sp500 outlook: Can the Bullish Momentum Last as New Records are Set?

Table of Contents

ToggleNavigating New Peaks: Drivers and Risks for the S&P 500 Outlook

As investors and traders, we constantly seek to understand the forces shaping the market landscape. Recently, the S&P 500 index, a key benchmark for the U.S. equity market, has achieved a significant milestone: reaching new all-time highs. This rally has unfolded despite lingering geopolitical tensions and shifts in the economic forecast. For many, it raises a crucial question: can this upward momentum endure, or are we approaching a potential turning point?

In this article, we will delve into the factors that have propelled the S&P 500 to these new peaks, explore the underlying economic data, examine the Federal Reserve’s evolving stance on interest rates, and analyze the market’s technical posture. We will also identify the potential catalysts and headwinds that lie ahead, helping you, whether you are a new investor or an experienced trader, navigate the complexities of the current market environment with greater confidence.

- Understanding the impacts of geopolitical events on market stability can inform investment strategies.

- Monitoring inflation trends is crucial for anticipating Federal Reserve policy changes.

- Technical analysis can provide insights into market sentiment and potential price movements.

The Journey Upward: Recent Performance & Key Milestones

The performance of the S&P 500 throughout the year has been noteworthy. After overcoming earlier challenges, including bouts of volatility fueled by external events, the index has demonstrated significant resilience. This upward trajectory culminated in the recent achievement of new all-time highs, a clear signal of robust market sentiment.

We’ve seen a notable shift from periods of elevated uncertainty, reflected in a decline in the CBOE VIX index (often referred to as the market’s ‘fear gauge’) from its peaks. This suggests that investors are becoming more comfortable with the market’s direction, at least in the intermediate term. This period, sometimes dubbed a “summer rally,” has been fueled by a combination of improving fundamentals and shifting expectations.

The journey to new records wasn’t without its pauses or pullbacks, which are a natural part of any market cycle. However, the overall trend has remained firmly positive, driven by specific catalysts that we will explore in detail. Understanding these drivers is essential for comprehending the market’s current positioning and its potential path forward.

Deciphering the Driving Forces: Geopolitics and Energy’s Role

One significant factor contributing to the market’s recent strength has been a perceived easing of certain geopolitical tensions. While conflicts persist, particularly in the Middle East, the market has shown a remarkable ability to look past daily escalations, especially when they do not immediately threaten major global supply lines.

Crucially, this perceived easing has coincided with a notable decline in oil prices (like WTI crude oil). Why is this important for the stock market, specifically the S&P 500? Lower energy prices have a multi-faceted positive impact. First, they act as a de facto tax cut for consumers, freeing up discretionary spending. Second, they reduce input costs for many businesses, potentially boosting profit margins. Most importantly, lower oil prices contribute to a more favorable inflation outlook.

| Factors | Impact on S&P 500 |

|---|---|

| Geopolitical Tensions | Can cause volatility and affect consumer sentiment. |

| Oil Prices | Lower prices can stimulate consumer spending and business profits. |

| Inflation Outlook | Positive outlook can ease monetary policy and support markets. |

Inflation is a key concern for central banks, including the Federal Reserve, and plays a direct role in monetary policy decisions. When geopolitical events threaten to push energy prices higher, they fuel inflation fears, making central banks hesitant to ease monetary policy. Conversely, falling oil prices can help cool inflationary pressures, potentially giving central banks more flexibility to consider interest rate adjustments. This link between geopolitics, energy markets, inflation, and monetary policy has been a powerful driver for equity markets recently.

The Fed’s Shadow: Interest Rates, Inflation, and Expectations

Perhaps the most significant catalyst for the S&P 500 rally has been the evolving narrative around the Federal Reserve’s future monetary policy, specifically the anticipation of interest rate cuts. Market expectations for rate cuts have fluctuated throughout the year, heavily influenced by incoming economic data, particularly inflation reports.

Recent inflation data, including the Consumer Price Index (CPI), Producer Price Index (PPI), and Personal Consumption Expenditures (PCE) index, have generally been in line with or slightly below forecasts. While inflation remains above the Fed’s long-term target, the pace of increase appears to be slowing, and some measures suggest disinflationary trends are taking hold in certain areas of the economy.

Cooler inflation readings bolster the argument that the Fed may be able to lower interest rates later this year or early next. The Federal Reserve’s own projections, sometimes referred to as the “dot plot,” have also provided insights, signaling potential rate adjustments down the line. Lower interest rates tend to be bullish for equity markets for several reasons: they reduce borrowing costs for companies, potentially increasing investment and profits; they make fixed-income investments like bonds less attractive relative to stocks; and they can boost consumer spending by lowering loan rates.

The relationship between Treasury yields and equity market sentiment is also critical. As expectations for lower Fed rates have firmed slightly, we’ve seen a decline in Treasury yields across various maturities (like the 2-year, 10-year, and 30-year Treasury notes). Lower yields on ‘safe’ assets make the potential returns from riskier assets like stocks more appealing, thus providing support for equity valuations.

Understanding the interplay between inflation data, the Fed’s communications (including comments from Chairman Jerome Powell), and market expectations for the federal funds rate is paramount for anticipating future market movements. The Fed’s decisions remain a key variable for the S&P 500 outlook.

Economic Pulse Check: Beyond Inflation

While inflation and monetary policy dominate headlines, a broader look at economic indicators provides a more complete picture. Recent data paints a somewhat mixed, yet generally supportive, backdrop for the equity market.

Consumer sentiment, as measured by surveys like the one from the University of Michigan, has shown improvement. This suggests that consumers may be feeling more optimistic about their financial situation and the overall economy, which could support future spending. Similarly, reports like the NFIB Small Business Optimism Index have also indicated easing anxieties among small business owners, albeit from previously low levels.

| Economic Indicators | Current Trend |

|---|---|

| Consumer Sentiment | Improving |

| Retail Sales | Cautiously optimistic |

| Small Business Optimism Index | Easing anxieties |

However, other indicators show potential signs of softening. While retail sales have been closely watched, some measures of personal spending have suggested a more cautious consumer. Business inventories and capacity utilization provide insights into corporate activity, while housing starts and building permits give a read on the crucial real estate sector. Even data like weekly jobless claims offers a real-time look at the labor market’s health.

Analysts also utilize metrics like the Atlanta Fed’s GDPNow forecast, which provides a running estimate of current GDP growth based on incoming data. While these estimates can fluctuate significantly, they help paint a picture of the economy’s momentum.

For investors, it’s important to look beyond just one or two data points and assess the overall trend. The current economic picture appears to be one of continued, albeit potentially slower, growth, supported by improving sentiment but facing headwinds from higher cumulative costs for consumers and businesses. This ‘goldilocks’ scenario – not too hot (to reignite inflation fears) and not too cold (to signal recession) – is generally favorable for equity markets.

Tech Titans Leading the Charge: The AI Revolution Continues

It’s impossible to discuss the S&P 500’s performance without acknowledging the outsized contribution of the technology sector, particularly stocks heavily involved in Artificial Intelligence (AI). Companies like Nvidia and Microsoft have seen extraordinary gains, driven by strong demand for AI-related hardware and software.

These mega-cap technology stocks represent a significant portion of the S&P 500’s market capitalization. Their strong performance disproportionately impacts the index’s overall movement. The excitement surrounding the potential of AI has fueled investor enthusiasm and directed substantial capital towards these leaders.

While this concentration of gains in a few large stocks has been a powerful engine for the rally, it also introduces a degree of risk. If the momentum in the AI space were to falter, or if these specific companies faced unexpected challenges, the impact on the S&P 500 could be significant given their weighting in the index. However, for now, the narrative of AI-driven growth remains compelling and continues to attract investment, serving as a core pillar of the current market rally.

Other tech giants, like Apple and Tesla (though facing their own unique challenges), along with key players in cloud computing and digital services, also contribute to the sector’s influence. The ongoing innovation and adoption of new technologies provide a fundamental growth driver that underpins a significant portion of the S&P 500.

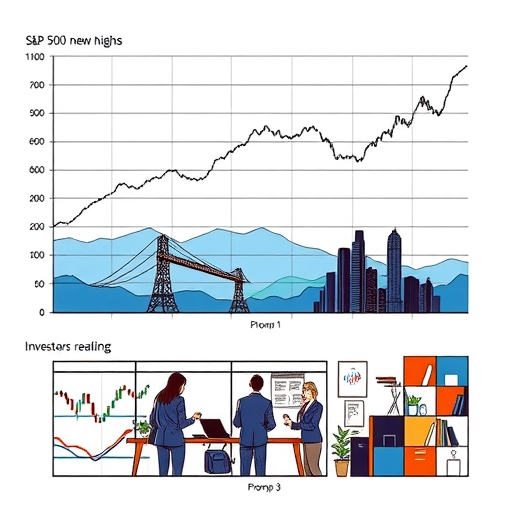

Reading the Charts: Technical Analysis of the SPX

Beyond the fundamental and economic factors, technical analysis offers valuable insights by studying price patterns, trends, and indicators. For the S&P 500, the intermediate-term technical picture remains bullish. The index is trading comfortably above key moving averages, such as the 200-day Simple Moving Average (SMA), which is often used to gauge the long-term trend.

Reaching new all-time highs is, by definition, a bullish technical signal, indicating that demand is currently outweighing supply at all previous price levels. It suggests that the path of least resistance remains upwards.

However, seasoned traders know that even strong trends can experience pauses or pullbacks. While the overall uptrend is intact, some near-term technical indicators are showing signs of slowing momentum. This doesn’t necessarily signal an imminent reversal, but it does suggest that the pace of the rally might moderate, or that the market could be due for a period of consolidation or a shallow correction.

| Technical Indicators | Current Signal |

|---|---|

| 200-day SMA | Above trend, bullish |

| New All-Time Highs | Bullish signal |

| Momentum Indicators | Signs of slowing |

Identifying potential resistance levels is less straightforward when trading at new highs, as there is no historical price resistance above the current level. However, technical analysts may look at Fibonacci extensions or psychological levels to project potential future targets. On the downside, key support levels would be previous swing highs and significant moving averages like the 20-day or 50-day SMAs.

For investors, the key takeaway from the technical perspective is that the primary trend is up, supporting continued participation. For traders, monitoring near-term momentum indicators and watching for potential divergences between price action and indicators (like the Relative Strength Index, RSI) can provide clues about potential short-term volatility or pauses.

Beyond the Giants: Market Breadth and Other Indices

While mega-cap tech stocks have led the charge, a healthy market rally is often supported by broad participation across various sectors and company sizes. This is where the concept of market breadth becomes important.

Market breadth refers to the number of individual stocks participating in the rally or decline. When the S&P 500 is making new highs, it is ideal to see a large percentage of its constituent stocks also participating positively, rather than just a few large names driving the index higher. Recent data on market breadth has been encouraging, showing expanding participation beyond just the top handful of stocks. This suggests underlying strength in the broader market, which is a bullish confirmation signal.

Looking beyond the S&P 500, indices like the Nasdaq Composite (also influenced heavily by tech) have also performed strongly, often tracking or even outpacing the SPX. The Dow Jones Industrial Average, representing a basket of 30 large, established companies, provides another perspective on market health.

The Russell 2000 (RUT), which tracks small-cap stocks, offers insight into the performance of smaller, domestically focused companies. The Russell 2000 has shown signs of potential bullishness recently, suggesting improving sentiment towards riskier assets. However, it has faced significant resistance levels. A decisive breakout in the Russell 2000 could signal increased confidence in the broader economic outlook, as small caps are often more sensitive to domestic conditions than large multinational corporations.

Monitoring these different indices and market breadth helps provide a more complete picture of the market’s health and the extent to which the rally is broad-based versus concentrated.

Anticipating What’s Next: Upcoming Catalysts

Markets are forward-looking, and future movements will be heavily influenced by upcoming events and data releases. As we look ahead, several key catalysts could shape the S&P 500’s trajectory:

- Economic Data Releases: High-impact reports like Nonfarm Payrolls (jobs data), Retail Sales, and Purchasing Managers’ Indexes (PMI) for manufacturing and services will provide fresh insights into the economy’s strength and inflationary pressures. Strong data could fuel growth optimism but also potentially reduce expectations for Fed rate cuts, while weak data could increase rate cut odds but raise recession fears.

- Earnings Season: The upcoming second-quarter earnings season will be crucial. Investor focus will be on whether companies, particularly in the tech sector, can continue to deliver strong results and maintain positive forward guidance. Earnings performance is a fundamental driver of stock prices.

- Federal Reserve Commentary: Speeches and interviews from Fed officials, including Chairman Powell, will be scrutinized for any shifts in tone or hints about future monetary policy decisions ahead of upcoming FOMC meetings.

- Policy Updates: Developments regarding potential trade tariffs (such as on goods from certain countries), progress or lack thereof on proposed tax legislation (like a potential US tax bill), and government spending debates could all introduce uncertainty or provide clarity for businesses and markets.

Staying abreast of these upcoming catalysts is essential for anticipating periods of increased volatility or potential shifts in market direction. Each piece of data or policy announcement can be a puzzle piece in forming the overall market outlook.

Navigating the Headwinds: Lingering Risks and Uncertainties

Despite the recent strength and achievement of new highs, the market is not without its potential headwinds and sources of uncertainty. Maintaining a balanced perspective, acknowledging these risks, is crucial for prudent investing and trading.

- Geopolitical Escalation: While Middle East tensions eased somewhat, the underlying conflict persists. Any significant escalation, particularly involving major oil-producing regions or global powers, could swiftly reverse the positive impact seen from falling oil prices and reignite market volatility. Trade disputes with key partners also remain a potential source of friction.

- Inflation Persistence: Although recent data has been favorable, inflation could prove stickier than anticipated. Supply chain disruptions, unexpected increases in commodity prices (beyond oil), or persistent wage pressures could force the Fed to maintain higher interest rates for longer than the market currently expects, potentially dampening equity valuations.

- Policy Uncertainty: Debates around fiscal policy, potential changes to taxation, and regulatory actions can create uncertainty for specific industries or the market as a whole.

- Valuation Concerns: After a significant rally, particularly in the tech sector, questions arise about valuations. While growth prospects are strong for some companies, high valuations leave less room for error if earnings disappoint or growth slows.

- Consumer and Business Health: While sentiment has improved, actual spending and investment activity could soften if economic conditions deteriorate, impacting corporate earnings.

These headwinds are not necessarily predictions of doom, but rather factors that warrant close monitoring. They represent potential sources of volatility that could challenge the market’s upward momentum.

Integrating Strategy: What This Means for You

So, what does this complex picture mean for you, the investor or trader? First and foremost, it emphasizes the importance of staying informed and adopting a strategic approach rather than reacting impulsively to daily news.

The current environment of new highs with underlying risks suggests a market that requires both confidence and caution. For long-term investors, maintaining a diversified portfolio aligned with your risk tolerance and investment goals remains paramount. Market rallies to new highs are often followed by periods of consolidation or corrections, which can present opportunities to add to positions in quality companies at more favorable prices.

For active traders, understanding the interplay between macroeconomic data, Fed expectations, sector-specific drivers (like AI), and technical signals is key. While the overall trend is bullish, volatility can still arise from unexpected news or shifts in sentiment. Using technical levels for support and resistance, managing position sizes, and utilizing risk management tools are essential.

Recognize that market dynamics are constantly evolving. What drove the market yesterday may not be the primary driver tomorrow. Continuous learning and adaptation are vital for navigating the financial markets effectively.

Conclusion: Looking Ahead

The S&P 500’s ascent to new all-time highs marks a significant achievement, reflecting the market’s ability to absorb and overcome various challenges throughout the year. The rally has been powerfully supported by easing geopolitical fears impacting oil prices, a more favorable inflation outlook increasing expectations for potential Federal Reserve rate cuts, and the continued dominance of the technology sector fueled by excitement around Artificial Intelligence.

While the immediate outlook appears measured bullish, bolstered by expanding market breadth and an intact intermediate-term uptrend, it is crucial to remain vigilant. Lingering risks from potential geopolitical flare-ups, persistent inflationary pressures, uncertainties in trade policy, and domestic political debates could introduce volatility and challenge the current momentum.

As we move forward, pay close attention to upcoming economic reports and the second-quarter earnings season, as these will provide the next critical data points for assessing the market’s path. By combining an understanding of the macroeconomic landscape, key sector trends, and technical signals, you can approach the current market environment with a more informed perspective, positioning yourself to navigate the opportunities and risks that lie ahead in the S&P 500.

sp500 outlookFAQ

Q:What are the main factors driving the S&P 500’s recent performance?

A:The main factors include easing geopolitical tensions, lower oil prices, and expectations for Federal Reserve interest rate cuts.

Q:How do interest rates affect the S&P 500?

A:Lower interest rates generally boost the S&P 500 by reducing borrowing costs for companies and making stocks more attractive compared to bonds.

Q:What risks should investors be aware of?

A:Investors should monitor geopolitical escalation, persistent inflation, and valuation concerns as potential risks to the market.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。