starlink.fx: Why Investors Should Pay Attention to Starlink’s Global Impact

Table of Contents

ToggleStarlink’s Ascent: Navigating a Complex Global and Financial Landscape

Welcome, aspiring investors and keen market observers. Today, we turn our attention to a celestial endeavor that is reshaping global connectivity: Starlink. This ambitious project from SpaceX isn’t just about launching satellites; it’s a fascinating case study in the intricate interplay of cutting-edge technology, high finance, international trade policy, and domestic regulation. As you seek to understand market dynamics beyond traditional asset classes, exploring ventures like Starlink offers valuable insights into how innovation, capital, and geopolitical factors converge.

Think of Starlink as a vast, orbiting network designed to bring high-speed internet to every corner of the globe, particularly underserved areas. But building such a network requires monumental investment, complex logistical operations, and adept navigation of bureaucratic hurdles in dozens of countries. For us to truly grasp Starlink’s potential and the challenges it faces, we must look beyond the impressive rocket launches and delve into the financial realities, the strategic maneuvers on the global stage, and the regulatory environment it operates within. Are you ready to explore this unique intersection of technology, finance, and global policy?

In this analysis, we will unpack the layers of Starlink’s operations, from its rapidly expanding satellite constellation and significant funding efforts to its strategic reliance on US government support for international market access and its navigation of critical domestic infrastructure testing. We will examine the financial calculus behind its current unprofitability and future revenue projections, identify its key competitors, and consider the multifaceted hurdles it must overcome to achieve its ambitious goals.

Here are some aspects to consider regarding Starlink:

- Innovative Satellite Technology: Starlink uses advanced technology to enhance global connectivity.

- Funding Sources: The project is supported by both private investments and government grants.

- Regulatory Navigation: Starlink must work within complex legal and regulatory frameworks in various countries.

Building the Orbital Backbone: Starlink’s Satellite Constellation and Deployment Pace

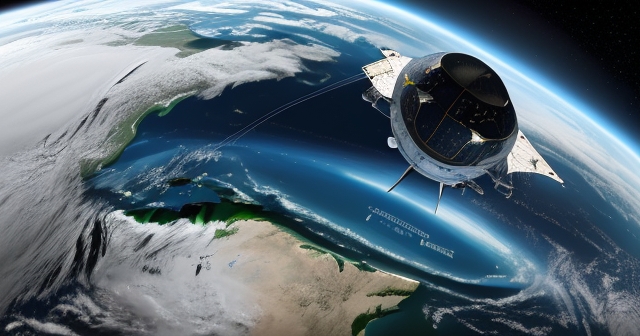

At the heart of Starlink is the satellite constellation itself – a network of thousands of small satellites operating in Low Earth Orbit (LEO). Unlike traditional geostationary satellites positioned much higher, LEO satellites offer significantly lower latency, which translates to a much more responsive internet experience, critical for applications like video calls and online gaming. The deployment of this constellation has been remarkably rapid, primarily facilitated by SpaceX’s reusable Falcon 9 rockets.

SpaceX maintains a relentless launch cadence, sending dozens of Starlink satellites into orbit on a single Falcon 9 mission. This efficiency is crucial because the sheer number of satellites is what enables global coverage and capacity. We see frequent reports of Falcon 9 boosters completing multiple flights, a testament to the reusability that dramatically reduces launch costs – a key factor in making such a massive constellation economically viable. Recent launches have included satellites with advanced capabilities, such as Direct to Cell technology, promising connectivity directly to standard mobile phones in the future.

Consider the scale: achieving meaningful global coverage requires thousands of satellites. SpaceX has already deployed a significant portion of its planned constellation, and the launches continue regularly from sites like Cape Canaveral. This rapid deployment is a core strength, allowing Starlink to offer service in expanding geographical areas relatively quickly compared to competitors who may have slower launch schedules or rely on third-party providers. The technological foundation is being built, piece by orbiting piece.

However, this rapid deployment also presents challenges. Managing such a large and growing constellation requires sophisticated traffic management to avoid collisions, a concern that regulatory bodies and other satellite operators closely monitor. The brightness of the satellites has also raised concerns within the astronomical community, leading SpaceX to implement mitigation measures. These are technical hurdles that, while perhaps not immediately impacting the user’s internet speed, are critical for the long-term sustainability and responsible operation of the LEO environment.

The Financial Orbit: Funding, Valuation, and the Quest for Profitability

Building and operating a global satellite network is an incredibly expensive undertaking. The estimated cost for the full Starlink constellation is often cited as being in the realm of $10 billion or more. Where does the money come from to fund such a capital-intensive project? Starlink, being part of SpaceX, has benefited from significant private funding rounds. Reports indicate that over $5.3 billion in total funding has been secured, including investment from major players like Sequoia Capital and Alphabet (Google).

Beyond private investment, Starlink has also received government support, notably through grants from the US Federal Communications Commission (FCC) aimed at providing broadband internet access to rural areas. This mix of private capital and targeted government funding underscores the perceived strategic importance and commercial potential of the project. However, even with billions raised, the path to recouping the immense initial investment and achieving profitability remains a significant challenge.

Understanding Starlink’s valuation can feel like trying to track a fast-moving satellite – estimates vary, but they are consistently substantial. Reports from 2021 placed the pre-money valuation at $73.2 billion, and potential post-listing valuations in the event of an IPO are speculated to exceed $80 billion, sometimes even reaching over $100 billion. These high valuations are not based on current profits, as Starlink is currently not profitable. Instead, they are driven by future revenue projections and aggressive user growth targets.

| Funding Source | Amount |

|---|---|

| Private Investments | $5.3 billion |

| FCC Grants | Not Disclosed |

The core financial challenge lies in the cost structure. Not only is the constellation expensive to build, but the user terminals (the satellite dishes you install at your home or business) are reportedly sold below their production cost. This strategy aims to accelerate user acquisition, but it creates an immediate loss on hardware sales that must be offset by subscription revenue over time. The fiscal calculus involves balancing the upfront loss on terminals with the recurring income from subscribers, while also managing the ongoing operational costs of the constellation and ground infrastructure.

Eyes on the Prize: Revenue Projections and User Growth Targets

Despite the current lack of profitability, the financial models supporting Starlink’s high valuation are based on optimistic projections for future revenue and user growth. Aggressive targets envision millions of users connecting to the service in the coming years. For instance, projections have suggested user growth reaching 14 million by 2025 and capturing perhaps 2.3% of the global online user base by the same year. What would such growth mean for Starlink’s revenue?

Analysts have projected substantial revenue figures, potentially reaching $30 billion to $50 billion by 2025. These figures sound staggering, and they are a key reason investors are willing to pour billions into the venture and why an IPO is eagerly anticipated by some. Achieving these revenue levels depends heavily on successfully expanding into diverse global markets and maintaining competitive pricing while simultaneously scaling the infrastructure and reducing costs.

The strategy is clear: build a massive network rapidly, attract a large subscriber base quickly even at a hardware loss, and then leverage the scale and recurring subscription revenue to eventually become profitable. This requires not only technical execution but also successful marketing, customer service, and perhaps most critically, navigating the complex pathways to legal operation in countries around the world. Each new country that grants Starlink market access represents a potential new pool of millions of subscribers, directly impacting those crucial revenue and user growth projections.

The scale of the ambition is immense. Think about the potential revenue from just one large market like India, where capturing even 1% of the consumer broadband market could generate an estimated $1 billion annually. This illustrates why international expansion is not merely a nice-to-have, but a critical component of Starlink’s financial viability and the justification for its current valuation and the ongoing funding efforts.

Global Reach, Policy Touch: How US Trade Influences Starlink’s Market Access

One of the most fascinating aspects of Starlink’s global expansion isn’t purely technical or even financial; it’s geopolitical. Securing the necessary regulatory approvals and licenses to operate in foreign countries often involves navigating complex negotiations that can be intertwined with broader international relations and trade policy between the United States and those nations. We see evidence that Starlink’s market entry is, in some instances, being linked to US trade discussions, including sensitive topics like tariffs.

Consider the examples of countries like Lesotho and Cambodia. Reports indicate that discussions around granting Starlink operating licenses have sometimes been linked to or seen as goodwill gestures related to potential trade deals or resolving issues concerning US tariffs on their exports. This suggests a strategic synergy where a US company’s market access is viewed, at least by some foreign governments, through the lens of their overall economic relationship with the United States. It’s a clear illustration of how corporate expansion can become a tool or bargaining chip in international diplomacy and trade negotiations.

This dynamic adds a layer of complexity to Starlink’s market access efforts. It’s not simply a matter of meeting technical requirements or paying licensing fees. It can involve high-level government-to-government discussions where the commercial interests of a company like Starlink are part of a larger package of bilateral relations. For you as someone interested in global markets, this highlights the critical role that national policy and international diplomacy can play in enabling or hindering the growth of even the most innovative private enterprises.

While not every country’s decision on Starlink will be tied directly to trade talks, the fact that it happens in some instances underscores the strategic importance governments place on controlling internet infrastructure and the leverage they perceive in granting access to foreign providers. This environment requires careful negotiation, understanding local political landscapes, and often, the backing of one’s home government.

Strategic Diplomacy: The Role of US Government Advocacy in Starlink’s Expansion

Given the potential links between Starlink’s global expansion and US foreign policy, it is perhaps not surprising to learn that the US government is actively involved in advocating for American satellite companies, including Starlink, abroad. Internal government documents and reports reveal a concerted effort by the State Department and US embassies in various countries to promote the adoption of American satellite internet services.

This advocacy became particularly explicit under the Trump administration, which reportedly saw satellite internet as a strategic area where the US could gain a “first-mover” advantage and counter the influence of Chinese and Russian competitors in the telecommunications space. Documents from this period specifically named Starlink as a company the US government was advocating for. The rationale was clear: promoting American satellite technology wasn’t just about supporting a US business; it was about advancing US strategic interests globally, ensuring connectivity aligned with US standards, and limiting the potential influence of rival state-backed systems.

| Government Support Actions | Description |

|---|---|

| Advocacy for Market Access | Encouraging foreign governments to grant licenses to Starlink. |

| Promotion of Technology | Highlighting advantages of US satellite technology in diplomacy. |

While the Biden administration has continued to push for the adoption of LEO satellite technology globally, the advocacy may have become less explicitly tied to specific companies like Starlink by name, focusing more broadly on the benefits of the technology itself and American providers in general. Nevertheless, the underlying principle remains: the US government views American leadership in satellite internet as strategically important and is willing to use its diplomatic resources to support its companies’ access to foreign markets.

This high-level support can be crucial when navigating the regulatory labyrinths of different nations. Having the US embassy or State Department officials discuss the merits of Starlink with foreign regulators or government ministers can lend significant weight to the company’s efforts. It elevates the conversation from a purely commercial matter to one of bilateral economic cooperation and strategic alignment, potentially smoothing the path for regulatory approvals and market entry in challenging environments across Africa, Latin America, and Asia.

Connecting the Homeland: Starlink’s Engagement with US Domestic Regulation

While much attention is paid to Starlink’s global expansion and the international hurdles it faces, navigating the domestic regulatory environment within the United States is equally critical. Agencies like the FCC oversee satellite communications, while others, such as the Federal Aviation Administration (FAA), have oversight over air traffic control and airspace usage, areas where satellite technology is becoming increasingly relevant.

Starlink’s operations intersect with the FAA’s purview in several ways. The satellites themselves transit through controlled airspace, and their launch and deorbiting procedures must comply with FAA regulations. More recently, there have been discussions and reports regarding Starlink’s potential role in upgrading critical US infrastructure, specifically air traffic control systems.

Reports emerged about Starlink potentially taking over a large FAA contract for the Telecommunications Infrastructure (FTI) program, currently held by Verizon. These reports suggested a massive shift in how vital air traffic control communications might be handled, potentially replacing older fiber-optic based systems with satellite links. However, SpaceX has publicly denied these specific reports, clarifying that while they are engaging with the FAA, it is not in the context of a full takeover of Verizon’s existing FTI contract.

This distinction is important. A full contract takeover would imply replacing an incumbent provider for the entire national system, a complex and highly regulated process. SpaceX’s clarification indicates a more targeted involvement, focusing on testing and potentially integrating Starlink as part of broader upgrades, alongside other technologies like fiber and wireless, rather than displacing existing infrastructure entirely. This nuanced engagement still highlights the potential for satellite internet to play a role in critical domestic systems, but on terms that may be different than initial media reports suggested.

Beyond Consumer Broadband: Testing Starlink for Critical Infrastructure

So, if Starlink isn’t taking over Verizon’s FAA contract, what exactly is its engagement with the Federal Aviation Administration? As SpaceX has confirmed, they are indeed testing Starlink for use as part of FAA infrastructure upgrades. This testing is focused on providing connectivity for the FAA’s air traffic control systems. Why is this happening, and where?

SpaceX has indicated that these tests are occurring in locations like Alaska and New Jersey. These sites may represent diverse operational environments, allowing the FAA and SpaceX to assess Starlink’s performance under various conditions, including potentially remote or challenging terrains where traditional fiber optic lines might be less reliable or cost-effective to install and maintain. The motivation for the FAA to explore satellite options like Starlink stems from perceived critical safety issues with some existing systems.

SpaceX has reportedly provided its services free for these initial tests, emphasizing the perceived critical nature of the need for improved infrastructure safety. This willingness to offer services pro bono for testing underscores the strategic importance SpaceX places on potentially becoming a provider for such vital government systems. It’s a way to demonstrate the reliability and capability of the Starlink network in a high-stakes application.

Partnering with entities already involved in government contracting, such as L3Harris Technologies (which is involved in FAA systems), lends credibility and technical expertise to the testing process. This collaboration allows for the evaluation of how Starlink can integrate with existing or planned FAA infrastructure. The potential for Starlink in this domain extends beyond simply providing basic internet; it could involve connecting remote radar sites, ground-to-air communication facilities, or other critical components of the air traffic control network. This illustrates how Starlink’s potential market extends beyond consumer broadband to potentially high-value enterprise and government applications.

A Crowded Sky: Identifying Starlink’s Key Competitors

While Starlink has captured significant public imagination with its rapid deployment and ambitious goals, it does not operate in a vacuum. The market for satellite internet and, more broadly, global connectivity is becoming increasingly crowded and competitive. Understanding who Starlink is up against is crucial for assessing its long-term prospects and profitability.

In the LEO satellite space, key competitors include Oneweb and Amazon’s Project Kuiper. Oneweb, a UK-based company, is also building a significant LEO constellation and has secured substantial funding, including from the UK government and SoftBank. Project Kuiper, backed by the vast resources of Amazon, is another major player with plans for thousands of satellites, leveraging Amazon Web Services (AWS) for ground infrastructure and service delivery via Azure Orbital. These competitors are pursuing similar goals – providing global high-speed internet connectivity – and are vying for the same customer segments and regulatory approvals.

| Competitor | Description |

|---|---|

| Oneweb | UK-based satellite provider building a LEO constellation. |

| Project Kuiper | Amazon-backed project aiming for thousands of satellites. |

Beyond other satellite providers, Starlink also competes with traditional terrestrial internet services, including fiber optics and 5G wireless networks. In urban and suburban areas with well-developed infrastructure, fiber and 5G often offer higher speeds and lower latency than satellite, posing a significant challenge to Starlink’s competitiveness. Starlink’s primary advantage lies in serving remote or rural areas where these terrestrial options are unavailable or prohibitively expensive.

Furthermore, the competitive landscape includes state-backed telecommunications companies, particularly from countries like China and Russia, which may view satellite internet as a strategic sector. These entities might develop their own systems or influence foreign governments to favor their own providers, potentially creating additional geopolitical and market access hurdles for Starlink, especially in regions where China and Russia exert significant influence. This multi-faceted competition from both commercial rivals and state-backed entities adds complexity to Starlink’s global expansion strategy.

The Profitability Puzzle: Addressing High Costs and Market Pressures

We’ve touched upon it already, but let’s delve deeper into the most critical financial hurdle for Starlink: achieving sustained profitability. As we noted, the company is currently not profitable, largely due to the immense upfront capital expenditure required to build the constellation ($10B+ estimate) and the strategy of selling user terminals below cost.

The terminal cost is a significant barrier to entry for potential users, even with the below-cost pricing. Reducing the manufacturing cost of these terminals is crucial for improving the unit economics. SpaceX has been working on newer, cheaper versions, but the challenge remains substantial. Each time a user buys a terminal, Starlink incurs a loss that must be amortized over the lifetime of the subscription revenue. This requires a significant number of subscribers and a long average subscriber life to turn a profit.

Scaling the network to accommodate millions of users also presents ongoing costs related to ground stations, network management, customer support, and satellite replacement/upgrades. While launch costs per satellite have decreased thanks to Falcon 9 reusability, the sheer volume of satellites and the need for continuous launches to replace aging units or increase capacity represent a persistent expenditure.

Moreover, market pressures from competitors can limit Starlink’s ability to raise subscription prices significantly. If Oneweb, Kuiper, or 5G providers offer competitive services at lower price points, Starlink may face pressure to lower its own rates or risk losing subscribers, further impacting the path to profitability. Regulatory hurdles in obtaining licenses in new markets can also slow down the rate of user acquisition, delaying the point at which revenue consistently exceeds costs. This confluence of high initial investment, subsidized hardware, ongoing operational costs, and market competition creates a complex financial environment where turning potential into profit is the ultimate test.

Starlink’s Trajectory: Balancing Immense Potential with Significant Hurdles

Where does all of this leave Starlink on its ambitious journey? We’ve seen a company rapidly deploying a transformative technology with the potential to connect millions globally and generate billions in revenue. The backing of SpaceX and the strategic vision of Elon Musk provide a powerful engine for innovation and execution. The potential markets, from rural broadband users to maritime, aviation, and even critical government infrastructure, are vast and lucrative.

However, the path forward is anything but guaranteed. The financial hurdles are substantial, requiring immense capital and a clear strategy for moving from significant losses to sustained profitability. The success of the planned IPO, when it eventually happens, will hinge on investor confidence in Starlink’s ability to execute its growth plan and navigate these financial challenges.

Furthermore, Starlink’s expansion is deeply intertwined with geopolitical factors and regulatory landscapes. Success in gaining market access depends not only on the quality of the service but also on navigating complex bilateral relations, trade policies, and the willingness of foreign governments to allow a major US-backed satellite provider to operate within their borders, especially given the competitive landscape that includes state-backed rivals.

Technical challenges, such as managing a growing constellation safely, mitigating environmental impacts like satellite brightness, and continuously improving the technology, also remain ongoing concerns. The intensity of competition from other satellite providers and terrestrial networks means Starlink must constantly innovate and demonstrate value to attract and retain subscribers. Starlink’s trajectory is a fascinating blend of unprecedented technological achievement and significant business, financial, and political complexity.

Conclusion: A Glimpse into the Future of Global Connectivity

In closing, Starlink represents a bold step towards a more connected world, leveraging the power of LEO satellite technology to reach populations and locations previously underserved by traditional infrastructure. Its rapid deployment, ambitious financial targets, and potential integration into critical systems highlight its transformative potential.

Yet, as we have explored, its journey is fraught with significant challenges. Achieving profitability requires overcoming high initial costs and navigating a complex financial model. Global expansion is not merely a commercial exercise but one deeply influenced by trade policy, government advocacy, and international relations. Competition is fierce across multiple fronts.

For you, whether an investor or simply an observer of global trends, Starlink’s story offers a compelling example of the forces shaping the future of technology and markets. Understanding the interplay between technological innovation, capital requirements, regulatory environments, and geopolitical strategy is key to evaluating ventures of this magnitude. Starlink’s success or failure will likely depend on its ability to navigate this intricate web, turning its technological prowess and strategic backing into sustained global impact and financial viability.

starlink.fxFAQ

Q:What is Starlink?

A:Starlink is a satellite internet constellation being constructed by SpaceX to provide high-speed internet access globally.

Q:How does Starlink work?

A:Starlink uses a network of low-Earth orbit satellites to beam internet connectivity to specially designed terminals on the ground.

Q:What challenges does Starlink face?

A:Starlink faces challenges including high initial costs, competition from other providers, and navigating regulatory requirements in various countries.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。