Tick Size: How This Tiny Increment Controls Your Trading Success & Market Dynamics

Table of Contents

ToggleIntroduction: What Exactly is “Tick Size”?

In the fast-moving world of finance, even the smallest price changes can have outsized consequences. One such detail—often overlooked but deeply embedded in market mechanics—is the concept of tick size. This term refers to the minimum increment by which the price of a financial instrument can move up or down. Whether you’re watching a stock edge from $50.00 to $50.01 or a futures contract jump in 0.25-point strides, you’re witnessing tick size in action. Far from being a mere technicality, this granular pricing rule shapes how trades are executed, how liquidity is structured, and how profits are captured across markets. From stocks and futures to forex, tick size governs the rhythm of trading activity, influencing everything from bid-ask spreads to algorithmic strategy design. In this comprehensive guide, we’ll explore what tick size really means, how it varies across asset classes, and why it matters for traders at every level.

Clarifying the Confusion: Financial vs. Biological Tick Size

Before diving deeper, it’s worth clearing up a common mix-up. The word “tick” can trigger very different mental images—one of a tiny arachnid crawling through grass, the other of a price shift flashing across a trading terminal. While both share the same name, their worlds couldn’t be more different. In finance, “tick size” has nothing to do with insects or their physical dimensions. Instead, it’s a precise market construct that defines the smallest possible price movement in a traded asset. This article focuses exclusively on that financial definition, untangling its role in modern trading systems and explaining how it influences everything from order execution to market structure. No biology labs here—just the mechanics of price movement in real-world financial markets.

The Fundamentals of Tick Size in Financial Markets

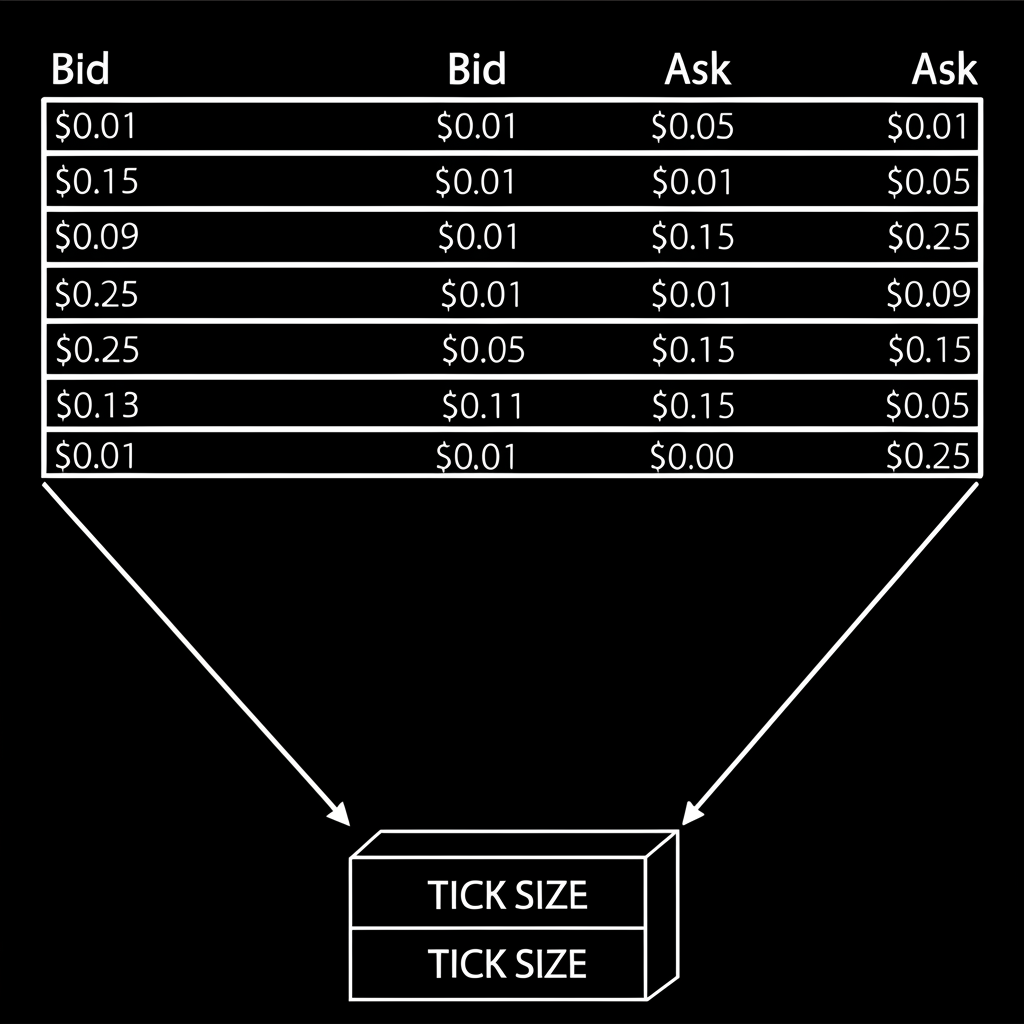

At the heart of every electronic exchange lies a system of price increments, and tick size is the building block of that system. It determines how finely prices can be quoted, shaping the landscape of the order book and influencing how easily buyers and sellers can match. For instance, if a stock is quoted at $100.00 and the next possible price is $100.01, that one-cent jump represents a single tick. Similarly, in futures, a contract might move in increments of $0.25—each of those steps is one tick. This level of granularity affects not only how prices evolve but also the spread between what buyers are willing to pay and what sellers are asking. A smaller tick size allows for tighter spreads, potentially lowering transaction costs, while a larger one can widen those gaps. Ultimately, tick size is foundational to price discovery—the process by which markets determine fair value through supply and demand.

Understanding “Tick Value” and Its Calculation

While tick size tells you how much a price can move, tick value tells you what that movement is worth in monetary terms. This distinction is critical for traders who need to calculate risk, reward, and position sizing with precision. The formula for determining tick value is straightforward:

Tick Value = Tick Size × Contract Multiplier (or Share Size)

To illustrate, consider two scenarios. A single share of Stock XYZ with a $0.01 tick size has a tick value of just one cent. But in the futures market, the same $0.01 tick size can mean something very different. Take Crude Oil futures (CL), which have a tick size of $0.01 per barrel and a contract multiplier of 1,000 barrels. A one-tick move equals $10 in profit or loss ($0.01 × 1,000). This amplification is why understanding tick value is essential—it transforms abstract price movements into real-dollar outcomes.

Here’s a comparison across different instruments:

| Instrument | Tick Size | Contract Multiplier | Tick Value Calculation | Tick Value |

|---|---|---|---|---|

| Stock XYZ | $0.01 | 1 share | $0.01 × 1 | $0.01 |

| Futures ABC | $0.25 | $50.00/point | $0.25 × $50.00 | $12.50 |

For active traders, especially those using leverage or managing large positions, even a few ticks can translate into significant gains or losses. That’s why tick value isn’t just a theoretical concept—it’s a practical tool for managing exposure and optimizing trade execution.

Tick Size Across Different Asset Classes

Though the principle of tick size applies universally, its application varies widely depending on the market. Different asset classes have developed unique conventions based on liquidity, volatility, and regulatory frameworks. Understanding these differences is crucial for anyone trading across multiple markets.

Tick Size in Futures Contracts

Futures markets operate under strict standardization, with exchanges setting fixed tick sizes for each contract. These increments are designed to balance precision with tradability, ensuring that price movements remain meaningful without becoming too granular. The CME Group, for example, defines tick sizes for all its contracts—from equity indices to commodities.

Here are some real-world examples:

| Futures Contract | Exchange (Example) | Tick Size | Tick Value (Example) |

|---|---|---|---|

| E-mini S&P 500 Futures | CME Group | 0.25 index points | $12.50 |

| Crude Oil Futures (CL) | NYMEX (CME Group) | $0.01/barrel | $10.00 |

| Gold Futures (GC) | COMEX (CME Group) | $0.10/troy ounce | $10.00 |

The E-mini S&P 500 contract, one of the most traded futures globally, moves in 0.25-point increments. With each point valued at $50, a single tick equals $12.50. This structure allows for precise price discovery while maintaining sufficient profit potential for market makers. Traders can find full contract specifications, including tick details, on the CME Group website, where every parameter is clearly defined to ensure transparency and consistency.

Tick Size in Forex Trading

In the decentralized world of foreign exchange, the equivalent of tick size is commonly known as a pip—short for “percentage in point.” A pip represents the smallest price change in a currency pair and serves the same function as a tick in other markets. Most major pairs, like EUR/USD or GBP/USD, quote prices to four decimal places, making one pip equal to 0.0001. For JPY-based pairs such as USD/JPY, the standard is two decimal places, so a pip is 0.01.

Some brokers now offer even finer precision through pipettes, which are one-tenth of a pip (e.g., 0.00001). This allows for tighter spreads and more nuanced pricing, particularly in high-frequency environments.

The monetary value of a pip depends on trade size. A standard lot in forex is 100,000 units of the base currency. Here’s how pip value breaks down:

| Currency Pair | Pip Size (Tick Size) | Pip Value (for 1 standard lot = 100,000 units) |

|---|---|---|

| EUR/USD | 0.0001 | $10.00 |

| USD/JPY | 0.01 | ¥1,000 (approx. $10 depending on exchange rate) |

| GBP/USD | 0.0001 | $10.00 |

As Investopedia explains, pip value is essential for calculating trade profitability and managing risk. Unlike futures, where multipliers are fixed, forex traders must consider both lot size and currency denomination when assessing the financial impact of each price movement.

Tick Size in Stock Markets

Stock markets have undergone a major transformation in how prices are quoted. Prior to 2001, U.S. equities were traded in fractions—1/8, 1/16, or even 1/32 of a dollar—meaning the smallest possible move was $0.125. This system, while traditional, often led to wide spreads and reduced price competition among market makers.

The shift to decimalization in 2001 changed everything. By standardizing tick sizes to $0.01, regulators aimed to increase transparency, narrow spreads, and lower trading costs for retail investors. The move succeeded in many ways, making markets more accessible and competitive.

In recent years, however, regulators have revisited the idea of larger tick sizes. From 2016 to 2018, the U.S. Securities and Exchange Commission (SEC) ran the Tick Size Pilot Program, testing whether increasing the minimum increment to $0.05 for certain small-cap stocks could improve liquidity and encourage market maker participation. The results were mixed: while some stocks saw improved quoting activity, others did not benefit significantly. The program ended without a permanent change, but it sparked important conversations about the trade-offs between tight pricing and market depth.

Today, most U.S. stocks trade with a $0.01 tick size. However, exceptions exist—particularly for low-priced securities, which may follow different quoting rules depending on the exchange. This flexibility reflects the ongoing effort to balance efficiency with inclusivity in market design.

The Impact of Tick Size on Trading and Market Dynamics

Far from being a passive rule, tick size actively shapes how markets behave. It influences everything from the behavior of market participants to the structure of liquidity and the effectiveness of trading strategies. Changes in tick size—even by a fraction of a cent—can ripple through the ecosystem, altering incentives and outcomes across the board.

How Tick Size Affects Liquidity and Bid-Ask Spreads

The relationship between tick size, liquidity, and spreads is complex and often counterintuitive. At first glance, smaller tick sizes seem ideal: they allow for tighter spreads, reducing transaction costs for investors. But the reality is more nuanced.

Smaller Tick Sizes (e.g., $0.01):

- Advantages: Enable finer price competition, leading to narrower bid-ask spreads. This benefits traders by reducing slippage and improving execution quality.

- Drawbacks: Can encourage “pennying”—where traders place orders just one tick ahead of competitors to gain queue priority. This fragments liquidity across multiple price levels and can make it harder to fill large orders efficiently. It may also squeeze market maker profits, potentially reducing their willingness to provide liquidity.

Larger Tick Sizes (e.g., $0.05):

- Advantages: Offer greater profit potential per trade for market makers, which may encourage them to post larger quotes and improve depth at key price levels. This can enhance the ability to execute block trades with less market impact.

- Disadvantages: Widen bid-ask spreads, increasing transaction costs for all participants. This can be especially burdensome for frequent traders or those operating in lower-volatility environments.

The optimal tick size strikes a balance—narrow enough to keep trading costs low, but wide enough to sustain healthy market maker participation. Regulators and exchanges continuously evaluate this equilibrium, especially as new trading technologies emerge.

Tick Size and Trading Strategies

Different trading styles respond differently to changes in tick size. What might be a minor detail for one trader could be a make-or-break factor for another.

- High-Frequency Trading (HFT) and Scalping: These strategies depend on capturing tiny price movements over very short timeframes. Smaller tick sizes are generally favorable, as they allow for more frequent entries and exits, tighter spreads, and faster profit accumulation. However, increased competition at each price level can erode edge, forcing HFT firms to innovate constantly.

- Market Making: Market makers earn from the spread between bid and ask prices. Wider tick sizes offer larger per-trade profits, but they also risk reduced volume. In smaller tick environments, market makers must rely on scale and speed to remain profitable, often adjusting algorithms to compete for order flow priority.

- Swing Trading and Long-Term Investing: For traders with longer horizons, tick size has less direct impact. Their focus is on broader trends and fundamental drivers. That said, transaction costs—shaped by spreads and thus influenced by tick size—still affect overall portfolio returns, especially over time and across many trades.

- Algorithmic Trading: Algorithms are coded to respond to tick-level data. They use tick size to define minimum profit targets, set stop-loss levels, and determine order placement logic. A change in tick size often requires recalibrating these systems to maintain performance.

Regulatory Perspectives and Historical Context

Regulators play a central role in shaping tick size policy. In the U.S., the SEC has been at the forefront of market structure reform, from the push for decimalization to the more recent Tick Size Pilot Program. These initiatives reflect a broader goal: creating markets that are fair, efficient, and resilient.

The move to decimal pricing in 2001 was a landmark decision, aimed at dismantling outdated fractional systems and reducing the cost of trading for everyday investors. While successful in narrowing spreads, it also led to unintended consequences—such as the rise of high-frequency trading and concerns about fragmented liquidity.

The subsequent pilot program showed regulators’ willingness to experiment and adapt. By testing larger tick sizes in select stocks, they gathered data on how market dynamics shift under different pricing rules. Although the program wasn’t extended industry-wide, it underscored the importance of ongoing evaluation in a rapidly evolving landscape.

Today, discussions around tick size continue, especially as new asset classes like cryptocurrencies emerge with their own quoting conventions. Regulators remain focused on balancing innovation with stability, ensuring that market structure evolves in a way that benefits all participants.

Practical Tips for Traders Regarding Tick Size

Understanding tick size isn’t just theoretical—it has real-world implications for your trading performance. Here are actionable insights to help you apply this knowledge:

- Check contract specs before trading: Always confirm the tick size and tick value for any instrument, especially in futures and options. Exchanges publish detailed specifications, and ignoring them can lead to miscalculated risks.

- Adapt your strategy to the market: If you’re a scalper, a wider tick size might reduce your edge. Conversely, if you’re executing large orders, a larger tick could mean better depth and easier fills. Know your environment.

- Factor in spread costs: Bid-ask spreads are built on tick increments. Instruments with larger ticks often have wider spreads, increasing your effective transaction cost. Account for this when sizing positions.

- Use tick value for risk management: If your stop-loss is set at 5 ticks away, multiply that by the tick value to know your exact dollar risk. This turns abstract price levels into concrete financial exposure.

- Leverage platform tools: Most modern trading platforms highlight valid tick increments and prevent invalid order entries. Learn how your system handles these rules to avoid execution errors.

Conclusion: Navigating the Nuances of Tick Size

Tick size may seem like a minor detail, but it’s a cornerstone of financial market infrastructure. It defines the smallest possible price movement, influences the monetary value of trades through tick value, and varies meaningfully across stocks, futures, and forex. Its impact extends beyond pricing—it affects liquidity, spreads, and the very design of trading strategies. From regulatory decisions like decimalization to the split-second calculations of high-frequency algorithms, tick size is a constant presence in market dynamics. For traders, understanding this concept isn’t optional; it’s essential. It empowers better decision-making, sharper risk control, and smarter strategy adaptation. In a world where every fraction of a cent counts, mastering tick size is a step toward more informed and effective trading.

Frequently Asked Questions About Tick Size

What is the main difference between “tick size” in finance and “tick size” of a biological tick?

In finance, “tick size” refers to the minimum price increment a financial instrument can move (e.g., $0.01 for a stock). In biology, a “tick size” refers to the actual physical dimensions (length, width) of an arachnid known as a tick. They are completely unrelated concepts that merely share a similar-sounding term.

How is tick size determined in different financial markets like futures and forex?

- Futures: Tick sizes are standardized and set by the respective exchanges (e.g., CME Group, ICE) for each specific contract.

- Forex: The smallest price change is typically called a “pip” (percentage in point). For most major currency pairs, a pip is 0.0001, while for JPY pairs, it’s 0.01.

- Stocks: In many markets, including the U.S., the standard tick size is $0.01, though this has evolved historically from fractional pricing.

What is “tick value” and how do I calculate it for a trading instrument?

“Tick value” is the monetary worth of one tick (the minimum price movement) for a specific financial instrument. It’s calculated by multiplying the tick size by the contract multiplier (or share size). For example, if a futures contract has a tick size of $0.25 and a contract multiplier of $50 per point, the tick value is $0.25 × $50 = $12.50.

Why is understanding tick size important for traders?

Understanding tick size is crucial for:

- Profit/Loss Calculation: It helps determine the monetary impact of price movements.

- Risk Management: It’s essential for setting appropriate stop-loss and take-profit levels in monetary terms.

- Strategy Adaptation: It influences the viability of various trading strategies, especially high-frequency trading and scalping, which are sensitive to small price changes and bid-ask spreads.

- Market Analysis: It provides insight into market liquidity and efficiency.

Did the SEC’s Tick Size Pilot Program change how stocks are traded?

The SEC’s Tick Size Pilot Program (2016-2018) temporarily increased the minimum tick size to $0.05 for a subset of small-cap stocks. While it provided valuable data on how wider tick sizes might affect liquidity and market making, the program was not made permanent for all stocks. Most U.S. stocks continue to trade with a $0.01 tick size, but the program highlighted ongoing regulatory interest in market microstructure.

How does tick size affect market liquidity and bid-ask spreads?

Generally:

- Smaller Tick Sizes: Tend to result in narrower bid-ask spreads, making trading cheaper but potentially leading to fragmented liquidity and “pennying.”

- Larger Tick Sizes: Can lead to wider bid-ask spreads, increasing trading costs but potentially incentivizing market makers to provide deeper liquidity at fewer price points, making it easier to execute larger orders.

Can tick size impact my trading strategy, especially for scalping or high-frequency trading?

Yes, tick size significantly impacts strategies like scalping and high-frequency trading (HFT). These strategies rely on capturing very small price movements. Smaller tick sizes allow for more precise entries/exits and tighter profit targets, potentially increasing the frequency and profitability of such trades. Conversely, wider tick sizes can make these strategies less viable due to higher transaction costs relative to potential profit per trade.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。