Sell Forex: Your Definitive Guide to Profiting in Bearish Currency Markets

Table of Contents

ToggleWhat Does “Sell Forex” Really Mean?

Forex trading isn’t just about betting on currencies to rise—sometimes, the real opportunity lies in anticipating a decline. When traders talk about “selling forex,” they’re referring to opening a short position on a currency pair. This means you’re speculating that the value of the base currency will drop relative to the quote currency. The strategy involves selling the base currency first—often borrowed from your broker—and then aiming to buy it back later at a lower price, keeping the difference as profit.

For example, if you sell the EUR/USD pair, you’re essentially wagering that the euro will weaken against the US dollar. If the exchange rate drops from 1.0850 to 1.0750, you can repurchase the euros at the lower rate, repay the borrowed amount, and pocket the 100-pip difference. This ability to profit from falling markets makes short selling a vital tool in a trader’s arsenal, especially during times of economic uncertainty or monetary policy shifts.

The Mechanics of Selling: Bid, Ask, and Short Positions

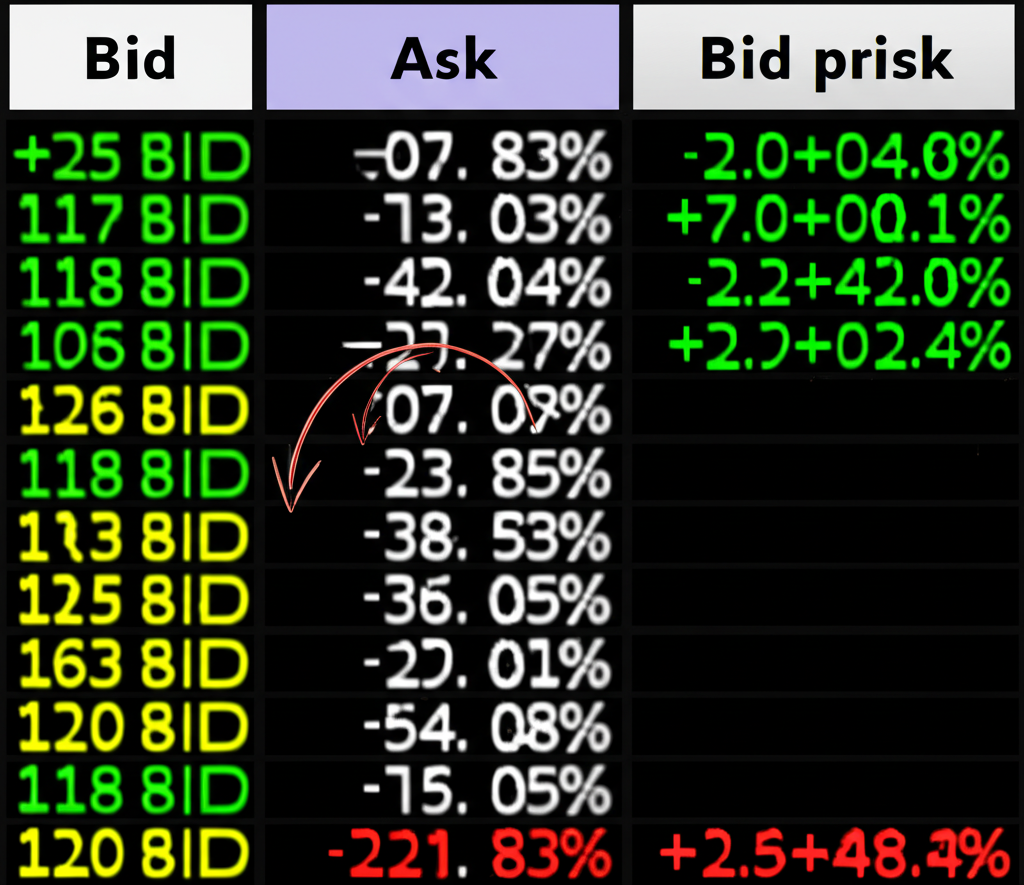

To effectively sell forex, you need to understand how pricing works in the market. Every currency pair quote displays two prices: the bid and the ask. The bid price is what buyers are willing to pay—it’s the price at which you can sell the base currency. The ask price, slightly higher, is what sellers demand—it’s the price at which you’d buy the base currency. The gap between them is the spread, which acts as a transaction cost charged by your broker.

When you place a sell order, you do so at the bid price. Let’s say EUR/USD is quoted at 1.0850 (bid) / 1.0852 (ask). By clicking “sell,” you’re entering the market at 1.0850, immediately exchanging euros for dollars. To close the trade, you’ll need to buy back those euros at the current ask price. If the market moves in your favor and the pair drops to 1.0800, buying back becomes cheaper, resulting in a profit. But if the price climbs, your buy-back cost increases, leading to a loss. This mechanism underscores the importance of timing and precision in short trades.

Buying vs. Selling Forex: Key Differences and When to Choose

At its core, forex trading offers two directional bets: going long (buying) or going short (selling). Each reflects a different market outlook. When you buy a pair like GBP/USD, you’re betting the British pound will strengthen against the dollar. That’s a long position—ideal in bull markets fueled by strong economic data or rising interest rates. Selling, on the other hand, is a bearish play. You enter a short position when you expect the base currency to lose ground.

For instance, if inflation spikes in Australia while the Reserve Bank signals no rate hikes, the AUD might start to slide. Traders who anticipate this can sell AUD/USD before the drop accelerates. Similarly, geopolitical tensions, deteriorating trade balances, or weakening consumer confidence can all create environments where selling a currency becomes a logical strategy. The key is aligning your trade direction with broader macroeconomic trends.

Identifying Bearish Trends for Selling Opportunities

Successful short selling doesn’t rely on guesswork—it’s rooted in analysis. Traders use a combination of fundamental and technical tools to spot potential downturns before they fully materialize.

Fundamental analysis focuses on real-world data that influences currency value. A country releasing weaker-than-expected GDP numbers, rising unemployment, or cutting interest rates often sees its currency depreciate. Central bank communications are especially powerful; a dovish tone suggesting future easing can trigger immediate selling pressure. News events like political instability or trade disputes can also undermine confidence in a currency, making short positions attractive.

On the technical side, chart patterns and indicators help confirm bearish momentum. Some widely watched signals include:

- Head and Shoulders: A reversal pattern where a peak is flanked by two smaller highs, signaling an uptrend exhaustion.

- Death Cross: When the 50-day moving average drops below the 200-day, indicating long-term bearish sentiment.

- Bearish Divergence: Price hits a new high, but momentum oscillators like the RSI or MACD fail to confirm, suggesting weakening upward force.

Using both types of analysis together increases the probability of a successful short entry. For deeper insights into economic indicators, Investopedia offers a detailed guide on how they influence forex.

How to Execute a Sell Order: Step-by-Step Guide

Placing a sell order is simple once you’re familiar with your trading platform’s interface. While many platforms exist, MetaTrader 5 (MT5) remains a top choice due to its advanced tools, customizability, and widespread adoption.

Choosing Your Trading Platform: Focus on MT5 Integration

To open a short position on MT5, follow these steps:

- Open the Order Window: Press F9, click “New Order” in the toolbar, or right-click a pair in Market Watch.

- Select the Currency Pair: Choose the symbol you want to trade, such as USD/JPY.

- Set the Volume: Enter your desired lot size. For beginners, 0.01 lots (a micro lot) is a sensible starting point.

- Add Stop-Loss and Take-Profit: Define your risk and profit targets. These orders help automate your strategy and remove emotion from trading decisions.

- Choose Execution Type: Select “Market Execution” for immediate entry at the current bid price.

- Click “Sell by Market”: Confirm the trade to open your short position.

Once executed, you’ll see the position listed in your terminal with a negative volume, indicating a short.

Understanding Sell Order Types: Market, Limit, and Stop Orders

Not all sell orders are the same. Depending on your strategy, you can use different types to enter or exit trades:

- Sell Market Order: Executes instantly at the best available bid price. Best when you want immediate entry and are confident in the current trend.

- Sell Limit Order: Sets a sell order above the current price. For example, if EUR/USD is at 1.0850, placing a sell limit at 1.0870 means you only sell if the price rises and hits that level. This is useful if you expect a pullback before a downtrend resumes.

- Sell Stop Order: Placed below the current price. If the pair is at 1.0850 and you set a sell stop at 1.0830, the order activates only if the price drops to that level. This is commonly used to short breakouts below support zones.

Setting Stop-Loss and Take-Profit for Sell Positions

Risk management is non-negotiable in short trading. Because markets can rise sharply and unexpectedly, uncontrolled losses are a real danger. A well-placed stop-loss acts as a safety net. For a sell trade, your stop-loss should be set above your entry point. If the price moves against you and hits this level, the position closes automatically, limiting your loss.

Conversely, a take-profit order locks in gains by closing the trade when the price reaches a favorable level below your entry. For example, if you sell EUR/USD at 1.0850 with a take-profit at 1.0750, the trade closes when the pair drops 100 pips, securing your profit. Combining both orders ensures discipline and consistency, especially during volatile market swings.

Decoding Trade Sizes: What “Sell 0.01” Means in Forex

Trade size directly impacts risk and reward. In forex, position sizes are measured in lots:

- Standard Lot: 100,000 units of base currency

- Mini Lot: 10,000 units

- Micro Lot: 1,000 units

When you see “sell 0.01,” it means you’re trading 0.01 lots—or one micro lot, equivalent to 1,000 units of the base currency. For instance, selling 0.01 lots of GBP/USD involves shorting 1,000 British pounds.

Micro lots are ideal for beginners or traders with smaller accounts. They reduce exposure per trade, making each pip movement less impactful financially. This allows for more controlled risk, slower capital drawdown during losing streaks, and a safer learning curve. As confidence and capital grow, traders can gradually scale up to larger lot sizes.

Risk Management Strategies When Selling Forex

Short selling carries unique risks. Unlike buying, where the maximum loss is limited to the investment, short positions theoretically face unlimited losses if a currency keeps rising. That’s why risk management isn’t optional—it’s essential.

Leverage, Margin, and the Risks of Shorting

Leverage allows you to control large positions with minimal capital. For example, with 50:1 leverage, a $2,000 deposit can control a $100,000 trade. While this magnifies gains, it does the same for losses. If a short trade moves against you, losses accumulate quickly.

Your broker requires a certain amount of capital—called margin—to maintain the position. If losses erode your account equity below the required level, you’ll face a margin call, forcing you to either deposit more funds or have your positions closed automatically. This risk is especially high in volatile markets, such as during major news events. Understanding how leverage and margin interact is critical for long-term survival, as brokers like Forex.com explain in their educational resources.

Implementing the 2% Rule for Selling Positions

One of the most effective risk management tools is the 2% rule, which limits your exposure on any single trade to no more than 2% of your total account balance. Here’s how to apply it:

- Determine 2% of your capital: With a $5,000 account, the maximum risk per trade is $100.

- Set your stop-loss: If you sell USD/CAD at 1.3500 and place a stop at 1.3550, your risk is 50 pips.

- Calculate pip value: For 0.01 lots of USD/CAD, each pip is roughly $0.10.

- Adjust position size: At $0.10 per pip, a 50-pip stop means a $5 risk per micro lot. To stay within the $100 limit, you can trade up to 20 micro lots (0.20 lots).

This method ensures that even a string of losing trades won’t devastate your account, preserving capital for better opportunities.

Advanced Considerations for Selling Forex

As traders gain experience, they begin to consider more nuanced aspects of short selling that go beyond entry and exit points.

Rollover (Swap) Fees on Short Positions

When you hold a forex position overnight, your broker applies a swap or rollover fee. This reflects the interest rate differential between the two currencies. If you’re short a high-interest currency (like the Turkish lira) against a low-interest one (like the Japanese yen), you may earn positive swap. But if you’re short a low-yielding currency, you could pay interest daily.

These fees add up over time, especially on long-term positions. Always check your broker’s swap rates before holding short trades overnight. Some brokers offer swap-free Islamic accounts for traders who prefer to avoid these charges.

The Psychology of Short-Selling

Short selling challenges trader psychology. Most people are conditioned to “buy low, sell high,” so selling first feels unnatural. There’s also the mental burden of potential unlimited losses—while a stock can’t go below zero, there’s no upper limit to how high it can go.

This fear often leads to premature exits or missed opportunities. Overcoming it requires mental discipline, a well-tested strategy, and strict adherence to risk controls. Journaling trades, reviewing outcomes, and practicing on demo accounts can help build the confidence needed to execute short trades with clarity and consistency.

Conclusion: Mastering the Art of Selling in Forex

Selling forex is more than just flipping a switch—it’s a strategic discipline that opens doors to profit in falling markets. From understanding bid-ask spreads to placing precise sell orders and managing risk through tools like stop-losses and the 2% rule, short trading demands both knowledge and emotional control. By combining technical and fundamental analysis, using appropriate lot sizes, and staying aware of leverage and swap costs, traders can navigate bearish environments with confidence. With consistent practice and a structured approach, selling becomes not just a tactic, but a core skill in achieving long-term success in the forex market.

Frequently Asked Questions About Selling Forex

What is the fundamental concept of “selling” in forex trading?

Selling in forex, also known as “going short,” means you are speculating that the base currency of a pair will depreciate in value relative to the quote currency. You sell the base currency with the expectation of buying it back at a lower price later, profiting from the price difference.

How does a “sell order” differ from a “buy order” in terms of profit generation?

A sell order profits when the price of the currency pair falls. You sell high and aim to buy back low. A buy order (or “long position”) profits when the price of the currency pair rises. You buy low and aim to sell high. They are opposite strategies based on different market outlooks.

What does the phrase “sell 0.01” signify when executing a forex trade?

“Sell 0.01” means you are executing a trade with a volume of 0.01 lots. This corresponds to a micro lot, which is 1,000 units of the base currency. It’s a small trade size often used by beginners or those with limited capital to manage risk effectively.

Can a beginner effectively sell forex, and what are the initial steps?

Yes, beginners can sell forex. The initial steps involve:

- Understanding the concept of going short.

- Opening a demo account to practice.

- Learning to identify bearish market conditions.

- Familiarizing yourself with your trading platform (e.g., MT5) and how to place a sell order.

- Implementing strict risk management from the start.

It’s crucial to start with small trade sizes like micro lots.

What are the key market indicators that signal a potential selling opportunity for a currency pair?

Key indicators include:

- Fundamental: Weak economic data (GDP, employment), dovish central bank statements, rising inflation (if unmanaged), or geopolitical instability impacting a country.

- Technical: Bearish chart patterns (e.g., head and shoulders, double top), moving average crossovers (shorter-term below longer-term), or bearish divergences on oscillators.

These signals suggest a currency may depreciate.

How can I implement risk management, such as the “2% rule,” when selling forex?

To implement the 2% rule when selling:

- Calculate 2% of your total trading capital. This is your maximum allowable loss per trade.

- Determine your stop-loss level for the short position (above your entry).

- Calculate the pip value for your chosen currency pair and desired lot size.

- Adjust your position size (lot size) so that if your stop-loss is triggered, your loss does not exceed 2% of your capital.

This ensures no single trade can severely deplete your account.

Which forex trading apps or platforms are best suited for executing sell orders, particularly for beginners?

Platforms like MetaTrader 5 (MT5) and MetaTrader 4 (MT4) are widely used and offer robust functionality for executing sell orders, including market, limit, and stop orders. Many brokers also offer proprietary platforms that are user-friendly for beginners. It’s recommended to choose a platform that is intuitive, offers a demo account, and has good educational resources.

What is the role of leverage and margin when taking a short position in forex?

Leverage allows you to control a larger trade size with a smaller initial capital outlay (margin), amplifying both potential profits and losses. Margin is the amount of capital required by your broker to open and maintain your leveraged short position. While leverage can boost returns, it also increases the risk of margin calls if the market moves significantly against your sell trade.

Are there specific strategies or signals that indicate when to sell a particular currency pair?

Yes, strategies often combine fundamental and technical analysis. For selling, look for:

- Fundamental: Negative economic news, interest rate cuts, or political instability in the base currency’s country.

- Technical: Bearish chart patterns (head and shoulders, double top), bearish divergences on indicators, or breaking below key support levels.

Confirming signals from multiple sources can increase the probability of a successful sell trade.

Can you provide a practical example of how to place a sell order on MetaTrader 5 (MT5)?

On MT5:

- Open the “New Order” window (F9).

- Select your desired currency pair (e.g., EURUSD).

- Input the “Volume” (e.g., 0.01 for a micro lot).

- Enter your Stop-Loss (SL) and Take-Profit (TP) levels (optional, but recommended for risk management).

- Ensure “Market Execution” is selected for immediate trading.

- Click the “Sell by Market” button.

This will open a short position at the current bid price.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。