECB comes with important disclaimers. They are estimates based on a specific methodology and sample of bonds, calculated at a particular time of day. They aim for accuracy but cannot guarantee it, and they are not liable for errors, delays, or any reliance placed upon the data for investment decisions.

This is a crucial point for any trader. While official data from central banks and reputable sources provides a robust foundation for analysis and understanding the market landscape, real-time trading requires real-time data feeds and platforms connected directly to trading venues. The ECB data helps you understand the *why* and the *how* of yield curve movements over time and across different segments, but it’s not the tool you’d use to execute a trade based on a fleeting price change.

Think of the ECB data as the high-level weather forecast showing the expected climate trends, while your trading platform provides the live radar showing the exact position and intensity of the current storm cells. Both are valuable, but for different purposes.

For those of you looking to apply this macro understanding to actual trading, perhaps in related markets like Forex or CFDs on indices or commodities that are highly sensitive to interest rate expectations and global risk, having a reliable platform is key. If you’re exploring options, Moneta Markets is a platform worth considering. Based in Australia, it offers access to over 1000 financial instruments, catering to both novice and experienced traders.

Integrating Yield Curve Analysis into Your Trading Toolkit

So, how can you take this knowledge about the Euro area yield curve and integrate it into your trading? It’s about building layers of analysis.

Firstly, monitor the key factors driving the curve: incoming US economic data, commentary from Federal Reserve officials, shifts in US Treasury yields, ECB policy announcements, statements from ECB Governing Council members, and significant shifts in Eurozone economic data (like inflation and growth). Pay attention to market commentary from analysts at major banks (like those quoted in the source material, such as Jefferies, Societe Generale, Rabobank) as they often provide insights into how these factors are being interpreted and priced.

Secondly, watch the key points on the curve and the spreads we discussed (German 10Y, German 2Y, Italian 10Y, BTP-Bund spread). Look for significant moves or changes in trend. Is the curve steepening or flattening? Is the BTP-Bund spread widening or narrowing? What could these movements signify in the current economic and policy context?

Thirdly, consider how these movements might impact other assets you trade. A falling Eurozone yield curve driven by ECB rate cut expectations might weigh on the Euro exchange rate (EUR). A widening BTP-Bund spread could signal broader stress in the Eurozone, potentially affecting risk sentiment and equity markets. Understanding these linkages allows for more informed trading decisions, whether you’re trading bonds directly or using other instruments.

Whether you’re trading currencies, indices, or other CFDs, the platforms you use should offer the flexibility and tools needed to act on your analysis. In this regard, Moneta Markets‘ support for popular platforms like MT4, MT5, Pro Trader, combined with features like high-speed execution and competitive spreads, provides a strong foundation for implementing diverse trading strategies based on complex market analysis like yield curve dynamics.

The Path Ahead: Uncertainty and the Yield Curve’s Future

Looking ahead, the Euro area yield curve will continue to be shaped by a complex interplay of forces. The path of US monetary policy and the health of the US economy will remain significant external drivers. Domestically, the ECB’s response to evolving inflation and growth data within the Eurozone will be paramount. Policymakers have emphasized uncertainty, suggesting that future rate decisions are not locked in and could change depending on how the economic picture develops over the coming months.

Geopolitical factors, including trade relations and other global risks, could also trigger shifts in risk appetite, influencing demand for safe-haven bonds and impacting yield levels. For example, a sudden escalation of tensions could lead to a rush into German bunds, pushing yields lower, even if economic data doesn’t immediately warrant it.

For you, the trader, the key is to remain adaptable and informed. Continuously monitor the data, listen to the signals from central bankers, and observe how the yield curve reacts. The curve is a dynamic indicator, constantly adjusting to new information and shifting expectations. By understanding its mechanics and drivers, you gain a valuable perspective on the forces shaping the financial markets in which you operate.

The Euro area yield curve is far more than just a line on a graph; it is a sophisticated summary of market expectations, policy signals, and risk perceptions. Learning to read and interpret it is a powerful step towards enhancing your understanding of the financial landscape and improving your trading insights. Keep learning, keep observing, and keep connecting the dots – that is the path to mastering complex markets.

| Yield Type | Description |

|---|---|

| Zero-Coupon Yield Curve | Theoretical yields on zero-coupon bonds across different maturities. |

| Par Yield Curve | Hypothetical yields for coupon-paying bonds trading at par. |

| Forward Yield Curve | Indicates market’s implied future interest rates for a specific period. |

| Bond Type | Key Characteristics |

|---|---|

| German 10-year Bund | Benchmark for Eurozone, risk-free rates indicator. |

| German 2-year Bund | Reflects shifts in market’s pricing of ECB meetings. |

| Italian 10-year Bond | Incorporates Eurozone benchmark and sovereign risk premiums. |

| Economic Indicators | Potential Impact |

|---|---|

| US Economic Data | Can influence Eurozone yields and trader sentiment. |

| ECB Policy Announcements | Directly impact bond yields, especially shorter-term ones. |

| Geopolitical Events | Risk appetite shifts, influencing demand for bonds. |

euro yield curveFAQ

Q:What does the yield curve indicate?

A:The yield curve indicates future interest rates and economic health based on bond yields of varying maturities.

Q:How does the ECB influence the yield curve?

A:The ECB influences the yield curve through its monetary policy, impacting both short-term and long-term yields.

Q:Why do US Treasury yields affect Eurozone bonds?

A:US Treasury yields affect Eurozone bonds due to the interconnected global financial markets, where US Treasuries are viewed as a safe-haven asset.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。