usd/pln forex Trading Insights: How to Analyze The Market Effectively?

Table of Contents

ToggleDecoding the USD/PLN Pair: An Introduction to Forex Analysis

Welcome to our in-depth exploration of the USD/PLN currency pair. As aspiring or experienced traders, you understand that navigating the dynamic world of forex requires not just intuition, but a solid foundation in technical analysis and an understanding of key market data. In this comprehensive guide, we will break down the recent performance and technical landscape of the US Dollar against the Polish Zloty, providing you with the insights you need to approach this unique pair.

Think of this article as your compass in the USD/PLN market. We’ll examine the latest price action, delve into its historical performance across different time horizons, and perhaps most importantly, dissect the often-conflicting signals emerging from technical indicators and trader sentiment. Our goal is to help you synthesize this information, empowering you to make more informed decisions, always remembering that trading involves significant risk.

Are you ready to peel back the layers of the USD/PLN pair and understand what the data is really telling us?

The Current Pulse: USD/PLN’s Latest Price and Intraday Dance

Let’s start with a snapshot of where the USD/PLN pair stands right now. At the time of the last recorded data, the pair was trading near 3.7778. This represents a modest change from its previous close, showing a slight dip of around 0.0059 points, or roughly -0.1559%.

Understanding the intraday movement is crucial for short-term traders. Looking at the session’s data, we see the market opened near 3.784 (or 3.7837, depending on the data feed – a good reminder that data can vary slightly between sources). The previous close was also around 3.7837, indicating the session started very close to where the last one ended.

Throughout the day, the price fluctuated within a specific range. The recorded Day High reached up to 3.7862 (or 3.76302 from another source, again highlighting data nuances), while the Day Low touched 3.7792 (or 3.75532). This intraday range, while not exceptionally wide in this specific session, shows the typical back-and-forth price action characteristic of currency markets. For day traders, these levels – the open, high, low, and close – are critical reference points for strategy execution.

What does this immediate data tell us? It suggests relatively contained movement in the most recent session, with the pair drifting slightly lower. However, this is just a tiny piece of the puzzle. To truly understand the USD/PLN‘s potential direction, we need to zoom out and look at its performance over longer periods.

Navigating Short-Term Swings: 5-Day and 1-Month Performance

Moving beyond the single session, let’s examine the USD/PLN pair‘s performance over the very short term – the last five trading days and the previous month. This gives us a sense of the immediate trend and volatility.

Over the past 5 days, the data presents a bit of a mixed picture, depending on the source. One report shows a decline of about -0.86%, while another indicates a slight gain of +0.09%. This discrepancy underscores the importance of consistency in your data sources and understanding that different providers might capture slightly different timeframes or use varying methodologies. Regardless of the exact percentage, the numbers suggest that over the last week, the pair’s movement has been relatively contained, fluctuating around its starting point without a strong, clear directional bias emerging from just the 5-day data alone.

Extending our view to the past 1 month, we again see diverging numbers from different sources. One source reports a decline of approximately -2.45%, while another notes a gain of +0.25%. These differences might be due to reporting periods ending on different dates or specific calculation methods. However, taken together, they still point to a market that hasn’t established a definitive, powerful trend in the immediate past month. While one source suggests a notable dip, the other shows near flat performance. This kind of short-term uncertainty can be challenging for traders looking for clear momentum plays.

For you as a trader, what’s the takeaway from this short-term analysis? It tells us that recent price action has been somewhat choppy or range-bound, at least when viewed in isolation. There isn’t a screaming bullish or bearish signal based purely on the last month’s net change. This often leads traders to look for clues elsewhere – either in longer-term trends or, crucially, in the technical patterns forming on the charts.

Understanding these short-term fluctuations helps you gauge recent market sentiment, but it’s just the beginning of building a complete picture of the USD/PLN pair.

Mid-Term Trends: USD/PLN’s Path Over 3 and 6 Months

Now, let’s expand our horizon a bit further and look at the USD/PLN pair‘s performance over the medium term: the past 3 months and 6 months. Examining these periods can reveal more sustained trends that might be masked by short-term noise.

Over the last 3 months, the data from one source indicates a significant decline of approximately -4.71%. This is a more substantial move than what we saw in the 5-day or 1-month periods, suggesting that a notable downward trend has been in effect over the quarter.

Looking at the past 6 months, another data source reports a decline of around -2.09%. While this percentage is less than the 3-month loss reported by the other source (again, potential data variations or calculation differences), it still confirms that the general trajectory over the past half-year has been negative for the USD/PLN pair.

What is the significance of these mid-term figures for your trading analysis? A consistent depreciation over a 3-to-6 month period suggests that there might be underlying factors weakening the US Dollar relative to the Polish Zloty, or strengthening the Zloty relative to the Dollar. These factors could be related to macroeconomic policy, interest rate expectations, or shifts in global risk sentiment that favor emerging market currencies like the PLN over the safe-haven USD.

While the short-term data showed mixed or minimal movement, the mid-term perspective starts to paint a clearer picture of depreciation. This shift from short-term ambiguity to mid-term clarity is a classic example of why analyzing multiple timeframes is essential in forex trading. It helps you understand if recent wiggles are just noise or part of a larger, more significant trend.

The Persistent Downtrend: Deep Dive into YTD and 1-Year Performance

Let’s zoom out even further and examine the performance of the USD/PLN pair year-to-date (YTD) and over the past full year. These longer timeframes are crucial for identifying major trends that can dominate market sentiment for extended periods.

The Year-to-Date (YTD) performance shows a substantial decline. One source reports a drop of approximately -7.39%, while another indicates an even larger loss of around -8.49%. Regardless of the exact figure, a depreciation of over 7% within the first few months of the year is a significant move. This suggests that the dominant force influencing the USD/PLN pair since the beginning of the year has been bearish (downward).

Looking at the past 1 year, the trend of depreciation continues, albeit slightly less pronounced than the YTD figure. One source reports a 1-year decline of about -3.43%, while another shows a loss of around -4.15%. While these percentages are smaller than the YTD decline, they still confirm that over the full year, the Zloty has gained ground against the Dollar.

What should you take away from these figures? A persistent, multi-year decline, especially punctuated by a strong move down YTD, indicates that there are likely fundamental forces at play that are systematically weakening the US Dollar or strengthening the Polish Zloty. These could include:

- Differential interest rate policies between the US Federal Reserve and the National Bank of Poland.

- Relative economic growth prospects of the two countries.

- Geopolitical factors impacting risk sentiment and flows into or out of emerging markets like Poland.

- Fiscal policy decisions in either nation.

For traders, identifying such strong, longer-term trends is vital. While short-term volatility exists, trading in the direction of the dominant trend (in this case, downwards for USD/PLN) is often considered a higher-probability strategy. This doesn’t mean there won’t be significant upward corrections, but the overall ‘path of least resistance’ appears to have been downwards for some time.

| Period | Performance Source 1 | Performance Source 2 |

|---|---|---|

| YTD | -7.39% | -8.49% |

| 1 Year | -3.43% | -4.15% |

| 3 Months | -4.71% | -2.09% |

A Five-Year Lookback: Understanding the Structural Decline

To truly grasp the historical context of the USD/PLN pair‘s recent performance, we must extend our view even further back. Examining the 5-year trend provides insight into potential structural shifts or long-standing pressures on the exchange rate.

Over the past 5 years, one data source reveals a significant decline of approximately -9.82%. This figure reinforces the narrative of sustained depreciation that we observed in the YTD and 1-year data. While the 5-year loss (-9.82%) is slightly less than the YTD loss (-7-8%), this is simply because the 5-year period encompasses earlier years where the pair might have been higher. The fact that the YTD loss is so large within the context of a 5-year decline highlights that the bearish momentum has accelerated recently.

What does this longer-term decline tell us? A persistent downward trend over half a decade often suggests that the fundamental economic or monetary policy landscape has shifted in a way that consistently favors one currency over the other. In this case, it points towards the Polish Zloty gaining strength relative to the US Dollar over this extended period.

Potential drivers for such a sustained trend could include:

- Improvements in Poland’s economic stability and growth prospects, attracting foreign investment.

- Prudent fiscal management in Poland compared to the US.

- Changing risk appetite globally, leading to increased flows into emerging markets.

- Relative inflation rates and their impact on purchasing power parity.

- Central bank policies and interest rate differentials over time.

For you as a trader, understanding this 5-year context is crucial because it provides perspective. While short-term rallies can occur, trading against such a well-established, multi-year trend carries higher risk. It suggests that fundamental forces have been consistently pushing the pair lower, and significant evidence would be required to believe this trend is fundamentally reversing.

Historical Context: The All-Time View of USD/PLN

Finally, for a complete historical perspective, let’s consider the USD/PLN pair‘s performance over its entire trading history. This view helps to contextualize the recent declines within the very long-term trajectory of the pair.

According to one data source, the all-time performance of the USD/PLN pair shows a substantial gain of approximately +123.07%. How can this be, when we’ve just discussed significant declines over the past 1, 5, and YTD periods?

This seemingly contradictory data highlights the importance of the starting point. The Polish Zloty is a relatively younger freely traded currency compared to the US Dollar. Looking at its history likely means tracing the pair back to the early post-communist era in Poland, when the Zloty was significantly weaker against major global currencies like the US Dollar as the country transitioned its economy.

Over the decades, as the Polish economy has developed, stabilized, and integrated more closely with Western Europe (culminating in EU membership), the Zloty has likely appreciated significantly from its very low initial levels against the Dollar. The +123.07% gain represents the net change from that historical starting point to the current price.

What is the value of this all-time perspective for you today? While the +123% gain shows the Zloty has come a very long way from its historical lows against the Dollar, it doesn’t negate the recent trends. It simply provides context that the pair has experienced massive shifts over its existence. Today, we are operating within a different economic and political reality than the one that drove the initial massive rally from the historical lows. The all-time perspective reminds us of the potential for significant, long-term currency shifts, but the actionable information for current trading strategies lies primarily in the more recent performance trends and technical analysis.

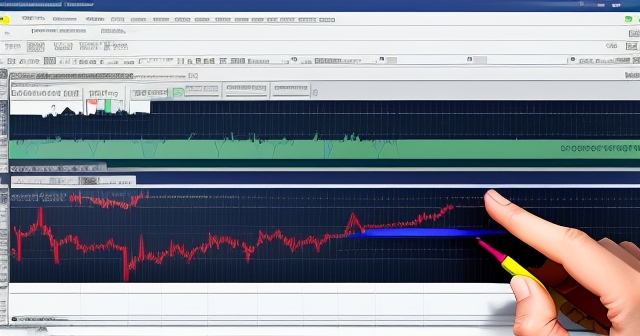

What Do the Indicators Say? Aggregated Technical Sentiment

Beyond historical price performance, technical analysis offers another crucial lens through which to view the USD/PLN pair. Technical indicators use mathematical calculations based on price and volume data to predict future price movements.

A summary of aggregated technical indicators for the USD/PLN pair, based on one source, currently indicates a “Neutral” stance. What does this mean in practice?

A “Neutral” signal from aggregated indicators suggests that when you look at a basket of common technical tools – such as moving averages, oscillators (like RSI, MACD), and momentum indicators – there isn’t a strong, unanimous consensus favoring either a bullish (upward) or bearish (downward) move. Some indicators might be giving buy signals, others sell signals, and still others might be oscillating around their neutral points. When combined, they cancel each other out, resulting in an overall “Neutral” reading.

For you as a trader, a “Neutral” technical summary can be interpreted in several ways:

- It might reflect a market that is currently range-bound, consolidating after a previous move, and lacking clear momentum.

- It could indicate indecision among market participants, with roughly equal buying and selling pressure.

- It might suggest that the market is waiting for a catalyst – perhaps a key economic data release (like NFP for the USD, mentioned in related news), a central bank announcement, or a significant geopolitical event – before establishing a clear direction.

A “Neutral” reading does not mean there are no trading opportunities. Often, consolidated or range-bound markets offer opportunities for short-term trades within the defined boundaries of the range. However, it does signal that chasing a breakout might be risky unless confirmed by other analysis methods.

This aggregated “Neutral” view sets the stage for the next crucial piece of the puzzle: the diverse and sometimes conflicting technical trading ideas shared by market participants.

The Bullish Case: Unpacking Optimistic Technical Trading Ideas

Even when aggregated technical indicators show “Neutral,” individual traders and analysts are always forming opinions and identifying potential opportunities. For the USD/PLN pair, despite the overall neutral signal and the dominant longer-term downtrend, there are still technical trading ideas suggesting potential upward movements – the bullish case.

What technical arguments support a potential “Long” position (buying the pair, expecting its value to rise)? Based on the provided data, some ideas are grounded in specific chart patterns and levels:

- Retesting Support or Break Lines: Traders might identify a previous support level (a price point where selling pressure historically diminished and buying pressure emerged) or a “break line” (perhaps the neckline of an inverse head and shoulders, or a level broken during a previous rally that could now act as support) that the price is currently approaching or retesting. If the price holds at this level, it could signal a potential bounce or reversal. The data mentions a support area possibly near 3.76-3.65, which, if retested successfully, could align with this bullish view.

- Higher Highs (HH) and Higher Lows (HL) Patterns: Identifying a sequence of HH and HL on a shorter timeframe chart is a classic bullish signal. It indicates that buyers are stepping in at progressively higher levels, pushing the price up. A trading idea might point to such a pattern emerging, suggesting the trend is shifting upwards, even if only temporarily.

- Regression Break Reversal: Some traders use regression analysis to identify the central tendency or trend line of price movement over a period. A “regression break reversal” might refer to the price breaking above a downward sloping regression channel or line, suggesting the previous downtrend based on that specific calculation is losing steam and a reversal could be underway.

These bullish technical ideas don’t necessarily negate the longer-term downtrend but rather look for potential counter-trend moves or the very early signs of a larger reversal. They require careful observation of chart patterns and price action at key levels. For you to evaluate these ideas, you would need to look at the specific charts and confirm if these patterns or retests are genuinely occurring.

Exploring Bearish Technical Perspectives: Contrasting Views on the Pair

Conversely, other technical analysts and traders looking at the same USD/PLN pair charts might identify signals that point towards a continued downward movement – the bearish case.

What technical arguments support a potential “Short” position (selling the pair, expecting its value to fall)? Based on the data, some ideas focus on the continuation of the existing trend or key resistance levels:

- Regression Break Continuation: This is the opposite of the bullish regression break reversal. A bearish idea might be based on the price failing to significantly move above a downward sloping regression line or channel, or even breaking below it, confirming the strength and continuation of the existing bearish trend identified by the regression analysis.

- Testing Resistance or Near Consolidation Bottoms: Traders might identify resistance levels (price points where buying pressure historically diminished and selling pressure emerged) that the price is approaching but failing to break through. The data mentioned a potential resistance near 4.12 (or even 4.10), which, if tested and held, would support a bearish view. Alternatively, the pair might be seen as trading near the bottom of a consolidation range, and a break below this bottom would trigger a short signal based on the expectation of further decline.

- Absence of Strong Bullish Confirmation: A bearish view might also be based on the *lack* of convincing bullish signals. If potential support levels are being weakly tested or if bullish patterns fail to fully form or break down, it reinforces the underlying bearish bias derived from the longer-term trends.

These bearish technical ideas align more closely with the established longer-term depreciation trend of the USD/PLN pair. They look for confirmation that the dominant trend remains intact and that any upward moves are merely temporary corrections. Just like with the bullish ideas, evaluating the bearish case requires you to analyze the charts yourself, identifying the specific levels and patterns that are being referenced.

The existence of both bullish and bearish technical ideas, even with an overall “Neutral” aggregated signal, highlights the subjective nature of technical analysis and the importance of developing your own trading plan based on signals you trust and understand. This is where your own analysis becomes paramount.

In choosing a platform to execute strategies based on these technical ideas, Moneta Markets‘ flexibility and technical advantages are worth noting. It supports MT4, MT5, Pro Trader, and other mainstream platforms, combining high-speed execution with low spread settings, offering a good trading experience.

Trading Without Specific News: Focusing on Technicals and Broader Themes

A notable data point mentioned in the provided information is the explicit statement from one source that “There is no recent news for this security,” meaning the specific USD/PLN pair. What does this imply for your trading approach?

When there is no specific, recent fundamental news directly impacting the US Dollar versus the Polish Zloty (such as bilateral trade agreements, direct central bank interventions, or major political developments unique to this pair), traders often shift their focus. In such an environment, the market’s movement is more likely to be driven by:

- Technical Analysis: As discussed, chart patterns, support and resistance levels, and indicator signals can become more influential when fundamental drivers are quiet. Traders may rely heavily on these technical cues to identify potential entry and exit points.

- Broader Macroeconomic Themes: Even without specific pair news, the USD/PLN will be impacted by larger forces affecting the US Dollar globally and the Polish Zloty within the context of emerging markets or the European economic environment. For example, significant US economic data (like inflation, employment figures – mentioning NFP as an example from related news context) will influence the global strength or weakness of the USD, affecting pairs like USD/PLN. Similarly, broader sentiment towards emerging markets or developments within the Eurozone (given Poland’s close economic ties) can impact the PLN.

- Risk Sentiment: During periods of heightened global uncertainty, the US Dollar often acts as a safe-haven currency, potentially strengthening against currencies like the PLN. Conversely, in ‘risk-on’ environments, funds might flow out of the USD and into currencies perceived as having higher growth potential, like the PLN.

So, while there might be no *specific* USD/PLN news, the pair isn’t trading in a vacuum. Its movements are a result of the interplay between technical forces and broader fundamental drivers affecting each component currency. When news is quiet, technical levels and patterns derived from past price action tend to gain prominence as traders search for structure and potential direction in the market.

Essential Considerations: Risk Management and Choosing Your Platform

Trading the USD/PLN, like any forex pair or financial instrument such as CFDs and cryptocurrencies (as mentioned in the disclaimers), involves a high level of risk. You can lose capital rapidly, especially when using leverage. It is crucial to approach trading with a clear understanding of these risks.

Before you ever place a trade, ask yourself:

- How much capital am I willing to risk on this single trade?

- What is my maximum acceptable loss for this trade (stop-loss level)?

- What is my target profit level (take-profit level)?

- Does this potential trade align with my overall trading plan and risk tolerance?

Effective risk management isn’t just about setting stop-losses; it’s about position sizing, understanding leverage, and never risking more than a small percentage of your total trading capital on any single position. The disclaimers correctly state that you should conduct your own due diligence and are fully responsible for your trading decisions.

Furthermore, the data you use is vital. We noted slight variations in data points between different sources (like CNBC and TradingView). While often minor, these differences can sometimes impact technical analysis, especially if you are relying on precise levels. Be aware that data accuracy and real-time availability are not always guaranteed across all platforms and feeds.

Finally, selecting the right trading platform and broker is a critical decision. It needs to be reliable, provide access to the instruments you want to trade (like forex pairs and CFDs), and offer the tools you need for analysis and execution.

If you are looking for a broker that provides regulatory assurance and enables global trading, Moneta Markets holds multi-country regulatory certifications from bodies like FSCA, ASIC, and FSA. They also offer services such as segregated client funds, free VPS, and 24/7 customer support in multiple languages, making them a preferred choice for many traders.

Choosing a platform is an integral part of your trading journey, providing the interface through which you implement your strategy and manage your risk. Do your research, choose wisely, and always prioritize the security of your funds and the reliability of execution.

Conclusion: Summarizing the USD/PLN Outlook

In summary, our deep dive into the USD/PLN currency pair reveals a market with several layers of complexity. On the surface, recent intraday movement has been relatively contained, showing only a slight dip in the last recorded session, although data sources show minor variations in precise figures.

Looking at historical performance, the picture becomes clearer: the USD/PLN has experienced significant depreciation over the past year and year-to-date, showing notable declines of around 4% to 8%. This recent weakness occurs within the context of an even larger decline over the past 5 years (nearly -10%), contrasting sharply with a substantial positive return over the very long, all-time history of the pair.

From a technical standpoint, aggregated indicators currently paint a “Neutral” picture, suggesting a lack of strong directional consensus from automated signals. However, examining user-generated trading ideas reveals a divergence in technical outlooks. Some traders see potential “Long” opportunities based on key support level retests, the formation of bullish chart patterns like Higher Highs and Higher Lows, or potential reversals indicated by breaks in regression channels. Conversely, others foresee “Short” potential, emphasizing the possible continuation of the bearish trend, failure at resistance levels, or bearish interpretations of regression breaks.

The absence of specific, recent news directly targeting the USD/PLN pair means that the market’s focus may increasingly fall on these technical factors and broader macroeconomic themes affecting the US Dollar and Polish Zloty individually.

For you as a trader, this analysis highlights the importance of considering multiple timeframes, understanding how to interpret conflicting technical signals, and recognizing the influence of wider market forces. Remember that forex trading inherently involves substantial risk, and success requires diligent analysis, robust risk management, and using reliable platforms and data.

As you navigate the opportunities and challenges presented by pairs like USD/PLN, continue to educate yourself, refine your strategies, and trade responsibly. The market is a constant teacher, and by understanding its nuances, you improve your chances of navigating it successfully.

usd/pln forexFAQ

Q:What are the main factors influencing the USD/PLN exchange rate?

A:Key factors include interest rate differentials, economic growth trends, geopolitical developments, and market sentiment towards the currencies involved.

Q:How can I effectively analyze the USD/PLN pair for trading?

A:Utilize both technical analysis (charts, indicators) and fundamental analysis (economic data, news) to form a comprehensive outlook on the pair.

Q:Is trading USD/PLN suitable for beginners?

A:While trading USD/PLN can be profitable, it involves risk. Beginners should educate themselves, start with a demo account, and consider their risk tolerance before trading with real money.

You may also like

Calendar

| 一 | 二 | 三 | 四 | 五 | 六 | 日 |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | 6 | 7 |

| 8 | 9 | 10 | 11 | 12 | 13 | 14 |

| 15 | 16 | 17 | 18 | 19 | 20 | 21 |

| 22 | 23 | 24 | 25 | 26 | 27 | 28 |

| 29 | 30 | 31 | ||||

發佈留言

很抱歉,必須登入網站才能發佈留言。