Entry Order: Master 4 Key Types for Strategic Market Control

Table of Contents

ToggleWhat is an Entry Order? Understanding the Basics

An entry order is a foundational tool in financial trading that allows traders to specify a future price at which they want to buy or sell an asset. Unlike market orders, which execute instantly at the current market price, entry orders remain inactive—pending—until the market reaches the trader’s predefined price level. This setup gives traders greater control over their trade execution, enabling them to enter positions strategically rather than reactively. By automating the timing of trades, entry orders help eliminate the need for constant screen monitoring and support disciplined decision-making based on prior analysis. Whether you’re aiming to buy during a dip or sell at a breakout, this mechanism is essential for executing well-thought-out strategies across stocks, forex, and cryptocurrency markets.

Why Use Entry Orders? Advantages for Traders

The strategic use of entry orders brings a host of practical benefits that elevate the effectiveness of any trading approach. One of the most valuable is automation—traders can set their desired price points in advance and step away, confident that their broker will execute the trade if conditions are met. This not only saves time but also ensures they don’t miss opportunities during off-hours or periods of high volatility.

Beyond convenience, entry orders promote precision. By locking in specific entry and exit levels, traders align their actions with technical indicators such as support and resistance zones, trendlines, or moving averages. For example, placing a buy limit order at a known support level allows a trader to enter a position only when the market confirms a potential bounce. This level of accuracy strengthens risk management by ensuring each trade adheres to a predefined risk-reward ratio, reducing the temptation to act impulsively.

Perhaps even more critical is the role entry orders play in emotional discipline. Markets can be unpredictable, and sudden price swings often trigger fear or greed, leading to poor decisions. With entry orders, the execution process is detached from emotion—once set, the trade follows the plan regardless of market noise. This systematic approach is a hallmark of consistent, long-term success in trading. As Investopedia explains, mastering different order types is a cornerstone of effective risk control and strategic execution in financial markets. Read more about entry orders on Investopedia.

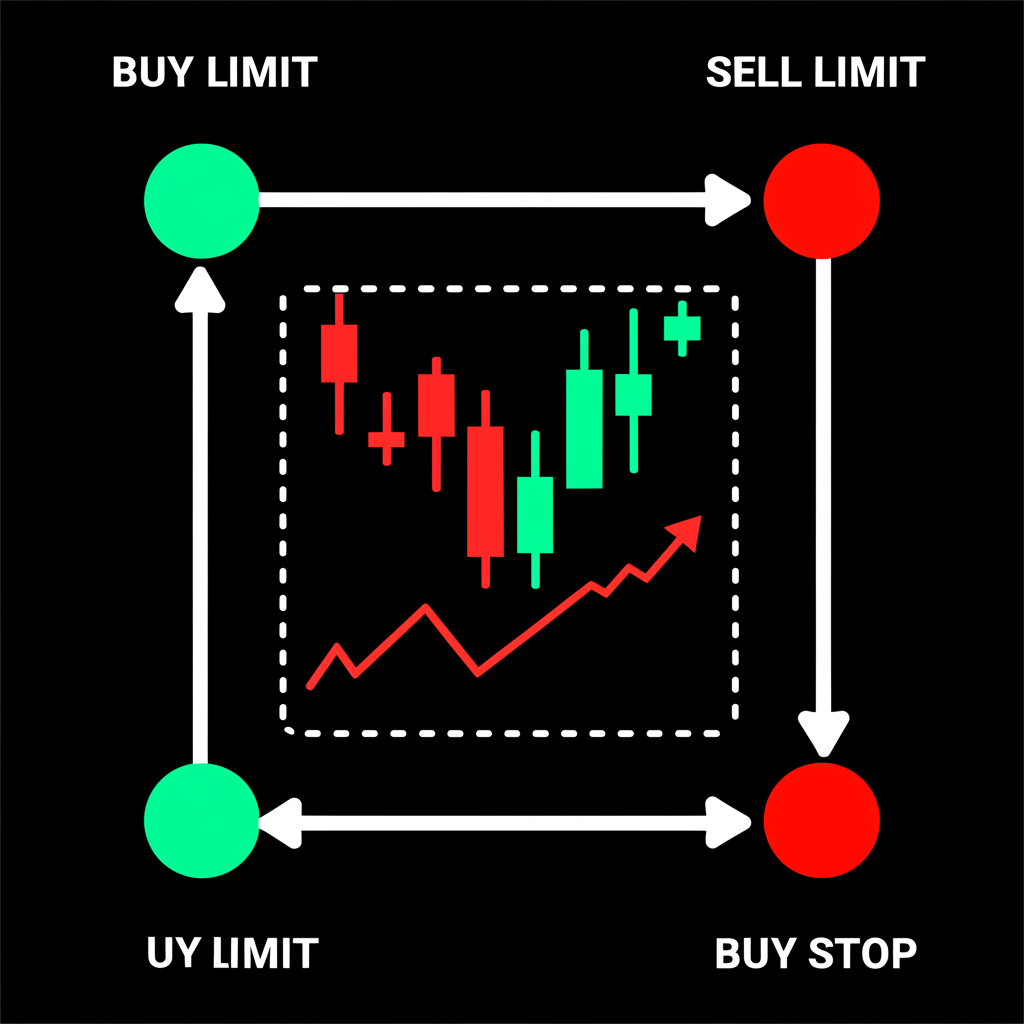

The Four Main Types of Entry Orders Explained

To trade with precision, it’s crucial to understand the four primary types of entry orders—each designed for different market scenarios and strategic goals. While they all delay execution until certain price conditions are met, their behavior and placement vary significantly.

Buy Limit Order: Buying Below Market Price

A buy limit order instructs your broker to purchase an asset at a specified price or lower. Since it’s placed below the current market price, it’s ideal for traders looking to buy on a pullback or when they believe the current price is inflated.

For instance, if a stock is trading at $100, a trader might set a buy limit order at $95. The trade will only go through if the price drops to $95 or lower, allowing the trader to enter at a better value. This type of order is commonly used in value-based strategies or when anticipating a temporary dip before an upward trend resumes. It’s particularly effective when combined with technical analysis, such as identifying strong historical support levels.

Sell Limit Order: Selling Above Market Price

A sell limit order allows you to sell an asset at a specified price or higher. Positioned above the current market price, it’s used when you want to lock in profits at a more favorable level than what’s currently available.

If a stock is trading at $100, you might place a sell limit at $108, expecting further upside before a reversal. This order ensures you don’t sell too early if the price continues to climb. It’s a go-to choice for profit-taking at resistance levels, allowing traders to exit at peak valuations without needing to watch the market constantly.

Buy Stop Order: Buying Above Market Price (Breakouts)

A buy stop order becomes active when the market price reaches or exceeds a specified stop price, at which point it turns into a market order. Placed above the current price, it’s designed to catch upward momentum.

Imagine a stock consolidating near $100 with resistance at $105. A trader expecting a breakout might set a buy stop at $106. If the price surges past that level, the order triggers, aiming to capture the start of a new uptrend. This approach is widely used in momentum and trend-following strategies. It’s also a common tool for covering short positions to limit losses if the market moves sharply against a bearish bet.

Sell Stop Order: Selling Below Market Price (Breakdowns/Stop Loss)

A sell stop order is placed below the current market price and activates when the price falls to or below the stop level. Once triggered, it becomes a market order to sell immediately.

For example, if you own a stock at $100 and want to limit your downside, you could place a sell stop at $90. If the price drops to that level, the position is automatically liquidated, helping to prevent larger losses. While primarily used as a protective stop-loss, it can also be part of a short-selling strategy, where a trader enters a sell position once a key support level breaks, signaling further downward movement.

How to Place an Entry Order: Step-by-Step Guide

Placing an entry order is a simple process on most modern trading platforms, though the exact steps may vary slightly depending on your broker. Here’s a universal guide to help you set one up confidently:

- Log in to your brokerage account: Access your trading platform via desktop or mobile app.

- Select the asset: Search for the stock, forex pair, cryptocurrency, or other financial instrument you want to trade.

- Open the order window: Click on “Trade,” “Buy/Sell,” or a similar button to bring up the order entry panel.

- Choose the order type: Select from options like Buy Limit, Sell Limit, Buy Stop, or Sell Stop, depending on your strategy.

- Enter the price: Input your target price—this will be the limit price for limit orders or the stop price for stop orders.

- Set the quantity: Specify how many shares, units, or lots you wish to trade.

- Adjust the order duration: Choose how long the order remains active:

- Good ‘Til Canceled (GTC): Stays active until filled or manually canceled, often used for longer-term strategies.

- Day Order: Expires automatically at the end of the trading session if not executed.

- Good-for-Time (e.g., GTC-Week): Some platforms offer custom durations for more control.

- Review and submit: Double-check all details—asset, direction, price, volume, and expiry—before confirming. Many platforms provide a preview window to avoid errors.

Once submitted, your order appears in the “Pending Orders” section, where you can track its status. Some platforms also allow you to modify or cancel the order at any time before execution.

Entry Orders vs. Market Orders: Key Differences

Choosing between an entry order and a market order depends on whether you prioritize price control or execution speed. While both are essential tools, they serve different purposes in a trader’s toolkit.

The table below outlines the core distinctions:

| Feature | Entry Order (Limit/Stop) | Market Order |

|---|---|---|

| Execution Certainty | Not guaranteed—the price may never reach your target. | Almost always executed immediately, assuming the market is open. |

| Price Certainty | High for limit orders (executes at or better than specified price). | Low—executes at the best available price, which may differ from the quoted price. |

| Immediacy | Delayed—only executes when price conditions are met. | Instant—fills as soon as the order is sent. |

| Control | High—you define the exact price or trigger point. | Low—you accept whatever price the market offers at that moment. |

| Typical Use Cases | Strategic entries, profit targets, stop-loss placement. | Urgent trades, high-liquidity markets, or when immediate exposure is needed. |

| Slippage Risk | Low for limit orders; higher for stop orders during volatility. | Higher, especially in fast-moving or illiquid markets. |

Market orders are best when you need to get in or out quickly, such as during news events or when adjusting positions rapidly. However, they come with the risk of slippage—where your order fills at a worse price than expected. Entry orders, on the other hand, let you wait for ideal conditions, making them ideal for planned, rule-based trading.

Advanced Entry Order Strategies & Considerations

Beyond basic placement, experienced traders integrate entry orders into sophisticated systems that enhance both precision and risk control. One powerful method is combining them with technical analysis. For example, placing a buy limit order at a tested support level increases the probability of a successful entry, especially when confirmed by volume or candlestick patterns. Similarly, setting a buy stop just above a resistance zone can help capture breakouts with minimal lag.

Advanced order types further expand strategic options:

- One Cancels the Other (OCO): Links two orders—such as a profit target and a stop-loss—so that if one executes, the other is canceled. This is invaluable for managing risk and reward simultaneously on a single position.

- One Triggers the Other (OTO): Sets a secondary order (like a take-profit or stop-loss) to activate only after the primary entry order is filled. This allows for fully automated trade management from entry to exit.

Despite their advantages, entry orders carry risks. Slippage is a major concern with stop orders, especially during high volatility or news events. For instance, a sell stop set at $90 might execute at $88 if the market gaps down overnight. Market gaps—common in stocks after earnings or in crypto during weekends—can cause stop orders to fill far from the intended price, undermining risk management. Limit orders, while price-protected, may not fill at all if the market moves too quickly past the target. Traders should adjust their strategies accordingly, using wider stops in volatile environments or combining order types for better protection.

Entry Orders in Different Markets: Forex, Stocks, and Crypto

Entry orders are a universal feature across financial markets, but their application varies slightly depending on the asset class and market behavior.

In forex trading, where markets operate 24/5 and price movements can be swift, entry orders are indispensable. Traders use buy limit orders to accumulate positions near support in major currency pairs, while sell stops protect long trades from sudden reversals. The ability to set pending orders allows forex participants to stay engaged globally without being glued to their screens.

For stock traders, entry orders support both long-term investing and active day trading. An investor might place a buy limit order below the current price to acquire shares of a strong company at a discount. Meanwhile, a swing trader could use a buy stop order to enter a breakout in a trending stock, ensuring they don’t miss the move. Stop-loss orders are equally vital for capping losses in unpredictable earnings plays or momentum runs.

In the cryptocurrency space, where prices can swing 10% or more in hours, automation through entry orders is not just helpful—it’s often necessary. Given the 24/7 nature of crypto markets, traders rely on sell stop orders to prevent catastrophic losses during flash crashes and use limit orders to buy the dip during sharp corrections. As highlighted in a report by Trading Platforms, advanced order types are increasingly central to navigating the fast-paced and often irrational crypto landscape. Learn more about crypto order types.

Common Mistakes to Avoid When Using Entry Orders

Even experienced traders can fall into traps when using entry orders. Recognizing these pitfalls early can save you from missed opportunities or unexpected losses.

One of the most frequent errors is setting orders too close to the current market price. A buy limit placed just $0.10 below the current level might never fill if the price only briefly brushes that point. Conversely, a sell stop placed too tightly could trigger during normal market noise, exiting you from a trade that would have recovered.

Another issue is neglecting to review or update existing orders. Markets evolve—support levels break, trends reverse, and fundamentals shift. An order that made sense a week ago may no longer align with current conditions. Failing to cancel or adjust outdated GTC (Good ‘Til Canceled) orders can lead to unintended trades when prices revisit old levels.

Ignoring volatility is another common misstep. In fast-moving markets, stop orders can trigger during short-lived spikes, leading to poor fills. Limit orders may be skipped entirely if the price rockets past without pausing. Adjusting your order placement based on average true range (ATR) or recent price behavior can improve execution quality.

Finally, misunderstanding order duration can backfire. A Day Order that expires prematurely might cause you to miss a setup that develops late in the session. On the other hand, forgetting about a GTC order placed months ago could result in an unwanted trade if the market suddenly loops back. Regular portfolio and order book reviews are essential for staying in control.

Disambiguation: “Entry Order” in Legal Context vs. Trading

The term “entry order” can be confusing because it has a completely different meaning outside of finance. In legal settings, “entry of an order” refers to the formal process by which a court records its decision in official documents. This administrative step makes rulings legally enforceable and often starts the clock for appeals or compliance actions. For example, a lawyer might file a motion requesting the entry of a judgment.

In contrast, within financial trading, an “entry order” is a pending instruction to buy or sell an asset at a specific future price. It has nothing to do with court procedures or legal documentation. This article focuses exclusively on the trading definition. The legal usage is mentioned only to prevent confusion and clarify that the two contexts are entirely separate.

Conclusion: Leveraging Entry Orders for Smarter Trading

Entry orders are more than just trade instructions—they are a cornerstone of disciplined, strategic trading. By allowing traders to define their entry and exit points in advance, these tools automate execution, reduce emotional interference, and improve risk management. Whether you’re using a buy limit to accumulate at a discount, a sell stop to protect profits, or a buy stop to ride a breakout, entry orders give you control in a world of constant market motion.

Their versatility across stocks, forex, and crypto makes them essential for traders at every level. When combined with sound analysis and proper risk parameters, entry orders transform trading from a reactive gamble into a structured, repeatable process. Mastering their use isn’t just about placing orders—it’s about building a resilient, rules-based approach that stands up to market volatility and psychological pressure. For anyone serious about trading, understanding and applying entry orders effectively is a critical step toward long-term success.

Frequently Asked Questions About Entry Orders

1. What is the primary function of an entry order in trading?

The primary function of an entry order is to allow traders to specify a future price at which they want to buy or sell an asset. This automates trade execution, ensures trades are placed at desired price levels, and helps manage risk by adhering to a pre-planned strategy without constant market monitoring.

2. How do a buy limit and a buy stop order differ in their execution logic?

A buy limit order is placed below the current market price and is designed to execute when the price falls to or below the specified limit. It aims to buy at a lower, more favorable price. A buy stop order, conversely, is placed above the current market price and becomes a market order (or limit order) once the price rises to or above the specified stop price. It is typically used for entering breakout trades or covering short positions.

3. Can entry orders protect traders from significant losses?

Yes, entry orders, particularly sell stop orders, are a primary tool for protecting traders from significant losses. By placing a sell stop order below the purchase price of an asset, traders can automatically exit a losing position if the price drops to a predetermined level, thereby limiting their downside risk. However, during extreme volatility or market gaps, execution might occur at a price worse than the stop price (slippage).

4. What considerations should be made regarding the duration or expiry of an entry order?

When setting an entry order, traders must decide its duration or expiry. Common options include “Good ‘Til Canceled” (GTC), which remains active indefinitely until executed or manually canceled, and “Day Order,” which expires at the end of the trading day. Choosing the right duration depends on your trading strategy; GTC orders require more vigilance to ensure they remain relevant, while Day Orders are suitable for short-term strategies.

5. Is it possible to use entry orders in highly volatile markets like cryptocurrency?

Absolutely. Entry orders are particularly valuable in highly volatile markets like cryptocurrency, where prices can change rapidly. They allow traders to set specific entry and exit points, manage risk with stop-loss orders, and take profits with limit orders, even when they cannot actively monitor the market. This automation helps mitigate emotional trading decisions often triggered by extreme price swings.

6. What are the potential drawbacks or risks associated with using entry orders?

Potential drawbacks include:

- No guaranteed execution: The market price may never reach your specified price, preventing the order from filling.

- Slippage: Especially with stop orders, execution might occur at a less favorable price than intended during high volatility or market gaps.

- Premature stops: Stop orders set too close to the current price can be triggered by minor market noise.

- Forgetting or not adjusting orders: Outdated GTC orders can lead to unintended trades if market conditions change significantly.

7. How does an entry order contribute to a disciplined trading strategy?

Entry orders are central to a disciplined trading strategy because they enforce predefined rules for trade execution. By setting specific prices in advance, traders commit to their analytical decisions, preventing impulsive actions driven by fear or greed. This systematic approach ensures trades align with a broader plan, enhancing consistency and risk management.

8. Are entry orders suitable for all types of traders, from beginners to advanced?

Yes, entry orders are suitable for traders of all experience levels. Beginners can use them to learn disciplined execution and risk management, while advanced traders leverage them for complex strategies, precise entries, and automated trade management across various markets. Understanding and utilizing entry orders is a fundamental skill for anyone engaging in financial trading.

9. What tools or platforms typically support the placement of entry orders?

Virtually all reputable online brokerage platforms, whether for stocks, Forex, commodities, or cryptocurrencies, support the placement of basic entry orders (buy limit, sell limit, buy stop, sell stop). Many also offer more advanced types like OCO (One Cancels the Other) or OTO (One Triggers the Other) orders, providing a comprehensive suite of tools for strategic trading.

10. How can I differentiate the trading term “entry order” from its legal meaning?

To differentiate, remember that in trading, an “entry order” is a command to a broker to buy or sell an asset at a specific future price. In a legal context, the “entry of an order” refers to the formal recording of a court’s decision or ruling, making it officially binding. The context will always clarify which meaning is intended; in finance, it always refers to a pending trade instruction.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。